Articles and News

Silver Jewelry Demand Drops; Investment Demand and Price Rise November 23, 2020 (0 comments)

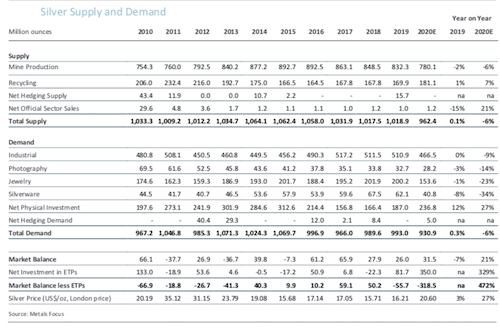

New York, NY—Despite a drop in jewelry demand, physical investment in silver is expected to surge some 27% in 2020, with bars and coin sales in the United States leading the market with a 62% gain this year.

These findings were presented as part of the Silver Institute’s annual Interim Silver Market Review webinar last week. Philip Newman, Managing Director at Metals Focus, and his colleague, Adam Webb, director of Mine Supply, presented the findings. This year, the silver price has risen strongly, achieving an intra-year gain (through November 13) of 38%, as the COVID-19 pandemic has led to a surge in safe-haven demand. Metals Focus expects the silver price to rise by 27% year on year, to average US $20.60 an ounce, the highest annual average since 2013.

Silver mine production is expected to fall by 6.3% in 2020. This reflects COVID-19 lockdowns implemented by several major silver producers during the first half of the year, which required mines to temporarily halt production. This led to lower output from Mexico, Peru, and China. The last countrywide restrictions on mining were lifted at the end of May and most mines have now returned to full production rates. However, there is a continued risk of localized outbreaks of the virus, which may impact output from individual operations in the future.

The pandemic has also had a pronounced impact on silver demand, especially in March/April. Although demand has recovered since that trough, most areas are still on track for heavy full year losses. Industrial fabrication, for example, is forecast to drop by 9% this year, a five-year low. This reflects the impact of lockdown restrictions, with supply chains heavily disrupted, end-users adopting an increasingly cautious approach to inventory replenishment, and factories facing labor supply problems. Photovoltaic demand will fall by 11% and use in the automotive sector is seeing a 17% drop despite gains in the use of silver in each vehicle. One bright note is that sectors connected to home renovation have often performed better because of the trend towards increased teleworking.

Global silver jewelry and silverware demand are expected to fall by 23% and 34% respectively. Heavy losses in India underpin the weakness in each segment. Demand in the United States, the world’s second largest jewelry consumer, also weakened, although the extent of the decline was more modest, and heavy destocking implies a sharp turnaround soon for suppliers.

The global silver market is forecast to see another physical surplus in 2020, the highest in three years. Even so, the strength of global silver investment is expected to continue comfortably absorbing this surplus.