Articles and News

What Does “Consumer Confidence Up” Really Mean? April 06, 2011 (0 comments)

San Francisco, CA--When the news headlines proclaim consumers feel more confident this month than last, or more confident this month compared to the same month last year, is this information something a retailer can translate into action?

Does a consumer telling a pollster he or she “feels” more confident about current conditions necessarily mean they’re going to do something different in terms of spending? And isn’t it ultimately what consumers do, rather than what they say, that matters most to the economy?

Is it more important to pay attention to the hard data—i.e. retail sales figures, unemployment figures, factory orders, et al as an economic indicator—or to soft data like sentiment and planned purchases? Consider how two respondents might answer a survey about an “intended” purchase. One may think, “Wow, I’d really like to get my wife a diamond bracelet for our next anniversary,” while another says, “I’ve got money put aside and I’m going shopping next week for the bracelet.” Both are intended purchases, but which one matters most to a jeweler? Or do both matter equally?

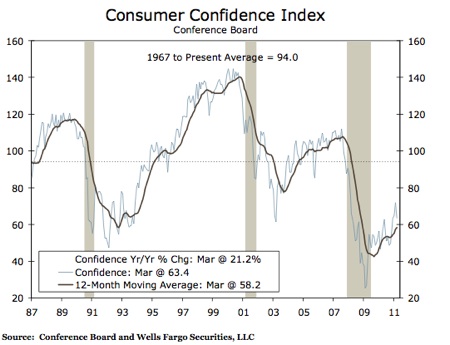

A special commentary just released by the Wells Fargo Economic Group titled “A Primer on Consumer Confidence” addresses these very issues. The paper explains the value of both hard and soft data in analyzing economic conditions. First it briefly explains the methodologies of the major consumer confidence indices (The Conference Board, the University of Michigan’s Consumer Sentiment Index, Bloomberg Consumer Comfort Index, the Rasmussen Reports and others). For example, the Confidence Board measure is based on a survey of 5,000 households, with a typical response rate around 3,000. Using 1985 as a benchmark year (neither a boom nor bust year) as a base of 100, it asks:

- Respondents’ appraisal of current business conditions

- Respondents’ expectations regarding business conditions six months hence

- Respondents’ appraisal of the current employment conditions

- Respondents’ expectations regarding employment conditions six months hence

- Respondents’ expectations regarding their total family income six months hence

It also asks questions about planned significant expenditures such as homes, vacations, automobiles, major appliances and so forth.

The University of Michigan study asks similar questions, but from a more personal, less esoteric perspective, such as “would you say you and your family are better or worse off financially than you were a year ago?” and “do you feel you’ll be better or worse off financially a year from now?”

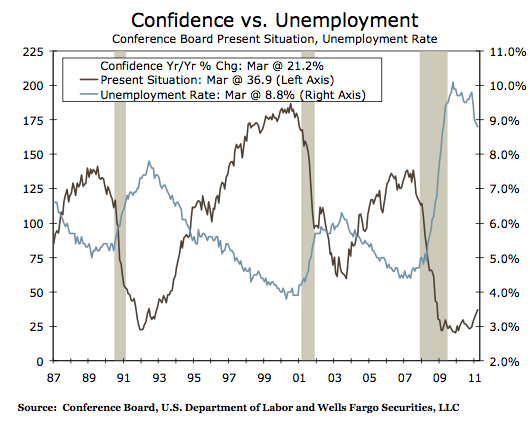

According to Wells Fargo economists, while interpretation of consumer confidence data is clearly more art than science, useful analysis of the “soft” data of these surveys can be drawn. Especially is this true when comparing survey data from similar periods in past economic cycles. Is the confidence level at this point of the economic recovery greater or lesser than the same point in a previous recovery? Variances such as these can help determine the strength and perhaps even the speed and length of the recovery. Answers also sometimes can be predictive, such as the “present situation” component of the Conference Board survey in March. The modest 3.1 point increase in confidence reported for March was an important clue that the unemployment rate would drop that month.

The complete report can be accessed here.