Articles and News

The Real Threat Amazon Poses For Luxury Jewelers December 18, 2013 (0 comments)

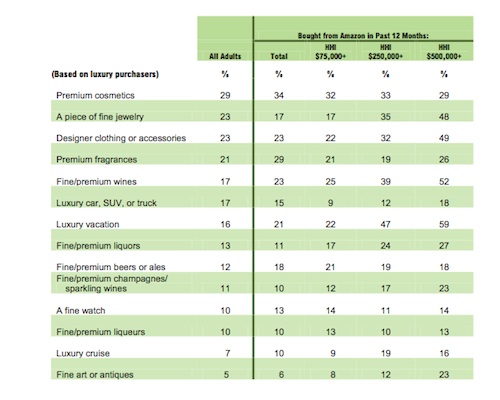

New York, NY—Earlier this fall, Amazon.com quietly launched a luxury beauty store on its website, and premium cosmetics are the number-one luxury category purchased on the site. But the number-two luxury category on the site is fine jewelry, and the likelihood of a jewelry purchase on Amazon rises sharply with income—biting into the very same customer base prestige jewelers rely on.

It’s no secret that Amazon has its sights set on upscale consumers. According to the Shullman Luxury and Affluence Monthly Pulse, the site—which is tied with Wal-Mart for largest retailer in the United States—has significant penetration into the luxury market already.

“What happens in the [luxury] retail market if and when Amazon starts opening other luxury stores?” asks Bob Shullman, president of Shullman Research Center, which conducts the Pulse.

The average American adult lives in a household with an income of approximately $71,000, says Shullman, but Amazon’s demographics skew higher: the average Amazon customer has an income of about $89,000. As household income increases, so does Amazon's penetration. For example, 68% of entry-level affluents ($75,000+ HHI) shopped Amazon in the past year. 69% of adults in the $250,000+ HHI segment have shopped it in the past 12 months, and 63% of those earning $500,000 or more. But of those ultra-affluents in the $500,000+ income segment, 64% shop on Amazon once a month or more.

According to Shullman’s research, 23% of all respondents bought a piece of fine jewelry in the previous 12 months, whether on Amazon or elsewhere. But when asked if they bought a piece of fine jewelry on Amazon, figures diverge sharply as income rises. Among all adults, 17% said they bought fine jewelry on Amazon, and that figure stays the same for the entry-level affluent segment (HHI starting at $75,000). When income hits $250K, however, that figure more than doubles to 35%, and leaps to 48% for ultra-affluent consumers whose income is $500K or more. The only categories that surpass jewelry among these consumers are luxury vacations (59% of ultra-affluent consumers bought one on Amazon), premium wines and spirits (52%) and designer clothing (49%, only one point higher than jewelry.) Fine watches, meanwhile, show far less divergence by income group.

This chart from the Shullman Luxury And Affluence Monthly Pulse shows luxury purchase incidence for a variety of categories. The findings to the left of the bold black line show luxury purchases among all adults, via any retail channel. The findings to the right show the purchases of those categories on Amazon, by income group. Chart source: Shullman Research Center

With these findings, the news that Amazon is looking into delivery by drone is less of a threat than what packages those drones might be carrying and to whom.