Articles and News

2021 Holiday Sales Expected To Smash All Records November 01, 2021 (0 comments)

Washington, DC—After rising sales in September and a robust prediction for holiday spending, the National Retail Federation last week put out a new forecast that’s even more bullish on the holiday.

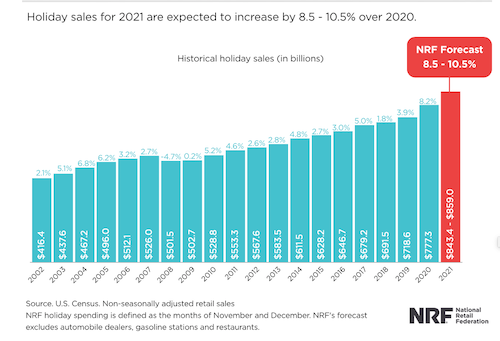

Holiday spending has the potential to shatter previous records, as the NRF now forecasts that holiday sales during November and December will grow between 8.5% and 10.5% over 2020—itself a record year, especially for jewelers. NRF’s numbers, which exclude automobile dealers, gasoline stations, and restaurants, compare with the 8.2% gain in 2020 and an average increase of 4.4% annually over the past five years.

“There is considerable momentum heading into the holiday shopping season,” NRF president and CEO Matthew Shay said. “Consumers are in a very favorable position going into the last few months of the year as income is rising and household balance sheets have never been stronger. Retailers are making significant investments in their supply chains and spending heavily to ensure they have products on their shelves to meet this time of exceptional consumer demand.”

NRF chief economist Jack Kleinhenz added, “The unusual and beneficial position we find ourselves in is that households have increased spending vigorously throughout most of 2021 and remain with plenty of holiday purchasing power.”

2020 saw extraordinary growth in digital channels as consumers turned to online shopping to meet their holiday needs during the pandemic. While ecommerce will remain important—NRF expects that online and other non-store sales, which are included in the overall total, will themselves increase between 11% and 15%—households are also expected to shift back to in-store shopping and a more traditional holiday shopping experience.

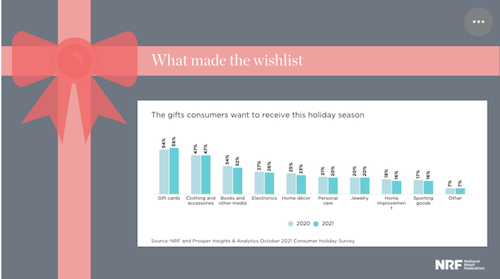

Jewelry is on the wishlist for about 20% of consumers, according to data from the NRF/Prosper Insights & Analytics survey conducted in October. The number-one most desired gift—consistent with prior years—is gift cards, followed by clothing and books and other media, to round out the top three.

Kleinhenz sounded two cautionary notes about this holiday season, one about supply chain disruptions and another about any potential new variant surges in COVID-19. Either one has the potential to sidetrack spending, he said, but given strong household and income fundamentals, he still feels the holiday season is on track to be “stellar.”

NRF's holiday forecast is based on economic modeling that considers a variety of indicators including employment, wages, consumer confidence, disposable income, consumer credit, previous retail sales and weather.