Articles and News

NRF: September Retail Sales Up; Holiday Spending Reflects Continued Consumer Demand | October 27, 2021 (0 comments)

Washington, DC—Watch what consumers do, not what they say. Despite consumer grousing about supply chain issues and inflation, retail sales increased again in September.

The U.S. Census Bureau said overall retail sales in September were up 0.7% seasonally adjusted from August and up 13.9% year-over-year. Despite occasional month-over-month declines, Census data shows sales have grown year-over-year every month since June 2020.

The National Retail Federation’s calculation of retail sales—which excludes automobile dealers, gasoline stations and restaurants to focus on core retail—also showed September was up 0.7% seasonally adjusted from August, and up 11% unadjusted year-over-year from September 2020. NRF also said worries about the COVID-19 delta variant pushed consumer spending toward merchandise rather than services like dining, entertainment, or travel.

“Today’s retail sales data confirms the sheer power of the consumer to spend, and we expect this to continue,” said NRF president and CEO Matthew Shay. “Despite persistent challenges related to the global pandemic, supply chain, and labor shortages, retailers and their partners have shown resilience and ingenuity in getting the workforce, goods, and systems in place to serve their customers and the communities where they operate. We welcomed the chance to collaborate with the Biden administration and industry partners this week to address supply chain and labor force issues. We have seen record imports this year and are confident that collectively we can work through these challenges to ensure a healthy and happy holiday season.”

NRF numbers were up 10.7% unadjusted year-over-year on a three-month moving average and up 14.5% year-on-year over 2020 for the first nine months of the year. That is consistent with—if not slightly ahead of—NRF’s revised forecast that 2021 retail sales should grow between 10.5 and 13.5 percent over 2020 to between $4.44 trillion and $4.56 trillion.

“The reopening of the economy was interrupted by COVID-19, and consumer spending other than retail hit a speed bump toward the end of summer,” NRF chief economist Jack Kleinhenz said. “Consumers remained active, but retail sales didn’t reflect as much of a shift away from goods to services as expected. That was a plus for retail because consumers still have a hyper-ability to spend thanks to wage and job gains and the household savings built up during the pandemic. Overall, the September report is very promising for a strong finish for the year.”

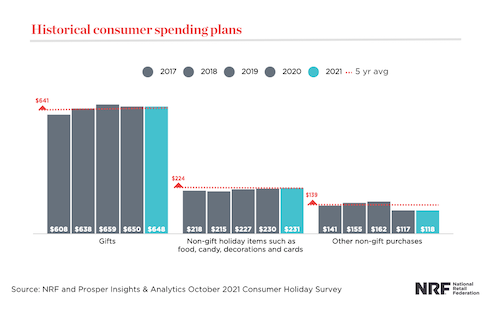

Consumers plan to spend $997.73 on gifts, holiday items and other non-gift purchases for themselves and their families this year, says NRF’s annual survey, conducted in October with Prosper Insights & Analytics, among 7,921 consumers.

90% of U.S. adults plan to celebrate the 2021 holidays, including Christmas, Hanukkah and Kwanzaa, up from 87% last year. “Consumers are ready to celebrate, and gift-giving is high on the list,” said Shay.

The $997 figure is on par with last year but slightly below the pre-pandemic spend of $1,047. NRF says the decline will come from lower spending on food and décor, as well as gifts for co-workers in a continued work-from-home environment. But it will not impact gifts for loved ones.

Supply chain issues are a concern for both retailers and consumers. NRF says the retail industry is working diligently with ports, labor, shippers, transportation providers, and government officials to overcome supply chain challenges. Consumers, meanwhile, have taken to heart warnings to shop early. Half of consumers have already begun holiday shopping, up from 42% this time last year. Items causing the most concern about supply are electronics, clothing, and toys.

Where will consumers shop? 57% said they plan to purchase holiday items online this year, in line with pre-pandemic norms. Other top holiday shopping destinations include department stores (47%), discount stores (44%), grocery stores (43%) and clothing/accessories stores (30%). 24% of consumers specifically plan to shop at a local or small business.