Articles and News

THE SECRET TO FINDING THAT ELUSIVE SUPER-RICH CUSTOMER | October 31, 2012 (3 comments)

New York, NY—In a recent essay written for The Luxury Society, Doug Gollan, group president and editor-in-chief of Elite Traveler magazine, discussed how surprisingly few luxury brands make a concerted effort to target the ultra-affluent, a demographic that typically spends about a quarter-million dollars per year per household on fine jewelry.

But Gollan says most luxury brands spend the bulk of their efforts and dollars targeting the aspirational affluent, a demographic that, as we’ve seen since 2008, is far more prone to economic fluctuation and far more likely to cut back spending when times get tight.

In an exclusive interview with The Centurion Newsletter, Gollan tells jewelers where those ultra-affluent, recession-proof consumers are, how to find them, and especially, how to motivate them to buy from you. At that spending level, it only takes one or two of these customers to make a huge difference in a jeweler’s annual profit.

The Centurion Newsletter: In your Luxury Society essay, you prove the ultra-affluent will spend whatever they want if they're motivated enough, using New York mayor Michael Bloomberg’s self-funded re-election campaign as an example. But since these consumers can afford anything they want—and most aren’t running for mayor of New York—what exactly motivates them enough to buy?

Doug Gollan: Marketing motivates everyone. It’s why we reach for a candy bar for ‘energy’ or a Coke ‘to quench our thirst.’ The point I was making [in my essay] is that luxury brands spend hundreds of millions chasing aspirational consumers, but often ignore the super-rich.

Ultra high net worth (UHNW) consumers are motivated by the same things all of us are: quality, prestige, craftsmanship, uniqueness, love, happiness, etc. But many brands assume the UHNW customer knows their products. They may know the name, but they probably know a lot less about these luxury brands than the brands think.

Research shows over 90% of the super-rich are self-made. They were never the aspirational customer. They were the person who figured out a better way to make widgets, and at 42, sold the company for $400 million. The spouse and kids probably were focused on helping [the company] for a dozen years while nobody knew if they would make it. Credit cards were used to fund the business, not take fancy vacations.

There is a lot of money to be had from these UHNW families now that they are rich, but the luxury companies to a large degree ignore them as an advertising target, assuming they already know. But they don’t know.

Doug Gollan, group president and editor-in-chief of Elite Traveler, in his favorite seat.

Centurion: You identify these consumers as global citizens. How can a local jeweler appeal to someone who's been everywhere and seen it all? How can a typical luxury jeweler outside the rich watering holes like New York or Aspen find these consumers in their own area?

DG: Researcher Wealth-X found that there are at least 100 UHNW families in every state except Alaska and North Dakota. When I look at Elite Traveler's database of private jet owners, they come from across the 50 states. In the United States, there are some 5,000 airports servicing private jets. While they may travel the world, they also have local roots. One of the reasons our magazine has been successful is by being on private jets—we reach them wherever they happen to be.

Poor people don't own and fly regularly by private jet. By targeting private jet travelers and owners in your store's footprint, you are following the money much as Neiman Marcus did with the oil families. Elite Traveler reaches these private jet travelers through our BPA audited circulation in over 100 countries, but you can go visit the private jet terminals at your local airport, speak to the owner or manager, and create your own local marketing program.

A recent cover of Elite Traveler. Its annual Watch Guide is pictured at the top of this page.

A couple of years ago, we did a direct mail program to private jet owners in targeted states, promoting a high-end South Pacific resort. One booking generated close to $500,000, from a Native American family that had made their fortune through local casinos. It was not the profile of 'who' many luxury marketers think their client is.

The early success of Neiman Marcus was taking the wealthy oil wildcatters and educating them about the best life had to offer: fashion from Paris, jewelry from Italy, and so on. A high end men's clothier in Canada takes newbies who’ve made tens of millions in the oil and gas fields and gets them dressed for both boardrooms and St. Bart’s. Billionaire Larry Ellison was born to an unwed mother and was adopted by relatives.

The beauty of this market is you only need a handful of good UHNW clients to dramatically impact your sales and profits!

Centurion: What kind of jewelry do these consumers seem to want? Is it the typical "luxury" image of something large and lavish, or is it something more unusual or casual, but rare and fine?

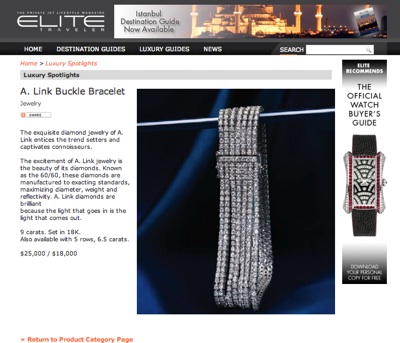

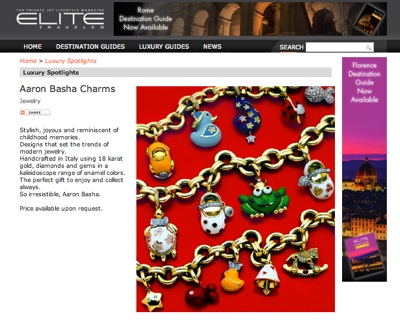

DG: It's all of the above. Our experience comes from readers buying jewelry directly from the magazine. While we have some great success stories of brands selling necklaces, rings, and watches that retail for hundreds of thousands of dollars, we have one loyal advertiser who runs silver. His experience is that our readers buy multiple pieces, stacking [on the body] and also gifting. While a $1,000 price point may seem a lot in the [non-affluent] world, even at the two-, three-, and four thousand dollar mark, that is typical gifting or accessorizing [for the ultra-affluent]. Our reader buys three new dresses and four pairs of shoes, it's $10,000—and then another $10,000 spent on jewelry is everyday life.

A. Link is featured in Elite Traveler's online product guide for jewelry.

Centurion: Your essay focused on how brands can target this customer. Are these customers likely to shop brands, perhaps because their friends do? Or are they more likely to want bespoke unbranded goods?

DG: I think the point about marketing and selling to the rich is they have the same emotions as everyone else. They are human beings; just with a $5.3 million household income they happen to be very, very rich, as in the case of our readers. Sometimes brand is important. Brand of course is about status, but at the same time a unique piece that captures their attention is also motivating. The difference is, while most of us see beautiful jewelry and say 'someday,' or 'If I get the raise,' for the UHNW consumer price is not a factor. That doesn't mean they don't want a good price. It simply means if they want it, they can acquire it, not just desire it. The average [UHNW] annual household spend on fine jewelry is $247,000, so there is a big payoff.

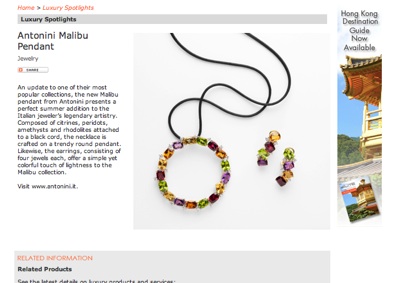

Both Aaron Basha and Antonini also participate in the Elite Traveler online product gallery.

Centurion: F. Scott Fitzgerald once famously wrote that the rich are different—they have more money. Apart from the money, what is different in serving this customer vs. serving a mass-affluent customer?

DG: From an advertising perspective, very little, but from a service perspective, I think it’s a mixed bag.

Over the 11 years we have been publishing Elite Traveler, I have seen UHNW consumers respond in our magazine to ads that are run in general media. From a service perspective, yes, many of the super-rich can be very demanding—but we all know low-yield customers who take a lot of time as well. I know stories about super-rich consumers who are amazing, including paying for an operation for a salesperson's wife, and the like.

My best recommendation is treat super-rich customers with the same respect and business acumen that has made you successful.