Articles and News

Boom! Part II: How To Reach The People Who Have The Money To Buy, Whatever Their Age | October 22, 2014 (0 comments)

Merrick, NY—How did 76 million people suddenly become invisible?

Easy. Their children—roughly also about 76 million of them—turned 18 and marketers fell in love with them and abandoned their parents.

“Boomers went from overhyped to overlooked,” says longtime advertising expert Sharon Krinsky. Unfortunately, in an obsessive quest to reach Millennials while they are still ostensibly forming lifelong brand loyalties, marketers are ignoring some critical facts:

- Nobody is blindly loyal to a brand forever anymore: not Boomers and not their Millennial children. Earlier generations tended to remain loyal to the same brands they first selected as young adults, but no more.

- Boomers still control 70% of the wealth in this country, and their spending power for luxury goods is 20 times greater than Millennials.

- Boomers came of age during a historic anomaly that both profoundly shaped their behaviors and no longer exists. Millennials will have a much harder time reaching the same success level as their parents.

Historical perspective: Don’t overlook the unique forces that shaped the Boomer generation into the cultural powerhouse it became, says Lori Bitter, president of The Business of Aging, a consulting firm in Alameda, CA.

“Prior [to Boomers] the word teenager really didn’t exist. When you were old enough to work, you worked. This idea of an extended childhood or youth period began with the Boomers. They were the first youth culture we had in our society,” she told The Centurion.

“Between large numbers of Boomers who went to college, plus things like the advancement of women, suddenly marketers saw this huge group of very interesting people and said ‘let’s follow them’ and created a whole industry around them.”

But sheer numbers alone didn’t make Boomers the consuming powerhouse they are. Luck and timing had as much to do with their success as anything else. Born after both the deprivations of the Great Depression and the rationing of World War II, Boomers were the product of a country tired of scrimping and starved for consumer goods. New technologies developed for war were turned toward consumer production, and with both Europe and Asia focused on rebuilding, the United States faced very little global competition.

The postwar prosperity into which Boomers were born was an anomaly in U.S. history. Millennials, meanwhile, face tremendous competition for jobs, both from a global economy that didn’t exist in the postwar years, and from automation that eliminated many well-paying factory jobs that didn’t require a college education. Even though Millennials are the best-educated cohort in the history of the United States, finding a good job is a lot like playing musical chairs—there simply aren’t enough to go around.

The good news is that Millennials were raised by the spend-and-consume Boomers, and they are a consumer culture, she says. They’re also not afraid to mix high and low: they’ll buy a garment at Target and wear it with their grandmother’s diamond engagement ring and ask their parents for a Louis Vuitton handbag for Christmas.

A luxury handbag is out of reach for many Millennials, but not for their Boomer parents, who will buy it for their child as a gift.

Target interest, not age. So how can a brand or retailer successfully target both the Boomers who have lots of money to spend now, and attract the Millennials it needs to support it in the future?

The first step is to focus on who’s keeping the lights on. Sharon Krinsky and Bob Hoffman, principals of San Francisco-based Type A Group, told The Centurion that someday Millennials will indeed outspend Boomers—but not for at least 10 or 15 years. Hoffman, author of 101 Contrarian Ideas About Advertising, added, “Spending money now because someone may shop with you in 10 or 15 years is silly. I have news for you: they won’t remember your ad in 15 minutes!”

Bitter concurs. Boomers still have a good 20 years’ worth of spending in them, she says. She also doesn’t buy the argument that Boomers now mainly spend money for experiences or health care, not more things.

“Part of the natural progression of aging is not being in acquisition mode. But that’s closer to 70 and above, not 55-65, where most Boomers are.” Boomers, she says, are still buying things, albeit more selectively.

Hoffman pegs the age at which consumer spending sharply drops off even higher, at 75-80.

“One of the misconceptions about Boomers is that they’re downsizing. But between 1999 and 2009, spending by people age 49 and above grew 45%. That’s a huge jump in 10 years,” he told The Centurion. If anything, Millennials are more likely than Boomers to choose experiences over things, he says. But he firmly believes that as they mature and have both more money and families, they’ll buy houses and cars, just like their parents did. But as a group, they’re not there yet.

Bitter and Hoffman both warn not to discount the number of Boomers supporting Millennial children in some form, whether it’s paying for their housing or their cars or just buying them luxury presents they can’t afford themselves.

Boomers and Millennials are more likely to share common interests than Boomers would have with their Depression-era parents. Appealing to those interests is what keeps a product relevant to all ages.

Apple is a very successful example of how to appeal to all ages, says Hoffman. The early iPod ads that showed dancing silhouettes were skewed young, but everything else successfully appeals to a broad range of ages and doesn’t pander to any one group.

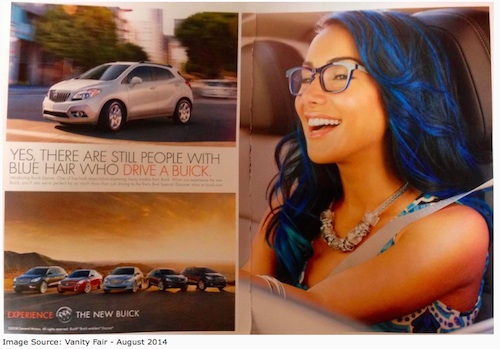

Another brand that has successfully bridged the gap is Buick. With an average customer age of 60, the automaker needed to retool its image. It did so first by focusing on what consumers want in a car, and then redesigning its cars to fit the modern consumer’s needs. Watch an interview with Buick’s director of marketing here.

But it also made itself relevant by acknowledging its own stodgy image and turning that to advantage. The darling of the blue-hair set also wants the customer with punked-out blue hair. Grandma's sedan isn't what it used to be.

Buick's latest advertising campaign targeting a new kind of blue-haired customer.

Meanwhile, three cars that the auto industry markets as “youth cars,” (the Scion, Ford Focus and Chevrolet Cruze) actually have much higher sales to older consumers than to the Millennial audience they’re targeted at, says Hoffman.

“De Beers followed Boomers through their growth,” says Lori Bitter, who used to work at J. Walter Thompson, the advertising agency that handled the De Beers account. “You had the diamond engagement ring, the eternity band, and the three-stone ring. But now you don’t see a lot of that advertised to young girls. But if you came out with a grandparents’ ring that isn’t the same old dowdy birthstone ring, I bet you’d sell it in droves!“ (Editor’s note: Bitter, who left J. Walter Thompson and now has her own consulting agency, was unaware that De Beers dropped generic diamond advertising in favor of its proprietary Forevermark brand.)

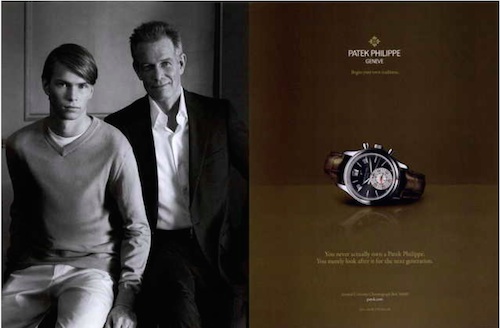

Luxury watch brands also do a good job of targeting all ages by focusing on interests, whether it’s a sports tie-in like Rolex, Breitling, and Alpina, or Patek Philippe’s famous tagline, “You never actually own a Patek Philippe. You merely look after it for the next generation.”

Patek Philippe crosses generational appeal with its ads featuring (ostensibly) a father and son, and touting the heirloom quality of its watches.

“They attract people who appreciate beauty and quality,” says Bitter.

All three ad experts had praise for Tiffany, Alex & Ani, and Stella and Dot as examples of jewelry ads that present jewelry as something youthful but not young—exactly how Boomers see themselves—yet also appealing to Millennials.

“If you sell luxury jewelry, you don’t want to target everybody. You want to be unique,” says Hoffman.

“You have to give Millennials a reason to buy jewelry,” adds Sharon Krinsky. “The [De Beers] right-hand ring gave women a reason, or permission, or an alibi, to treat themselves to jewelry. What’s the justification to a Millennial?”

Boomers may control the purse strings now, but there is still the fact that someday—even if it’s more than a decade away—they will mature out of the market, and then it’s going to be up to the Millennials to carry the torch. (Gen-X, the age cohort from 36-49 that’s sandwiched between the two, has spending power but it is significantly smaller—11% smaller—so even with spending at the same rate per capita, total sales to that group will show up as a decline. And, says Bitter, they’re also underemployed and not earning to their full potential yet, because the Boomers are working longer, not retiring, and not making room for the X’ers to rise to leadership positions.)

As a jeweler, what does all this mean for your marketing budget?

It’s not rocket science, says Hoffman. Independent jewelers know who their customers are; they see them every day. Evaluate your customer base according to what they spend (and yes, you should be tracking who buys what!), and break out your advertising budget accordingly. If only 10%-15% of your sales are bridal, he says, don’t put 85% of your marketing budget toward it. Put 85% of your efforts to where 85% of your sales are coming from.