Articles and News

Holiday Kickoff: Tickets Up; Online Rockets; Consumers Trying New Brands; Jewelry A Winner | December 04, 2019 (0 comments)

New York, NY—The 2019 holiday shopping season is off to a solid start, according to multiple analyses of the five-day Thanksgiving weekend.

A Black Friday sales report from retail marketing technology company Bluecore has found that more than half (54%) of Black Friday purchases this year were brands that consumers had never tried before. It predicts that almost one-fourth (22%) will become repeat customers of those brands. These findings were consistent across multiple product categories, including jewelry. Additionally, 60% of second purchases occur within 100 days of the first purchase, says Bluecore.

For the second year in a row, Bluecore looked at shoppers’ real-time and historical Black Friday buying patterns and product interactions, including purchases, across 158 retail brands in multiple retail categories: Apparel (51 brands), Footwear (22 brands), Home (15), Technology (7), Beauty (13), Jewelry (7) and Other (43). The resulting data offers insights into how Black Friday 2019 compares to 2018, as well as to a typical day. It also uses past year data to predict what retailers can expect from new 2019 Black Friday customers in 2020.

Bluecore’s report found that retailers in apparel, jewelry, and beauty saw their average order ticket rise between 5% and 20% on Black Friday 2019 vs. 2018. By contrast, the average ticket for footwear, home, and technology products declined slightly from last year’s figures, though all four of these categories saw the largest percentage of first-time buyers: 68% of footwear buyers purchased a brand for the first time, and 65% of jewelry, home, and technology buyers did likewise. 38% of jewelry shoppers researched the products they wanted to buy two weeks in advance of purchasing; on par with apparel, beauty, home, and technology shoppers.

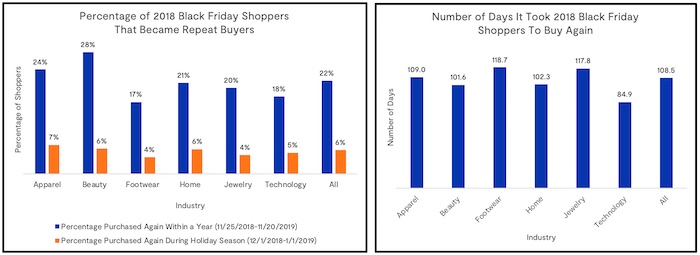

In 2018, more than 6% of Black Friday 2018 customers purchased again during the holiday season and 22% became repeat buyers within an average of 108 days after their initial purchase, with an average of 1.7 orders in since Black Friday 2018. Bluecore predicts similar results this year.

Left: 20% of shoppers buying jewelry on Black Friday are likely to purchase again within a year, and 4% are likely to come back for another purchase within the same holiday shopping season. Right, the average time it took for shoppers to return to the jewelry store for another purchase is 117.8 days. Charts: Bluecore.

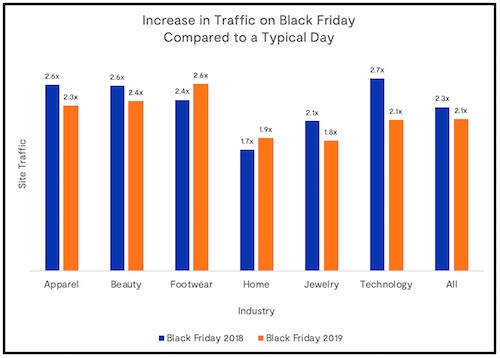

Overall, however, while Black Friday was a strong shopping day compared to a regular day during the year, its importance seems to be diminishing. Retailers in all categories saw increases in traffic compared to a regular shopping day—but smaller increases than in prior years.

Black Friday traffic increased 1.8 times on Black Friday compared to a regular day throughout the year. That's slightly below the 2.1x increase noted in 2018. Chart: Bluecore.

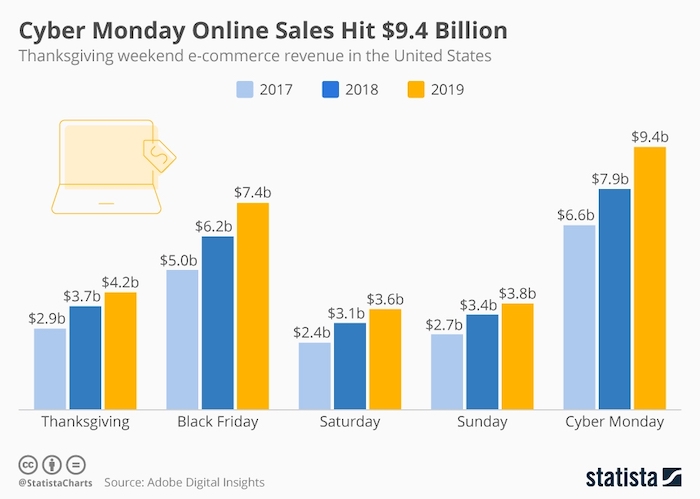

Separately, Cyber Monday (December 3) is rapidly becoming the new Black Friday. In a release on Tuesday, Amazon said Cyber Monday was the single biggest shopping day in the company’s history, based on the number of items ordered worldwide, and that independent third-party sellers in Amazon’s Stores—mostly small and medium-sized businesses—sold more items during Cyber Monday than any other 24-hour period in the company’s history. Top selling categories on Amazon for the weekend included toys, fashion, home, and health and personal care, as well as a variety of Amazon devices like Echo Dot, Fire TV Stick, and Alexa voice remote. Toys and devices were particularly strong sellers on both Black Friday and Cyber Monday.

For weekend retail as a whole, Retail Dive reports the big winner was mobile shopping—up 35% on Black Friday and responsible for $3 billion in sales on Cyber Monday—but brick-and-mortar foot traffic was down 3% year-on-year across the weekend, according to ShopperTrak data. Thanksgiving Day foot traffic rose 2.3% over last year, but it was offset by a 6.2% decline on Black Friday.

That said, however, the weather may have helped boost digital sales so high. A series of storms across various parts of the United States snarled holiday traffic plans and likely also drove people to their smartphones rather than to stores.

But consumers who did physically go shopping on Black Friday were there with a purpose: conversion rate was up 1.7% and shopper yield up 2.7%, said the Retail Dive report. It also pointed out that consumers still like the social aspect of shopping and the feeling of doing something holiday-related. And more good news for independent retailers: the “shop small” movement is catching on. Findings from the NPD Group’s Holiday Purchase Intentions Survey said the number of shoppers who intend to shop small and local this year rose 10%. Indeed, Small Business Saturday posted a record $3.6 billion in sales, with gains from both large and small retailers.

Finally, the best-winning strategy seems to be in-store pickup of online purchases. One out of every five online purchases will be picked up in person, says NPD’s survey. Retailers who provide a seamless shopping approach are likely to benefit from the many consumers who make additional impulse purchases when they come to pick up their goods, said NPD’s chief industry advisor Marshal Cohen.