Articles and News

Why $1300 Gold Can Be A Good Thing October 03, 2010 (0 comments)

New York, NY--Gold is at an all-time high, giving many jewelers a case of heartburn. But is it necessarily bad news?

To the positive, rising gold prices reinforce the lasting-value message of a fine jewelry purchase, a particularly relevant point for high-end designers and retailers.

“When consumers buy gold jewelry, there is a subliminal awareness of its investment value,” says Michael Pace, vice president of marketing, USA, for the World Gold Council. These days, he says, that awareness may not even be so subliminal.

Still, a pricey market hits everyone in the wallet, and the industry wants to know where prices are going.

According to Philip Newman, research director for GFMS, a precious-metal consultancy in London, indicators suggest prices still have a way to climb. “We suggest prices breaking $1,300 [an ounce] and possibly close to $1,350.” Moreover, he adds, these levels are likely to be sustained for a time, though that is dependent upon a continual flow of [investment] money into the market.

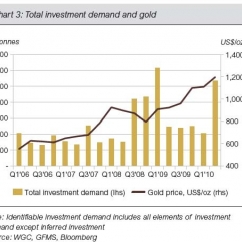

“When gold is driven more by investment than jewelry demand, that tends to lead to price volatility,” explains Newman.

This is an investors’ market. General economic and geopolitical factors, supply and demand, and investor mindset are among the main drivers of gold price, and right now investors are nervous. Apart from the expected worries about the American economy and European sovereign debt, since the collapse of Lehman Brothers, says Newman, investor mindset has shifted and they’ve gotten particularly skittish.

“If something that was seen as so safe can fail, one wonders what else can fail?” he explains. This sends investors flocking to havens like gold—which then tends to make things difficult for jewelers, because price volatility is much harder to deal with than steady price increases.

The degree of volatility, however, has declined since early 2009, says Pace. Now it’s more in line with the long-term average. Managing inventory and cash flow to accommodate a slow and steady increase is easier than dealing with wildly fluctuating ups and downs, but Pace reminds jewelers that they need to keep a mix of classic and fashion products in their cases, regardless of price fluctuations.

“If you only buy classic, you can’t differentiate yourself,” he says.

What to watch. Gold prices, like everything else, run in cycles. The 1990s were a bear cycle ($253 in July 1999) and the 2000s have been a bull cycle, says Newman. Prices will come down eventually, but nobody knows when or what will trigger the shift. One thing that isn’t likely, however, is to return below the $500 mark.

“Mining costs in the 1990s were much lower than they are today, for a variety of reasons. We don’t perceive, with the increased cost of mining, prices below $500,” says Newman.

Interestingly, the stock market is not necessarily an indicator of gold price. That, says Pace, is why investors like it as a means of adding diversity to their portfolio. “Gold is a truly global asset. At the same time, certain factors may affect gold jewelry demand one way, but investment demand another.”

Better indicators to watch are non-farm payroll employment, interest rates, and inflation. Non-farm payroll, especially, is a far better indicator [of overall economic conditions] than GDP, says Newman. So are whatever actions the government takes to rein in the budget deficit. If interest rates are raised, that can drive gold prices down because other investments start to look attractive again. But he emphasizes that a four or five month trend is far more relevant than a one-month blip.

Pace cautions against relying too much on any one indicator, because supply and demand are affected by so many global factors. Even short-term events like holidays or religious festivals or the financial meltdown of 2008 can affect price, though most drivers of price are long-term. Especially important is the rapid growth of demand in China and India. Both countries have a long-standing cultural affinity for gold and an emerging middle class hungry for gold, but gold mine output has declined in the past decade.

What goes around comes around. Recycled gold is an important part of the supply chain, and with the increased costs and decreased output of mining, its importance isn’t likely to diminish. Despite the “We Buy Gold” signs popping up on every Main Street in America, and an increasing number of designers touting “green,” i.e. recycled, gold, the bulk of it comes from Asia and India, where 22k or 24k gold jewelry is given in lieu of monetary gifts.

“In Western markets, there’s a stronger emotional connection to jewelry,” says Duvall O'Steen , director, jewelry PR and promotion for the World Gold Council. “’My mother gave me this necklace,’ or ‘I bought this when I got my first raise.’ People in the West are very reluctant to sell their gold—they will save it as a very last resort.”

Ironically, as prices have rocketed this year, the amount of recycled gold has declined. “In a more distressed economy, such as we saw in 2008 and 2009, gold recycling will go up, but as the economy recoups, recycling goes down as people see the long-term value of gold,” says Pace.

Jewelers who buy gold off the street will be facing new regulations starting in 2012, says Cecilia Gardiner , president and CEO of the Jewelers Vigilance Committee. All business will have to file a 1099 when they buy any goods (not just gold) where the total transaction is more than $600. The new regulation means that all buyers of gold will have to issue 1099 forms to consumers, who probably will have to pay tax on the money they receive. It also means that refiners who buy gold from retailers will have to issue 1099’s [to the retailers].

Trim the hedges. Should jewelers try hedging gold or buying gold futures?

Retailers are better off not, says Newman. Jewelers are merchants, not traders, he says. Major retailers [or manufacturers] might get quarterly locks on prices to keep their larger SKU’s price-protected, but that may be harder for an independent buying only a few pieces of a style or a small designer shop making only a limited quantity of pieces. Of course one can ask regular suppliers for a price lock, or those who are members of buying groups may be able to negotiate price protection from participating manufacturers.

This leads to the dreaded R-word: re-pricing. Yes or no? Those looking strictly at the cost of restocking will say yes, those with a marketing perspective say not so fast. But all agree that “how” can be more important than “if.”

“It’s about the message you send to customers,” says Newman. While a high-end jeweler wouldn’t throw a piece on the scale in front of a customer, if there are two similar pieces in the case and one is new and priced to reflect current gold while the other is a year old and hasn’t been re-priced, he says consumers may not see the value in the newer piece.

Retail jewelers tend to regard unit prices as sacrosanct, says Pace, which forces manufacturers to re-engineer pieces with lighter weights or lower karat weight to keep the price point. He says jewelers should not vary prices too frequently as that sends a confusing message of instability to customers, but a drop in quality—whether in weight or the hallmark—confuses customers as well, and diminishes the allure of the metal, he says.

“Customers don’t want to pick up a $1,000 piece of gold that feels like nothing,” says Duvall O'Steen . It’s better to show something smaller but heavier, she says, but sales associates often don’t realize how much consumers are willing to trade up. Instead they go for a quick, easy, price-point sale—or even feel guilty that a piece now is more expensive than it used to be. Yet the trend of today’s customer is to spend more for fewer but better-quality items, she says.

It all comes back to the time-honored technique of telling the gold story—its history, allure, romance, craftsmanship, design—and reinforcing value over price. “Don’t take the gold out of gold!” says O’Steen. “There is so much to be said about it that justifies its price.” Adds Pace, “Price should not be the enemy of gold. It’s precious and enduring and is the material of a good jeweler.

By Hedda Schupak

Editor, The Centurion