Articles and News

THE CENTURION HOLIDAY 2012 SALES SUCCESS INDEX: LUXURY JEWELERS’ SEASON OFF TO A VERY STRONG START | December 05, 2012 (0 comments)

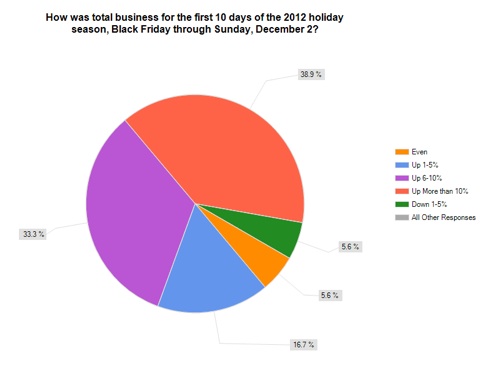

Merrick, NY—Luxury jewelers are finding a lot to smile about this holiday season so far. For the first week of the 2012 Centurion Holiday Sales Success Index, which measured sales from Black Friday through December 2, more than 90% of respondents saw a sales increase from the same period last year. The most respondents (38.9%) saw double-digit increases over last year, a 10% gain or better. Another sizable chunk of respondents—one third, or 33.3%—saw increases between 6% and 10% over last year’s figures. 16.7% of respondents indicated their sales grew more modestly, between 1% and 5% better than last year, while 5.6% of respondents each noted flat sales or slightly lowered sales, between 1% and 5% off last year’s figures for the same period.

The Centurion’s figures, which exclusively poll luxury jewelers, echo a trend also being seen in the general population of all jewelers. This report from National Jeweler shows sales growth at all levels, with more consumers willing to spend on gold and diamonds, a category the magazine says was a tough sell last Christmas.

Even prior to the start of the holiday season, things were looking optimistic for jewelers. In this video report on Rapaport TV in mid-November, Rapaport News editor Jeff Miller says sales at U.S. jewelry stores rose 3.6% year-to-date.

More than 90% of all respondents to the Centurion survey reported their sales from Black Friday through December 2 were up from last year (the coral, lavender, and blue slices). Only 11% reported sales even with last year (green slice) or down slightly (gold slice.) No respondents reported significant drops in sales.

Separately, a new report from Unity Marketing shows luxury consumers are again willing to spend money on jewelry. In its most recent quarterly survey of affluent consumers, the share of respondents who purchased jewelry in the quarter rose from 13% to 15%. But Danziger’s figures diverge from National Jeweler, Rapaport and The Centurion. At least prior to the holiday season, its respondents were looking for lower-priced items of jewelry like sterling silver or less expensive gems, and also turning to discounters and other value-focused channels.

The reason could be a varied, Danziger told The Centurion. It could be driven by changing priorities as affluent consumers mature and begin shifting spending toward experiences rather than “things,” or it could be a reaction to rising gold and diamond prices making smaller-for-the-same-money pieces seem like less of a value.

But The Centurion’s survey didn’t show any reluctance on the part of big spenders. Our spot-check survey found the best-selling products for the first week of the season were diamonds (all kinds, including loose, jewelry, and engagement rings), and Rolex and other luxury watches. Silver and fashion were both strong performers as well. Interestingly, several respondents said their customers were seeking value through second-hand goods, especially for watches and estate engagement rings.

Top "happy cat" image: Julie Flanders Blogspot