Articles and News

THE CENTURION HOLIDAY SUCCESS INDEX 2011: A SEASON THAT LIVED UP TO ITS PROMISE | January 04, 2012 (0 comments)

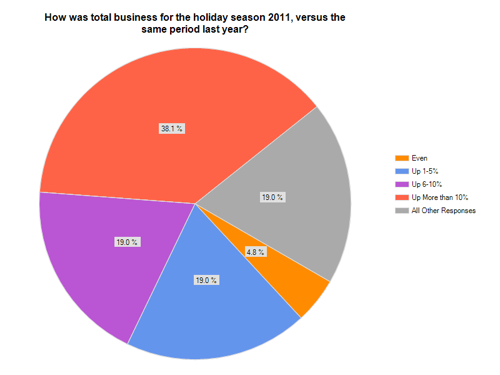

Merrick, NY—The holiday season is over and the results are in: for luxury jewelers, it was a very satisfying season overall. According to The Centurion’s exclusive 2011 Holiday Success Index gauging total sales for the season, more than three-fourths of respondents experienced sales gains over holiday 2010. Of these, 38% registered sales jumps of more than 10%, and another 38% posted gains between 1% and 10%.

One-third of respondents said the selling season was characterized by lower foot traffic but higher-ticket sales, but almost one quarter said they experienced just the opposite: more shoppers spending less money. Either way, most came out ahead. Only 19.1% of respondents saw a decline in sales this holiday vs. last year, but among those, most had relatively small drops, between 1% and 5%. 4.8% of respondents saw sales dip between 5% and 10% for the holiday season 2011 vs. the same period last year, but none of the respondents indicated a precipitous slide of more than 10%.

38.1% of respondents to The Centurion Holiday Success Index (red slice) saw sales rise more than 10% in 2011 over 2010. 19% each had gains between 6% and 10% or 1% and 5% (purple and blue slices), while another 19% saw some decline for the holiday (gray slice). A small percentage (orange slice) were flat with last year.

For the entire year, the news was even better—95% of respondents said total year’s sales for 2011 surpassed 2010, many by more than 10% and some as much as 40%. Wrote one, “We had our best year ever!” Another said a focus on vendor and customer relationships resulted in goals met—a 10% increase. Only 5% of respondents saw sales drop in 2011 vs. 2010.

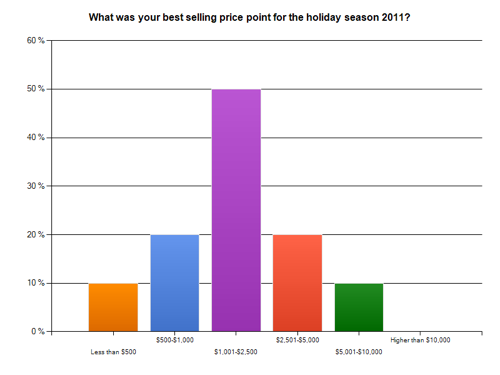

The middle may not be a popular place for politicians these days, but it’s a good place for jewelers. The best-selling price point for the season among luxury jewelers was between $1,001 and $2,500, with fully half of all respondents indicating this was their strongest category. The spread from the middle fell evenly, as well—20% of respondents each said their best-selling price points were between $501-$1,000, or between $2,501-$5,000. Ten percent each also saw significant strength in very affordable goods—under $500, or high-ticket items, starting at $5,001.

Most respondents said their best selling prices were right in the middle (purple bar), between $1,001 and $2,500. Next best were sales between $501 and $1,000 or $2,501 and $5,000 (blue, red bars). Some had the best strength at extreme ends of the price spectrum, either low (orange bar, under $500) or high (green bar, over $5,000). Respondents were allowed to check more than one category if applicable, so totals reach more than 100%.

Those who have money are back to spending. When asked what their single best sale was—and for how much—respondents overwhelmingly cited five- and even six-digit transactions. The highest reported was a Hearts on Fire diamond ring that sold for $425,000.

Among some of the other top sales cited:

- $85,000 estate piece

- Gregg Ruth important jewels diamond necklace, $83,000

- Simon G wedding set, $25,000

- $33,500 engagement ring

- $101,000 Jack Kelege ring

- Emerald-cut diamond band, $120,000

Respondents were asked to name their three top-selling categories. Overall, the top-selling category—not surprisingly—was diamond jewelry, including diamond fashion, earrings, and studs. Also not surprising was the second-best selling category, Rolex watches. Sterling silver also sold well, but specifically, Pandora’s popularity seemed to be waning a bit. Only 11.7% of respondents cited the brand among their top three best-sellers for the holiday, against 35.2% of respondents who cited silver in general (both jewelry and watches) as a top seller.

The Centurion’s findings tally with an upsurge in holiday sales across the board. According to this article in Women’s Wear Daily, if analysts’ projections are met—as they’re expected to be—the season will finish out above prerecession levels, with a record $252.3 billion in sales, beating the previously-held record of $251.7 billion in 2007.

While much of the final tally for total retail was attributable to online sales, The Centurion’s findings show that luxury jewelry—at least in the final purchase stage—still appears to be something people want to do in person. Only 4.8% of respondents reported any noticeable increase in online or mobile sales.

For retail in general, sales took on a barbell pattern this year—a huge surge over Black Friday weekend, followed by a worrisome dip for the intermediate weeks of the season, and another huge surge as Christmas Day neared. Shoppers were enticed by the early doorbusters, but clearly waited for further price incentives from retailers before hitting the stores again. While analysts acknowledge that retailers have gotten much better at planning and managing inventory since the drastic clearance sales of holiday 2008, they still haven’t figured out how to wean customers away from deals and get them to buy more at full price. That remains the challenge.

But for luxury jewelers, the sales pattern this year stayed fairly traditional. Some (23.8%) reported an early-season surge, but more than 85% reported sales either were steady throughout the season, or they experienced a late-season surge as the jewelry industry has grown used to in recent years.

Finally, in an encouraging trend that jewelers’ marketing efforts overall are working, the number of respondents—more than half—whose holiday traffic was made up equally of new and return customers far outnumbered those (19%) who saw mostly repeat customers. Few (4.8%) saw more new customers than return customers.

(Top photo: Growyourself.com)