Articles and News

Platinum Prices Plummet Below Gold | October 07, 2015 (0 comments)

Merrick, NY—As jewelers wondered if they’d ever see $800 gold again—let alone $400 gold—platinum has quietly slid down for the past five years.

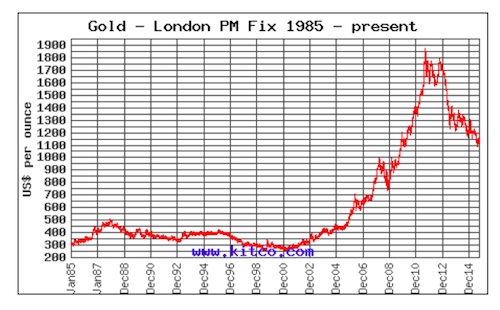

Last week, platinum plunged to $896 an ounce, the lowest price since December 2009. By Monday, it had recovered to $918 and at press time was trading at $945. Meanwhile, gold is trading at $1,145; a $200 difference per ounce. According to RMB Group, a commodity brokerage firm, this is one of only four times in history that gold is more expensive than platinum.

Among the precious metals, gold is the “investment metal” and platinum is the “industrial metal.” Gold prices are largely driven by investor activity and less so by its uses in various industrial applications. Platinum prices are largely driven by how much the metal is in demand for industrial use, primarily in the automotive industry but also in the pharmaceutical industry, as well as jewelry. And both investment and industry factor into silver prices.

The thin gold horizontal line represents the point at which platinum and gold trade at the same price. They were relatively close in the early 1990s—with a very slight dip in platinum below gold, but not enough for the market to react. The blue line represents platinum’s price, which dipped below gold around 2011 and 2013 when gold spiked to almost $2,000 the ounce. Data source, CQG; chart, RMB Group.

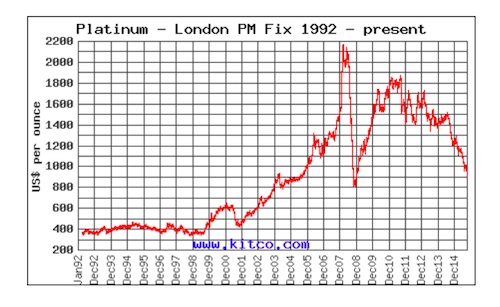

Platinum crept up to about $600 at the end of 2000 before falling back to the $400 range at the end of 2001. But at the same time, gold had bottomed out around $250 in 1998 and again in 2000. From there, both metals began their sharp trajectories upward. Gold peaked at about $1,850 in 2011, but platinum peaked sooner and higher—almost $2,200 at the end of 2007. Compare both trajectories on these charts from Kitco.com, which has historical data on gold prices from as far back as 1883. Its data on platinum goes back to 1960.

The “Dieselgate” scandal at Volkswagen has been blamed for platinum’s recent woes, but the metal is suffering from more than a Beetle bite. This article from Mining.com, published in July, shows the accelerating price drops for both platinum and palladium, another platinum-group metal with automotive applications. The difference is that platinum is used more in diesel engines—popular in Europe—while palladium is used more in gasoline engines, popular in the United States and China. With both Europe and China having some economic hiccups, it’s not surprising that both metals are down.

When the Platinum Guild International established its U.S. office in 1992, the metal was trading comfortably in the $400 - $500 range where, with a few small fluctuations, it stayed until the end of 1999. But at the time, gold was trading around $300 the ounce so the price difference coupled with platinum’s reputation—deserved or not—of being harder to work with than gold at the bench gave PGI plenty to address in the market. The metal had fallen out of popular use for jewelry since World War II, when it was declared strategic for the war effort and its use for non-military applications curtailed. White gold quickly became a substitute and remains a popular alternative, but platinum sales have been trending up in the past few years. Research conducted by PGI in 2014 shows that consumers do have a favorable view of platinum and would buy it if presented the opportunity. 43% said it’s their first choice of metal when purchasing a piece of jewelry and another 34% would seriously consider it. 77% of respondents felt platinum is worth its cost.