Articles and News

New Research Shows What Diamonds U.S. Consumers Really Are Buying | November 02, 2016 (0 comments)

Tel Aviv, Israel—In a diamond market that has offered little good news of late, research conducted by retail metrics firm NPD in the first half of 2015 shows some pockets of opportunity. More importantly, those areas—namely branded and larger diamonds—are especially key for luxury jewelers.

One of the biggest issues in the diamond industry, especially in the manufacturing sector of the diamond pipeline, is a lack of impartial and detailed data about consumer purchasing habits. Just how many diamonds do American jewelers sell every year? What are critical sales trends? And do consumers really want lab-grown diamonds?

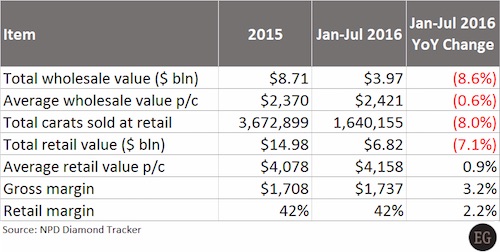

Market overview. In 2015, consumers purchased $14.98 billion worth of natural polished diamonds from specialty jewelry retailers in the United States, based on data collected from nearly 4,000 specialty jewelry retailer doors. The total volume of these purchases was 3.67 million carats, at an average value of $4,078 per carat. The total wholesale cost of polished diamonds purchased by American specialty jewelers was $8.71 billion, averaging $2,370 per carat. The average retail margin was 42%.

In trading activity from January to July 2016, the total cost of goods purchased by retailers fell 8.6% to $3.97 billion, and the average value of wholesale purchases softened 0.6% to $2,421 per carat, compared to the same period in 2015. Total value of polished diamond sales declined 7.1%, and the volume of sales fell 8% to 1.64 million carats.

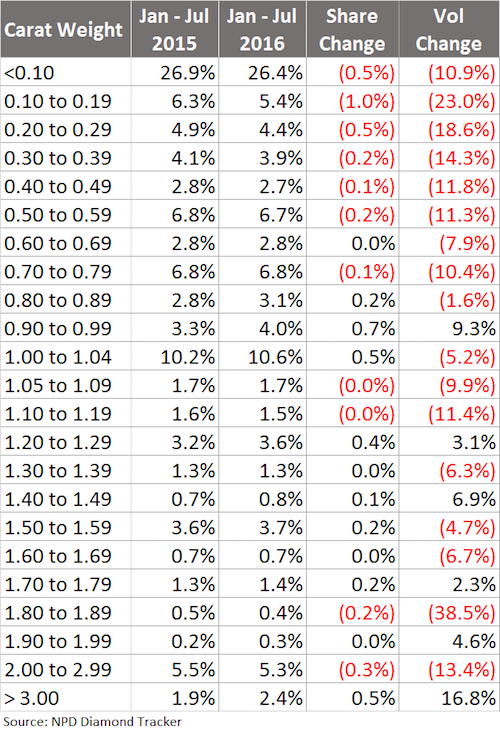

But within all these declines, there is one area where there was an increase: in the average value per carat of diamonds sold by retailers, which increased by nearly 1%. I believe the reason for the increase is first because of a shift in share between smaller goods and larger goods—there’s a very noticeable decline in sales of smaller goods under 0.90 carats compared to larger goods.

The second reason is because retailers acted to recover some of their lost revenues created by the decline in diamond sales. Wholesalers did not get a share of this pie, which retailers kept completely for themselves.

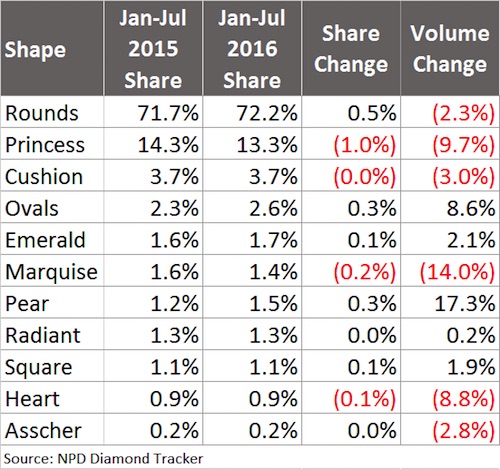

Consumer preferences. Round diamonds remain the most popular shape among consumers, representing more than 71% of all diamonds sold. Princess is second, with ovals and cushions in distant third and fourth. Together, these four shapes represent 92% of all diamonds sold by specialty jewelers in the United States. All other shapes collectively account for only about 8% of unit sales. It’s important to note, however, that demand for princess cuts declined during the first seven months of 2016, losing 1% share of total and 9.7% in volume (measured in carats).

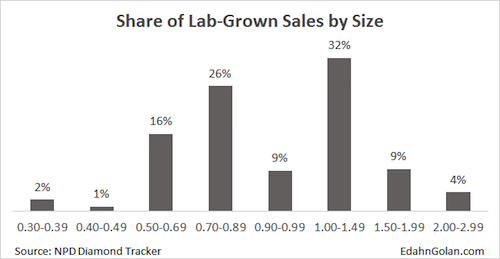

Year-over-year, sales of goods smaller than 0.90 carats have declined by varying degrees—1.6% to 23%—during the first seven months of 2016. At the same time, goods in sizes 0.90–0.99, 1.40–1.49 and 1.90–1.99 carats all increased noticeably. Collectively, this tells an interesting story. All are just shy of popular round sizes: 1.00, 1.50 and 2.00 carats; sizes where price per carat jumps. It seems, therefore, that American consumers are trying to save money by purchasing diamonds that look the same but cost less.

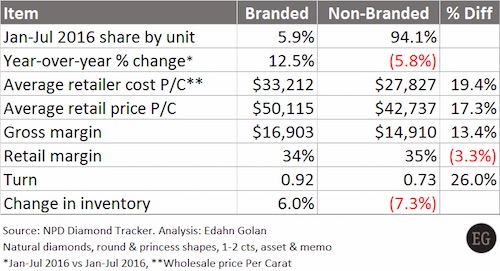

Branded Diamonds A Key Growth Category. During the January–July period of this year, sales of branded jewelry posted a double-digit increase of more than 12%, while sales of non-branded diamonds declined by nearly 6%.

Slowly and irregularly, but continuously, the number of branded diamonds purchased by consumers has increased over the past few years. In the period covered by this research especially, it has increased from less than 5% share of total diamonds sold by specialty retailers in January 2015, to more than 7% in recent months.

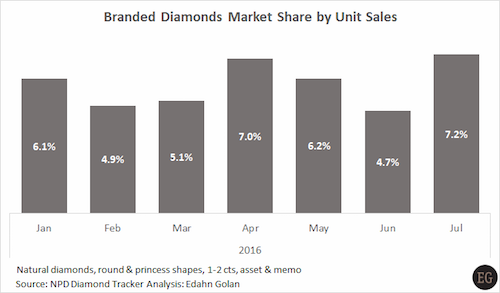

During the first seven months of 2016, the monthly share of branded diamonds fell below 5% only twice—but it also rose above 7% twice during the period, something that happened only once in all of 2015. Here are two charts showing the sales data:

While averaging only 6% of sales during the January–July 2016 period, branded diamonds are set to take up a growing share of sales because they represent an area for wider gross margins for retailers, as well as being in rising demand by consumers.

From a retailer’s perspective, this is an important opportunity to improve sales at a time when fears that Millennial purchases are diminishing. There is growing evidence that when uncertain about a purchase Millennials will turn to a brand, despite their jaded view of marketing. A renewed focus on marketing also is improving brand awareness and broad-demographic consumer interest in diamond jewelry.

The gross margin return on branded diamonds also is higher due to a much faster turn. Although the average retail margin shown in the table below is slimmer for branded diamonds, in some categories the average retail margin is better. Perhaps of greater importance, the turn of branded diamonds is much faster—13 months versus 16 months—for non-branded diamonds in the below example of natural, one to two carats, round and princess shape, asset and memo diamonds.

Therefore, even with the impact of a decreased retail margin per carat, if a retailer were to purchase $1 million worth of branded diamonds and another $1 million worth of non-branded diamonds of these characteristics, the gross margin return on the branded diamonds would be 19% higher per annum. It is therefore no surprise that retailers are indeed increasing the number of branded items in their inventory at the expense of non-branded items, up 6% in July compared to January.

Lab-Grown Diamonds’ Popularity Grows. Much can be said about the growing presence of lab-grown goods in the marketplace, about their marketing, issues of disclosure, differentiation of natural diamonds and even to what degree the traditional diamond pipeline should or should not be involved in the trade of lab-grown stones.

However, in the past year, it became clear that more and more U.S. retailers that were dead set against lab-grown stones have changed their minds and are now following their clients’ lead. And they are leading a change in consumption.

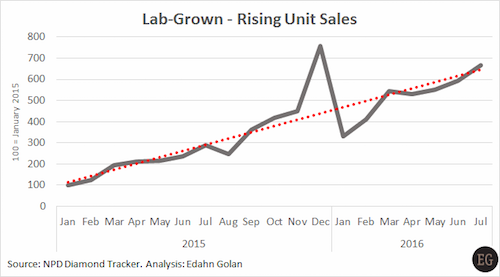

During 2015, consumer purchases of lab-grown goods increased sharply. The number of units sold increased 230% between January 2015 and January 2016. During July 2016 consumers purchased double the number of items sold in January 2016, and in August, the upward trend continued.

One caveat about this trend: diamond sales are cyclical, and a rise in sales during the holiday season does not necessarily reflect a rise in interest in lab-grown.

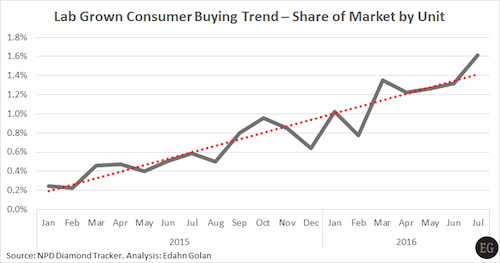

At first, consumer demand for lab-grown stones was very limited; less than a quarter of a percent of total loose and mounted diamond sales by US specialty jewelry retailers during January 2015. But by January 2016, the market share quadrupled, and crossed the 1% mark. In July, market share of lab-grown goods exceeded 1.6%. Based on August trends, it is not unreasonable to expect market share to double again by the end of the year.

Interestingly, during February, May, November and December, diamond sales tend to rise. They are “romantic” holidays (Valentine’s Day, Mother’s Day and the year-end holidays) during which bridal and anniversary jewelry is purchased. However, sales of lab-grown have relatively declined during those periods, an indicator that when buying important jewelry, consumers prefer natural diamonds: they want the real thing and view lab-grown stones as less romantic.

To read an extended version of this report including statistics on the manufacturing sector, click here.

Edahn Golan is an analyst advising financial institutions, global diamond firms, diamond industry organizations and governmental agencies on topics ranging from provenance of fancy color diamonds to the diamond’s contribution to local economies. Among his clients are diamond firms, miners, and the world’s second largest retail metrics firm. He has been quoted as an expert about the diamond sector and diamonds in The New York Times, the Wall Street Journal, and many other leading business and news publications. Click here to access his website, www.edahngolan.com