Articles and News

You Telling Me What To Do? A Governing Board Can Help Boost Business And Reduce Legal Threats | May 10, 2017 (0 comments)

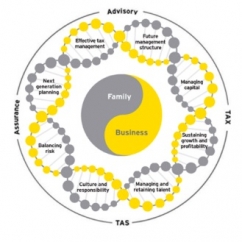

New York, NY—If you’re used to calling all the shots yourself, or maybe together with your spouse, EY Americas’ Family Business group (a division of Ernst & Young) suggests having a formal governing board, including outsiders to the business, can help your business grow and thrive. For instance:

You’re a business founder who isn’t planning to retire anytime soon, but you still want to prepare your heirs for the next stage of business growth, and be sure that when the time does come for you to step down, that they’re capable of carrying on. Or maybe your business is in the second or third generation but the siblings and/or cousins who own it are forever butting heads. Peace seems unattainable and it’s negatively impacting the business. Or, finally, you’ve been asked to serve on a board for another family’s business. What is your role? How much of your time will it take? Will you be guiding business strategy or refereeing family disputes?

A recent report from EY’s Family Business Services outlines all these questions and more. First, here are some different kinds of governing boards:

1. A family assembly or forum is comprised all of family members. It may have certain requirements to belong—such as a minimum age or being family by birth, not an in-law—but its purpose is to approve major policies and procedures and any changes to the family charter. It also may elect members to a family council.

2. A family council typically has five to nine members who serve staggered terms and serve as a liaison between the family and the business’s board of directors. They support family succession planning and education and assist in resolving family conflicts.

3. A shareholders’ council is the owners of the business, typically excluding spouses and family members who do not own shares in the business.

4. A business board of directors is the governing body of the business, and is separate from the family council. Most often, this board includes nonfamily members and is focused on defining the business strategy, overseeing its operations, and advising the leadership team.

5. A family board of directors blends both family and business governance. This is very typical when the second generation of the family business begins to have input into key decisions. Meetings can intermingle both business and family topics.

In the absence of a family council, the business board of directors also may handle family topics as they pertain to the business.

6. Lastly, an advisory board’s function is like a business board, but its members do not have voting rights. Advisory boards are used when owners feel a need for outside advice, but don’t want to cede control. It can be a transition from a family-governance board to a full business-governance board by adding nonfamily members in an advisory capacity first.

In contemplating the need for a governing board, EY says a few key questions include:

- How should business and family governance change as the business matures and the family grows?

- When is it time to separate business governance from family governance?

- What is the purpose of a board of directors and its members’ responsibilities?

- Who should be on the board?

In addition to the reasons mentioned above—the founding generation wanting to prepare the next generation to take over, and family conflict or disagreement that needs an outside facilitator—other key reasons for forming a governing board include:

- The benefit of outside perspective in creating strategy and ideas.

- If the business wants to borrow money, lenders tend to be more agreeable when there’s a formal board of directors; and

- A formal decision-making process through a board of directors reduces the risk of family member owners bringing litigation.

Who should be on your governing board?

EY says if family members own most or all of the company, they need representation on the board. Families often separate voting shares from common shares, and participation may be limited to those with voting shares. EY still suggests even non-voting family members should have some representation, even if it’s a nonfamily member speaking or acting on their behalf.

Spelling out specific family qualifications to join the board also can help avoid conflict. For example, can spouses serve on the board? If so, must they have been married for a certain length of time? Can the current board veto a family candidate who is inexperienced or otherwise likely to cause potential harm, whether to the camaraderie of the board or the business itself? Should new board members shadow in a nonvoting capacity before joining as a decision maker? What about a family member’s work role? Should they be on the board of directors if their day-to-day role at the company is not executive or managerial?

Other key qualifications for serving on a family business governing board include experience in the business’s industry, their contacts and network within that industry, personality dynamics that will make them a good fit for the board to work as a team, and proven shared values of the business and family. Other considerations include minimum or maximum age, gender balance, and so forth.

Candidates also need to know the time commitment required to attend meetings and preparing in advance or reviewing materials or financial statements. Geography also may be a consideration: is travel or teleconferencing okay, or should board members have a local perspective and be available on short notice?

Finally, will the board be exclusively family or will it have nonfamily members? EY strongly recommends bringing in at least one nonfamily member. For one thing, it is a good sounding board for the CEO to bounce ideas off someone who doesn’t have a financial stake in the outcome. This person can often see challenges or opportunities the family doesn’t see, and can be a buffer between the CEO and family criticism. The presence of a nonfamily board member also can help keep conflict management on a professional level, whereas an all-family board can devolve into shouting or name-calling.