Articles and News

The Luxury Season Roars On | December 14, 2016 (0 comments)

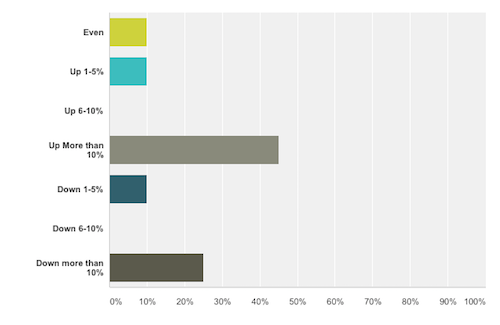

Merrick, NY—Almost half of all respondents to the Centurion 2016 Holiday Sales Success Index are reporting sales gains of more than 10% over last year. Whether it’s the improved economy or a post-election bump, jewelers will take it!

With 45% of respondents reporting double-digit gains, another 20% are reporting stable sales or modest gains for the third week of the holiday season (December 5-11). This puts almost two thirds (65%) of repsondents in positive territory. But there a few spots showing a challenge: 10% of respondents are down slightly versus last year’s sales for the same period, but one quarter (25%) are off more than 10% year-on-year for the week. Among those whose results are lower than last year, one observed that either the male gift shoppers that typically spend big haven’t come in—yet, he hopes—or there is a lot more business going to the Internet.

This year’s survey shows a noticeable shift toward more sales at a lower price point. In previous years, a few very high ticket sales pushed some jewelers’ total results way up, while their actual foot traffic was down. So far this year, however, no respondents reported individual sales above $20,000—and a lot are reporting a concentration of sales in the $3,000 and under range. More than three-fourths (77%) of respondents said their best-selling price points are under $3,000; of those, half said their strongest sales are coming in between $500 and $1,000.

16% each cited the $3,000 to $5,000 or $7,500 to $10,000 range as a strong category and 12.5% cited the $5,000 to $7,500 category as their best performer. (Respondents could select more than one price category of sales strength.)

In terms of product categories and brands, diamonds of course lead the pack with two-thirds of respondents citing diamonds in some form as their top seller for the season. Of those, engagement rings or other bridal jewelry remains the perennial favorite, with one-third of respondents citing bridal as their leading category for the holiday. Other diamond favorites were earrings (especially hoops), and necklaces. Silver and colored gem jewelry were named by 11% as their best-selling categories; 5% each cited estate jewelry or pearls.

Among best-selling brands, there are no runaway favorites so far among the better jewelers responding to the Centurion survey. Brands and designers cited for strong demand include Gabriel & Co., Simon G., John Hardy, Elizabeth Locke, Marco Bicego, Yossi Harari, Rolex, Roberto Coin, Tag Heuer, Pandora, and Vahan.

The majority of respondents to the Centurion Holiday Sales Success Index reported strong sales gains for the third full week of the season, December 5 through 11.

What changed between this year and 2015, which had decidedly more mixed results for luxury jewelers? One jeweler from Oklahoma summed up what a lot of respondents’ answers pointed to: “We sold some larger items earlier last year with small profit margins. So far [this year] we have sold more smaller items, but with higher profit margins.”

A major mid-Atlantic retailer echoed, “We have not seen the big-ticket sales we saw last year.” Another jeweler cited black diamond strands between $700 and $3,500 as his best-seller.

One Florida jeweler added says some sales have shifted to a new branded line they’ve added, but they’re still in the same general price range. “We did not have John Hardy last year, so we sold more colored stone jewelry in the $500- $1500 range. [This year’s] price points are very similar to last year’s, just slightly different categories.”

Not all jewelers are seeing their average tickets drop, though. One reported much lower ticket sales last year and another credited the Trump victory for this year’s improved results.

Top image: einsteinsoilery.com