Articles and News

The Centurion Holiday Sales Success Index, Total Season Sales: A Very Merry Christmas Indeed! | December 27, 2017 (0 comments)

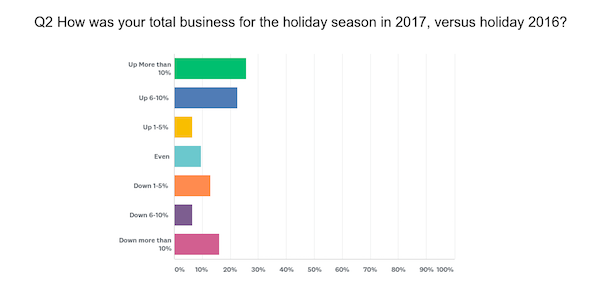

Merrick, NY—Luxury jewelers across the country should be smiling and satisfied as the holiday season concludes. For a majority of respondents to The Centurion’s weekly spot-check holiday sales survey, the 2017 holiday season was solid and, for some, spectacular.

More than one-fourth of respondents (25.81%) reported total holiday season sales were up 10% or more over 2016’s figures. Almost as many (22.5%) reported sales up between 6% and 10%, while 16% reported sales were either on par with last year or up slightly (less than 5%).

Not all jewelers were rejoicing, however. 35% of respondents experienced a “Bah! Humbug!” season with declines ranging from slight (13% of respondents) to significant (16% of respondents). Those respondents cited a variety of reasons for the declines, not least of which were those in areas where the fall’s devastating natural disasters occurred. Other respondents cited specific events last year, such as individual big sales or a renovation sale storewide, that pushed last year’s results up significantly and were not repeated this year. But with almost half of the jewelers who reported sales declines located in the Midwest, it’s a micro-trend that bears watching: was this an anomaly or is it another indicator of a greater coastal/heartland economic and cultural divide in the country?

It was a good season overall for luxury jewelers. The majority had strong results:

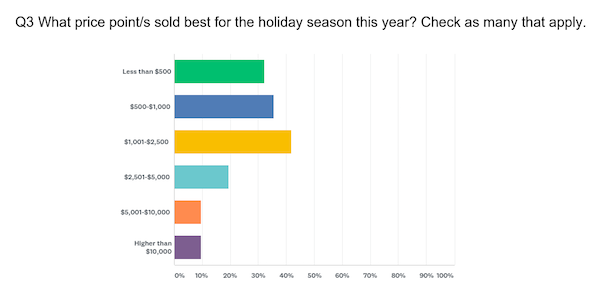

The best-selling price point for the season was between $1,001 and $2,500. 42% of respondents said that was their strongest selling category, compared to 36% that did best with items from $501 to $1,000 and 32% who did a lot of low-end volume with items priced under $500.

The sweet spot this year was slightly lower than 2016, when more jewelers reported strength in the $2,501 to $5,000 category, but it’s returned to par with other years. This also was the key sweet spot in 2015 and 2014. This year, 19% of respondents said $2,501 to $5,000 was their price point sweet spot.

Low to mid-range prices sold very well for better jewelers this season:

The Centurion asked respondents to name their biggest sale of the season. 7% reported six-figure sales. Another 14% reported their biggest sale was close to six figures ($90,000 or more) but not quite over that magic barrier. 17% cited sales of $50,000 or more, while for 27% the biggest sale was less than $10,000. The remainder cited sales between $10,000 and $49,999.

Of those, not surprisingly, the majority were diamonds of some kind, whether engagement rings, stud earrings or a fancy-color diamond. 17% reported their best sales were sapphire and diamond pieces (one was a color-change sapphire) and two respondents cited specific designer pieces (Charles Krypell and Alex Sepkus).

Among best-selling brands for jewelers this season, there were no surprises: Rolex, David Yurman, and Roberto Coin topped the list. Breitling and TAG Heuer also were favored watch brands. Designer silver by Frederic Duclos, Lagos, and Tom Kruskal were popular with some respondents, and affordable fashion lines like Gabriel & Co. and Frieda Rothman were cited by a few. The one trend of note was the relative absence of Pandora among the top-selling brands: only one respondent named it among the top three best-selling products for the season.

Business trends for the season spanned the gamut. 27% of respondents reported fewer shoppers but higher tickets per transaction, compared to 17% who reported higher foot traffic and lower tickets per transaction. 10% said the season was fairly similar to recent years; nothing changed dramatically.

Respondents were divided as to the timing of the season. 17% reported a stronger early season than late season, and of those, 60% said sales dropped way off in the last few days before Christmas. 10% said sales remained steady throughout; there were no early or late rushes. And 6% said they had their usual last-minute rush.

Respondents also were divided about the kind of customers they saw. The majority (48%) still said their business mostly came from longtime good customers, but 42% said they had more new customers than ever. And 24% saw former customers come back after a few years. Boomers still edge out Millennials as the main demographic for Centurion respondents, and a lucky 30% said all of those groups came to shop.

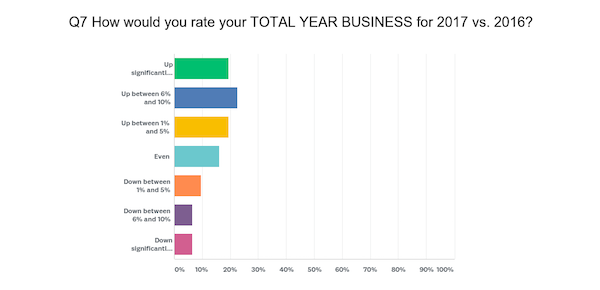

2017 was a good year overall for luxury jewelers. 61% of respondents finished the year up from 2016; of those, the majority saw total year sales gains between 6% and 10%. 22.5% finished the year down from 2016, but the majority reported only a slight decline, between 1% and 5%. 16% finished the year even with last year.

Here is a sampling of factors jewelers said impacted their total year results for 2017:

- New location

- Rain, consumer confidence, guilt

- All the natural disasters and mass shootings this year had people down in a funk

- Election hangover for the first few months of the year, which impacted overall mood for the region.

- Store and/or shopping center renovations; parking or road construction issues

- Competitors holding going-out-of-business sales

- Rolex not supplying enough or new product

- Local economy still slow

- Internal factors