Articles and News

Platinum Jewelry Sales Growth On The Rise, Says Global Business Review May 23, 2021 (0 comments)

Hong Kong—Platinum Guild International (PGI) on Tuesday released the results of its annual Platinum Jewellery Business Review (PJBR), revealing how jewelry retailers and manufacturers expanded platinum’s customer base to increase margins and profitability and return to growth in key global markets last year.

Consumer research throughout 2020 tracked a change in consumer attitudes and behavior in platinum’s four key markets of China, India, Japan and the United States, finding that the pandemic led to a re-prioritization of meaningful relationships and moments. In tandem, jewelry topped consumer wish lists, resulting in a willingness to pay a premium for platinum to mark important moments and relationships. Platinum’s stature as the metal of meaning enabled the jewelry industry to captivate consumers with a more compelling brand story.

Related: Findings In Latest PGI Consumer Study Look Good For Fine Jewelry

Correspondingly, the 2021 PJBR surveyed more than 10,000 manufacturers and retail stores across key platinum jewelry markets, in addition to over 2,000 consumers to provide the world’s most comprehensive and in-depth analysis of platinum jewelry’s performance in 2020.

“At PGI, the challenger mindset is central to an approach that has enabled platinum to punch above its weight in a jewelry category dominated by gold and diamonds. From the outset, we approached the pandemic as an opportunity for platinum to be a key driver of the industry’s recovery efforts. Platinum’s unique story and contribution to industry margins and profitability made it a natural to lead industry recovery as consumers returned to stores,” says Huw Daniel, global CEO of PGI.

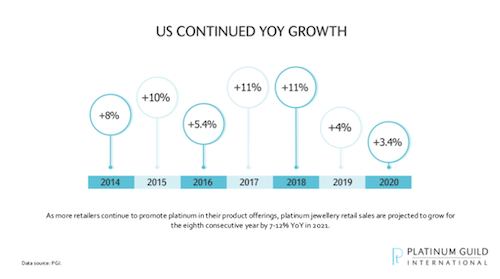

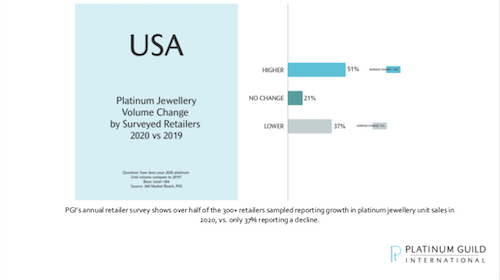

Key U.S. market findings. Platinum jewelry retail sales in the United States finished last year with an increase of 3.4% year-on-year based on PGI’s annual trade survey. Despite significant disruptions, jewelers benefited from diverted consumer spending, as consumers’ shifting priorities found an outlet in jewelry for signifying value and meaning. PGI experienced a significant increase in requests for support from retailers seeking to capitalize on the more accessible platinum price as they pivoted away from white gold. While pandemic measures shut down factories and impacted sales of new metal to manufacturers, retailers used this as an opportunity to sell aged inventory, resulting in a net increase in business.

The jewelry trade fared well with both platinum bridal and diamond fashion jewelry performing strongly. This led to the prioritization of platinum jewelry by partners such as Le Vian, whichrecently launched a new platinum collection at Jared, a division of Signet Jewelers, in over 130 stores. The Le Vian Platinum Collections have since expanded to 180 additional jewelry stores, as well as being featured in 3,500 trunk shows across the country. As a result, the brand’s 2020 platinum sales exceeded projections by 62% and platinum was named the ‘2021 Metal of the Year’ in the annual Le Vian “Red Carpet Revue Trend Forecast.”

This uptick in growth is expected to continue as more retailers promote platinum in their product offerings and platinum jewelry retail sales are projected to have modest growth for the eighth consecutive year in 2021.

Click here to access the full Platinum Jewellery Business Review.

Click here to watch a video showing how PGI and the platinum jewelry industry partners have deployed a challenger mindset to deftly expand customer base and increase margins. Key takeaways include:

- What strategic moves were impactful

- How the industry approached the pandemic as an opportunity

- How consumer sentiment insights shaped campaigns

- What is the platinum jewelry market outlook for 2021