Articles and News

Study: Not Having E-Commerce Hurts Jewelers’ Brick And Mortar Sales And Helps Gray Marketers | September 07, 2016 (0 comments)

New York, NY—Luxury e-commerce sales worldwide are projected to double by 2020, growing from 6% to 12% percent of all sales over the next four years.

In a recent study, L2, a New York-based think tank monitoring the progress of the digital luxury market, examined how digital channels are helping—or not—build sales in the luxury watches and jewelry category. The good news is that digital penetration in the notoriously online-resistant jewelry and watches category has grown markedly—more than half of brands in L2’s most recent recent Digital IQ Index: Watches & Jewelry are now e-commerce enabled, and three quarters of brands now list pricing information on-site.

The bad news is that gray marketers are online too, and doing a much better job getting in front of customers than authorized dealers.

58% of e-commerce enabled brands offer products costing over $10,000 for direct purchase online, and 39% offer products over $20,000—proving that e-commerce can work for high-priced products. Eight brands—Bell & Ross, Chopard, De Beers, Fred, Forevermark, Frederique Constant, Tiffany & Co., and Van Cleef & Arpels—offer products over $50,000 for direct purchase online. While few of those products may actually sell online, they are a key factor in e-influence on in-store purchases.

Transparent pricing information is also becoming the norm for brands across pricing segments. Clear prices are an important factor for e-influence, using digital to drive in-store activity, which plays a much larger role in the longer consideration process for watch and jewelry purchases—both locally and the transnational research international shoppers conduct when planning to buy abroad. Over two thirds of brands now list pricing information on their websites; even long-time holdouts including Rolex and Omega now testing retail price information online in key markets. They’re two of five brands that are not e-commerce enabled but who do offer pricing information; the other three are Buccellati, Boucheron, and IWC.

Prestige luxury brands also have adopted assisted sales and online concierge services with a vengeance, with 75% offering assisted purchase options and 36% offering on-site appointment booking.

But less encouraging are signs that luxury jewelry and watch brand equity that took decades (if not centuries) to build does not necessarily transfer proportionately online. And while e-commerce may not necessarily translate into significant increases in digital sales, not having the option can drag down brick-and-mortar sales and make it even harder to compete with the gray market. Gray marketers are extremely aggressive online, and with search capabilities far superior to brands’, they’ve been highly successful at capturing share of market.

Additionally, price-transparency holdouts—overwhelmingly watch brands—leave themselves particularly vulnerable to the grey market. Pricing information is highly visible on Google from grey marketer ads, websites, and forums, setting consumers up for disappointment when they go into an official point of sale with inaccurate expectations.

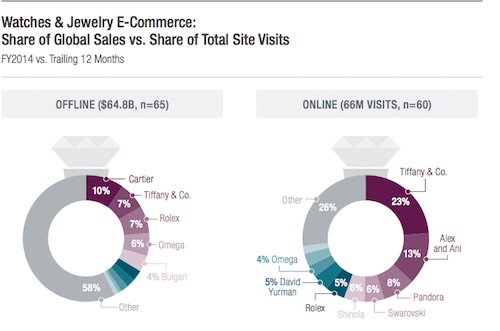

Within the total watches and jewelry industry, L2 says the top 10 brands represent only about 40% of global sales. Online, however, those brands control nearly 75% of all traffic to watches and jewelry brand websites. Only three brands—Tiffany & Co., Rolex, and Omega—appear on both lists, which L2 says signals a reshuffling of the deck favoring smaller, challenger brands experienced at selling direct online. Consequently, they attract a disproportionate share of online equity, and heritage brands with a history of weak digital investments and hesitancy towards e-commerce have a lot of catching up to do as online sales become an increasingly large proportion of the industry.

L2's findings compare top luxury brands' total share of market against their online appeal. Source: L2

Fighting the gray market online. Gray marketers are extremely aggressive in both search engine optimization (SEO) and search-engine marketing (SEM), areas that brands almost universally fail to optimize, says the L2 study. Sites like Jomasohp and Chrono24 have seen the return that extremely specific investments can have to drive sales, capturing market share at the bottom of the purchase funnel once a consumer is ready to purchase—a segment largely ignored by brands online.

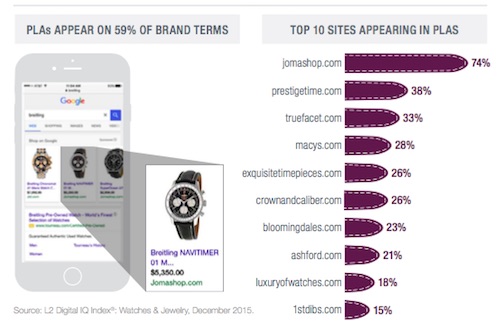

The rise of Google’s Product Listing Ads (PLAs) has also given gray marketers access to a wider variety of brand terms, such as “Rolex,” that would have been unaffordable in traditional SEM. Only sites that are e-commerce enabled can buy PLAs, leaving many brands defenseless to push out other bidders. PLAs show up against 59% of searches for watch and jewelry brands. In particular, Jomashop.com appears in 74% of PLA boxes on brand terms, while prestigetime.com appears in a PLA against 38% of brands.

With the rise of Google Product Listing Ads (PLAs), consumers are often being directed to gray market sites first whenever they search for a luxury brand. This is because gray marketers are especially aggressive in buying PLAs, which are only available for purchase by e-commerce enabled sites. Brands that aren't e-commerce enabled lose this line of defense.

E-influence vs. e-commerce. While direct to consumer e-commerce sales only account for 3.6% of prestige luxury sales, two in three purchasers are touched by at least one branded digital touch point during their research and browsing process, according to L2 research. E-influence is the digital future of the watches and jewelry sector, and brands must capitalize on the online research process, using sites as lead generation tools to convert a browsing session into a concierge interaction or in-store visit.

Brands to significantly ramp up SEO efforts to combat the grey marketers. But here’s the Catch-22: only brands with a direct-to-consumer e-commerce sites can buy PLA listing ads, so brands resisting e-commerce further handicap themselves at both the start and the end of the digital purchase path. In jewelry, only Tiffany & Co. appears on the first page of search results for more than 10% of jewelry keywords, while Shinola just hits the 10% mark in watches.

Brand/retailer partnerships can be an effective strategy to fight grey market real estate in PLAs--and for independent jewelers, it may be the only way. Reid Sherard, associate director of client strategy at L2, told The Centurion, "PLAs can be cost prohibitive for a small independent jeweler, but they also heavily favor scaled businesses. PLA listings are very competitive, since gray marketers are aggressive at bidding the more specific the search term gets. Thus, a large-scale campaign can get very expensive."

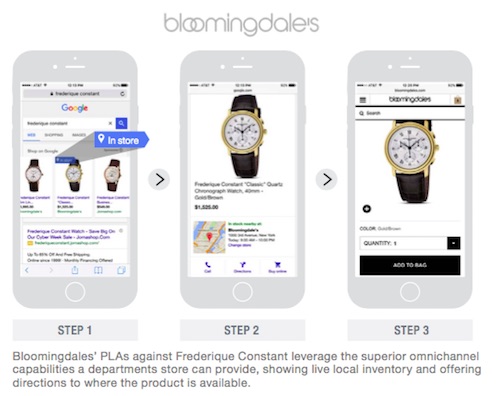

As a result, existing partnerships tend to favor department stores with big budgets and sophisticated e-commece. For example, Macy’s and Bloomingdale's both appear in the top ten sites buying PLAs in the category, buying against 28% and 23% of brand terms respectively. PLA listings from department stores can also leverage their superior omnichannel abilities, driving into a point of sale with live inventory visibility. Below, Bloomingdale's and Frederique Constant in partnership together get good PLA placement on a search.

L2's report acknowledged the challenges of brands in creating an online boutique when their main distribution strategy is via authorized independent local retailers who likely would view such an online boutique as direct competition. But just as brick and mortar retailers typically find sales of a brand go up--not down--when a brand boutique opens nearby, an independent jeweler partnership with a brand vendor for PLA ads could be a win-win for both: the retailer that couldn't afford a PLA on its own benefits from the brand's marketing resources, while the brand benefits from the retailer's loyal customers. But this only works as long as the retailer is e-commerce enabled, emphasizes Sherard. Without e-commerce, neither brand nor jeweler can buy a PLA even if they do have the budget.

Compromise programs that strike a balance between brand and retailer also are possible and, in the case of diamond jewelry, have been demonstrated effective in grabbing digitally generated dollars. Both Forevermark and Ritani have models where authorized retailers benefit from nearby transactions conducted entirely online, even if the consumer opts for a direct shipment of the product. The partnerships also allow retailers to show the full scope of inventory from the brand without having it in their own inventory.

Editor's note: Learn more about becoming e-commerce proficient at the 25in5 Conference, sponsored by Centurion and InStore. The conference will be held Monday, October 17 at the Ritz Carlton South Beach hotel in Miami Beach, FL. Additional details are available here. To register, call (516) 377-5909.