Articles and News

RETAIL IS STRONG DRIVER OF ECONOMIC RECOVERY May 08, 2013 (0 comments)

New York, NY—April’s positive jobs report was due in no small part to the retail industry, and the first quarter of 2013 saw strong growth in retail net income.

According to the International Council of Shopping Centers, U.S. shopping-center retail jobs rose by 33,000 last month, which accounts for one-fifth of the 165,000 jobs added to the U.S. economy in April. Restaurants and bars added another 38,000 jobs.

During the 12-month period from April 2012 to April 2013, U.S. shopping centers have hired 213,000 jobs, says ICSC. The retail industry now employs 12.5 million, about 9.3% of all payroll employment, its figures show. Retail employment has recovered slightly more than 500,000 jobs between December 2009 and April 2013, says ICSC, whose statistics are used by the U.S. Department of Labor.

The shopping center industry is a crucial driver of the economic recovery,” noted ICSC president and CEO Michael P. Kercheval in a statement. “These numbers illustrate that retail and retail development is a major economic pillar.”

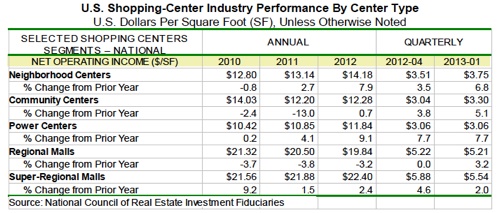

ICSC, along with the National Council of Real Estate Investment Fiduciaries, also reported strong first quarter growth in the U.S. shopping center industry overall. Net income in the industry for the first quarter of 2013 rose 5.5% over the same period last year, with neighborhood and power centers propelling growth. This is the fourth consecutive quarter of growth for the industry.

The biggest year-over-year first quarter increase was in the Midwest (8.6% gain), followed by the West (7.3% gain), South (4.0% gain), and, lastly, the East, which posted only a modest 1.7% gain over the same quarter of 2012. But the East came in second in net sales per square foot ($4.76), trailing the West’s $4.99 by only 23 cents. Despite having the largest year-over-year gain, the Midwest’s net sales per square foot were lowest in the nation at $3.53, followed by the South at $3.61.

(Performance data are based on NCREIF’s proprietary database of U.S. property operating information collected from investment managers for approximately 1,000 shopping-center properties. Figures for downtown and freestanding stores were not available.)