Articles and News

ANALYSTS: NO GOLD BUBBLE; PRICE CORRECTION SEEN | August 24, 2011 (3 comments)

Merrick, NY—What’s really going on with gold? Is it in a bubble? Or was this week’s double-digit plunge just a big hiccup?

It depends on whom one asks. Even experts at two divisions of the same bank—Wells Fargo—can’t seem to agree if it’s a bubble or not. But overall, more economists than not believe the wild fluctuations seen this week—such as this report in yesterday’s Wall Street Journal—are an inevitable and much-needed market correction, not a bubble.

Luxury customers don’t seem fazed by the price of gold anyway. Indeed, Russell Shor, senior industry analyst at GIA, says luxury retail jewelry sales are up about 7% year-over-year as of July. And jewelers who buy gold off the street find it both a tremendous traffic builder and a huge profit center. (See companion story here about one jeweler’s record gold-buying day.)

But what does all this mean for luxury jewelers at the counter?

Not much. Consumers aren’t showing resistance to gold prices, say jewelers. For example, Jim Rosenheim of Tiny Jewel Box in Washington, D.C., recently told The Centurion that any price pushback he’s seeing is for diamonds.

“Price-sensitive customers will trade down a little in [diamond] size, but not in quality. And we get no resistance at all on gold,” he says. And at Van Gundy Jewelers in southern California, bridal has remained strong, with no resistance to either gold or diamond prices, says general manager Megan Van Gundy.

“They still need engagement rings,” she says of her bridal customers who haven’t downscaled either diamond or metal selections due to price.

Due for a shakeout. Price alone does not create a bubble. Many economists say there’s more evidence that underlying market fundamentals support a high gold price, something that wasn’t the case with either NASDAQ tech stocks in 2000 or overblown real estate in 2007.

While gold price increases have been parabolic (having a rapid trajectory upward), the factors pushing the price up are not likely to change abruptly: mainly, it’s uncertainties surrounding both U.S. and European debt, and these issues will take time to resolve. It's also being helped by demand in countries where, for a variety of reasons, wealthy citizens don't want to put all their assets into local currency.

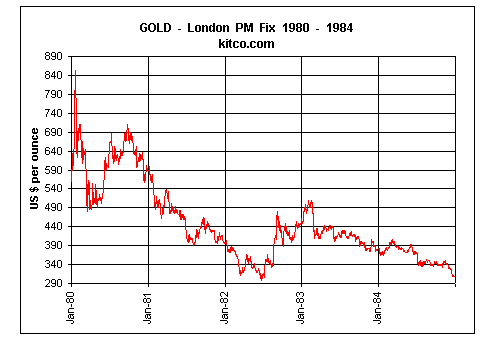

Leading consensus: Don't look for a repeat of this in 2011. Historical chart shows gold prices tumbling from its last period peak in 1980 to below 300 in early 1984. Source: Kitco.com.

Parabolic price increases are more likely than slower increases to be followed by a sharp drop as the market corrects itself. Gold is no different in that respect and it may experience some price drops in the near future——but most experts don’t forsee those drops to be significant. On Kitco.com, commentator Frank Holmes writes that gold is due for a correction—which he believes is necessary to shake out the short-term speculators—but its long-term outlook is solid. An August 22 report from the Wells Fargo Securities Group also says it is possible to see a near-term pullback of gold prices based on the parabolic pattern, but such a pullback would not be very large and would not last very long before prices begin rising again. Most experts agree it’s not likely for gold prices to dip much below $1,600, at least in the foreseeable future. Meanwhile, Philadelphia Inquirer business columnist Joseph DiStefano found it quite ironic that Wells Fargo’s economists said no bubble at the same time an executive in its private banking division was predicting a bubble.

It just goes to show how much debate is out there about whether gold is losing its luster. But without a crystal ball, who’s going to call a bubble until it bursts?

Former Fed chairman Alan Greenspan also is among those who believe gold is not in a bubble. In this report on Bloomberg.com, he says gold is a currency—echoing the same point made Martin Rapaport in a presentation at the 2011 Centurion Jewelry Show in January.

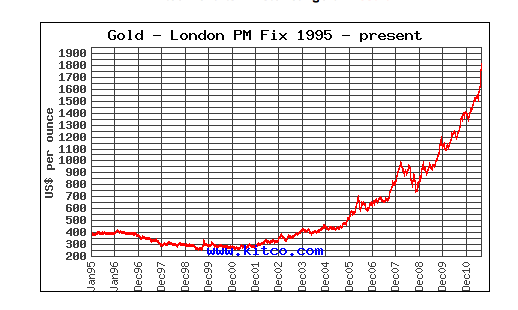

One factor could drive gold prices down significantly: if European or Asian central banks decide to liquidate their gold reserves, as some did in the late 1990s and early 2000s, sending gold below $300/ounce. But industry experts such as Dione Kenyon, president and CEO of the Jewelers Board of Trade, and Anna Martin, managing director of diamonds and jewelry for Standard Chartered Bank in London, think it’s unlikely.

“Our [bank’s] economists don’t see any indications that would happen,” Martin told The Centurion recently. Indeed, the World Gold Council’s second-quarter Gold Demand Trends report says gold purchases by central banks more than quadrupled in the second quarter of 2011, compared with the same period last year.

Historic graph shows gold hovering at around $425/oz in the mid-1990s (left segment of red line). When European and Asian central banks sold off some gold reserves (red line dip, beginning roughly early 1998 to mid 2002) it drove prices down below $300, until late 2002-early 2003, at which point the red line again turns upward as prices recovered and then began climbing. Source: Kitco.com

Jon Nadler, senior analyst for Kitco.com, agrees—to an extent. In an August 23 broadcast on Marketwatch.com (hear it here), he says speculators are driving up the price of gold, making it a bit less of a safe haven than investors might otherwise regard it. But with its 6,000-year pedigree, central banks still like it, he said. Nadler suggests investors consider gold as a kind of life insurance policy: there if you need it but you really don’t want to have to cash it in.

“If gold hits $5,000 an ounce, it means every other investment has become a pile of rubble,” he said in the broadcast. Paul Walker, former head of GFMS, precious-metals consultancy based in London, agrees. In an interview with South Africa-based Moneyweb.za, he expressed concern about the rapid run-ups but says the underlying reasons are there to support the high price.

Finally, one of the key reasons for the early 1980s drop from $800/oz to less than half that was that the Fed under Ronald Reagan raised interest rates into double-digits, and banks routinely offered 15% returns on deposits. With a guaranteed rate that high, it drove gold straight down as investors flocked to banks instead. That won’t happen today, says GIA’s Russell Shor.

Gold demand worldwide is up, says the World Gold Council report, but the increases (in both jewelry and investment) are being driven by India and China, which offset declines in the United States and Europe. Jewelry demand in India rose 17% by volume and 44% by value year over year for the second quarter, while in China it rose 16% by volume and 40% by value (in local currency).

In the United States, jewelry demand declined 8% by volume and 15% by value year-over-year for Q2. In Europe, only Russia saw a small increase in demand. Other European markets, such as Italy and the United Kingdom, saw 15% and 16% drops, respectively.