Articles and News

Annual Survey Of Affluence And Wealth Shows The Who, What, And Where Of Luxury Spending | May 20, 2015 (0 comments)

New York, NY—Luxury spending among affluent and wealthy households in the U.S. will increase by approximately 6.6% over the next year—more than twice the projected increase in the U.S. GDP—driven in large part by increased spending among both Millennials and the proverbial “one-percenters.” These figures were released as part of the 2015 Survey of Affluence and Wealth, produced by Time Inc. and YouGov.

The 10th annual edition of the Study provides an in-depth profile of the world’s most elite consumers, gleaning insight from 6,141 affluent respondents in 14 countries (2,958 in the U.S.).

This year, discretionary spending among the top 10% in the U.S. is expected to exceed more than $406 billion in the ten major categories monitored by the survey, driven primarily by increases in spending on automotive, travel, dining out/home entertainment, and fashion. Leisure travel is expected to grow the most among all categories studied, with an increase of 15.9% from 2014 to $115.2 billion. When asked about passions, travel was the top response (67%), followed by “spending quality time with my family” (65%). One third of all luxury spending will be automotive; more than one-fourth plan to buy a new car in the coming year, and to spend more than $70,000 on it.

Millennials and One-Percenters. While luxury spending is expected to see gains across all age and income groups, the largest increases are projected to occur among Matures (12.2%), Millennials (11.4%), and the proverbial “one percenters” (10%). Spending increases among matures is driven primarily by travel and dining out, while Millennials' increased spending will be broad based, including travel, dining out, fashion, apparel and accessories, as well as items for the home.

Spending among the one-percenters is at unprecedented levels and estimated to rise across all categories measured in the survey, except fine jewelry and watches—which tends to fall short in projections, but in actuality recoups from unplanned purchases, such as special occasions and holidays.

“The propensity and proven spending for luxury goods and services among Millennials confirms their importance in a category that has often been unattainable for this segment," said Caryn Klein, vice president of research and insights for Time Inc. “Millennials are a critical group to understand because of the differences in their values, communication, and how they shop for luxury. At the same time, we continue to see the significance of the boomers, estimated at 4.1%. Boomers carry strength in assets, which give them the distinction of representing the age group with the capacity to purchase the greatest amount of luxury goods, services and travel.”

Caryn Klein, vice president of research and insights for Time Inc.

Looking back to the immediate years preceding the Great Recession (2006-2007), an “emotional recession” pervaded the affluent class, says Dr. Jim Taylor, vice chairman of YouGov America. “Fear of recession gave rise to due diligence in value and worth, and the emergence of worth-based shopping. We saw that in our holiday forecasts [of that time],” he told the audience. Consumers were afraid of losing their jobs and immediately the fear response kicked in: don’t spend, get the household budget into shape, and pay down debt. Since then, fears have receded—and many of these consumers came out of the recession not only unscathed but also better off. Nevertheless, worth-based shopping has remained, he told The Centurion. Today it’s more about realizing that loved ones, not consumption, is the key driver to happiness.

Dr. Jim Taylor, vice chairman of YouGov

While an increase in discretionary spending across the top 10% bodes well for luxury goods retailers and service providers, and the economy at large, survey respondents within the United States and around the world indicated that theirs is a world filled with complexity and nuance. In analyzing the attitudes, moods, values, and habits of the global top 10%, the survey revealed two major themes that motivate the behaviors of the affluent class: the formation of a global affluent culture, and a shift that the experts at Time and YouGov have coined “enlightened choice.”

The only time in history that wealth grew at the same rate it is growing today was during the 17th century tulip boom in Holland, said Taylor. “The United States is the bellwether economy for the rest of the world in wealth generation,” It supersedes China by more than 12% in wealth generation. U.S. luxury spending is predicted to increase 6.6% in 2015, compared to the 2.9% increase projected for the total GDP.

Luxury spending among the upper middle class (HHI $120k to $200k) will increase 5.7%. Among the core affluent (HHI $200k- $450k), it will grow 5.6%, but among the top 1%, it will grow 10% this year.

By age, Millennial affluent spending will increase 11.4%, while Matures (age 65+) will boost their luxury spending by 12.4%. Boomers 50-65 will increase their luxury spending 4.2% and Gen X, 35-50, by 6.3%. (Editor’s note: Boomers also comprise part of the “mature” category from age 65 to 69). Finally, Taylor says gifts of $1 million or more are on a “huge rise,” predominantly from grandparent to grandchild.

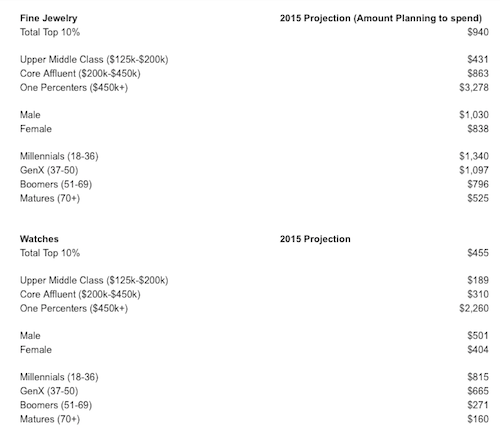

Here are the Time/YouGov survey findings on U.S. affluent consumer spending intent for jewelry and watches. (Editor's note: these figures are an average, not a median.) Despite dire industry predictions to the contrary, note that affluent Millennials lead the way in spending intentions for both fine jewelry and watches.

A “global affluent” culture. Cara David, managing partner of YouGov, says the rich are pretty much the same wherever you are—the product of a global adoption of common perspectives, standards, and expectations. This has led to a global affluent culture that in many ways supersedes their own native cultures. Affluent parents around the world want the same kind of success and security for their children.

“Characteristics of this culture include a focus on spending time on the people and activities that mean most to them, owning the same things, but more importantly, surrounding themselves with people who are more like them, regardless of the national boundaries that might otherwise divide them," she told the audience at the presentation.

Cara David, managing partner of YouGov

The global 10%'s growing sense of exuberance and eagerness to spend is motivated in part by living a debt-free life. 70% percent of U.S. respondents to the Time/YouGov affluent survey have no credit card debt, and 43% of the one-percenters have no mortgage.

But despite personally thriving, there are global concerns that weigh significantly on the mind of the global affluent class: unquantified risk such as terrorism and the need for personal safety and security; political uncertainty; economic ambiguity, both national and global; global warming; and social justice. These consumers are genuinely worried about climate change, income inequality, and the gap between the 1% and the 99%. As a result, respondents overwhelmingly support the old phrase that, “discretion truly is the better part of valor,” and 75% agree that people who have money should keep it under the radar, leading to more inconspicuous consumption. Today their emphasis is on wealth preservation more than wealth building.

Globally, the wealthy tend to identify themselves as business leaders, rather than entrepreneurs. But the tectonic plates are shifting, says Taylor: there is real concern about wealth inequality, especially as the majority of global political power is in the hands of the non-affluent. Wealthy respondents to the survey said their own personal economy is ok, but are worried that “the economy” isn’t ok. They also are afraid that “the system is indeed loaded unfairly,” said Taylor, even if they’re personally benefiting from that imbalance.

Less brand loyalty, especially in jewelry. Today’s affluent consumer is more attuned to luxury goods that reflect their values. Among the top 5% of survey respondents, there was a distinct decline in willingness to identify their favorite brands within specific categories, most notably when asked about retailers, fashion brands, luxury hotels, and jewelry brands.

“We are entering an age where luxury consumers around the world are becoming less loyal to brands. According to our data, as these consumers approach a major purchase, the number of brands in consideration expands and the willingness to spend more, likewise, increases. Single brand loyalists are nearing extinction as people use their digital resources to bring a pocketful of brands to the same marketplace,” said Taylor.

“This doesn’t mean that brands don’t matter," he continued, "but rather that the consumer is empowered to make richer, more enlightened choices, spurred primarily by technology in the form of comparison shopping, and a preference for a more personalized buying experience. This shift in control has significant repercussions for luxury brands and luxury brand managers.”

Even so, he says, the time has come for luxury marketers. After years of building a moat (i.e. cash) to protect themselves and their families, there is an excess of resource just waiting to be spent.