Articles and News

De Beers 2020 Diamond Insight Report Explores Consumer Opportunity In The ‘New Normal’ | November 09, 2020 (0 comments)

London, UK—De Beers Group on Monday released its 2020 Diamond Insight Report, collating key findings from the company’s consumer research undertaken during the Covid-19 pandemic. The key overarching takeaway is that there’s no going “back to” normal as consumers around the world are now in a “new normal.”

The report highlights both new trends and previously existing trends that have now accelerated as consumers adapt to this new normal. Based on the outcomes of monthly sentiment surveys with U.S. consumers from March to August, three clear findings emerged: consumers are adapting to the new normal, demand for diamonds continues, and diamonds retain broad appeal across consumer segments.

“The COVID-19 pandemic has changed our lives in the most fundamental of ways: how we live, how we work, how we connect with others, and the world around us. Some of these changes will be temporary, while others are likely to be long lasting,” said De Beers CEO Bruce Cleaver in the report.

The report also looks at key macro trends that will shape the future of the jewelry sector. The importance of building trust with consumers, particularly in a virtual world, and providing a seamless ‘phygital’ (i.e. physical and digital) experience that embraces social media commerce were recurring themes. In addition, technologies such as augmented reality and virtual reality that help consumers bridge the physical and digital worlds when buying luxury goods, particularly those where the ‘try on’ component is a key part of the purchasing journey, will continue to rise in prominence.

With the COVID-19 pandemic restricting movement, consumers’ emotional and economic confidence was badly knocked in the first half of 2020. Retail outlets as well as hospitality and travel businesses in both the United States and around the world closed temporarily and, in some cases, permanently—affecting jobs and incomes, and curtailing weddings and other celebrations around the world.

However, by August/September, the shock had receded. Although the pandemic is causing economic uncertainty, De Beers’ research in August showed six in 10 U.S. consumers said that their personal finances had not been affected and three-fourths reported feeling optimistic about their longer-term financial situation, over the next three years. Since two-thirds of Americans cancelled travel plans this year, over 40% of all consumers found themselves with extra disposable cash.

But De Beers’ research indicated that people are still seeking stability and reassurance. The strongest consumer need across all global markets is for emotional security. People commonly crave joy and optimism, and place importance on expressing connectedness and gratitude whenso much is uncertain, said the report.

Cleaver said, “This has been a year like no other, with wide-ranging implications for diamond jewelry retailers all around the world. It was only fitting that this year’s Diamond Insight Report takes a holistic view of how the pandemic has shaped the consumer psyche in 2020 and, most importantly, how diamond jewelry brands and retailers can adapt and evolve their consumer engagement strategies to embrace the emerging opportunities in this new normal.”

How And What Shoppers Will Be Buying.The report confirms what many jewelers already know: that consumers are willing to shop in-store again when proper health precautions are followed. Reassuring them of the safety of the store visit and purchase process will be a top priority for retailer communications. But the rise of online shopping is here to stay and online channels inevitably remain an important way for customers to browse and purchase.

In the current climate, showy excess seems appropriate—something that also was evident after the financial crash of 2008. Consumers that do have money to spend are mindful of how they spend it. De Beers’ research in August and September showed that, as in other periods of crisis, many people are gravitating back to what they know and trust, making timeless classics (such as solitaires) highly attractive. Since consumers increasingly seek designs with a personal touch, “classic-with-a-twist” pieces will have great appeal.

Younger consumers continue to show more interest in innovative designs, particularly if backed by a well-known brand, says the report.And the emphasis on responsible and ethical production is continuing to grow, especially among Millennial and Gen-Z consumers. Brands (and retailers) are well advised to consider transparency, authenticity, and purpose as a key part of their marketing strategy.

Related: Next-Gen Jewelry Retailers Talk About Current Consumer Values And What That Means For Business

Similarly, the report stresses that with diversity and inclusion high on consumers’ agenda, diamond jewelry that celebrates new types of union, life milestones or new forms of personal expression is likely to find an eager market.

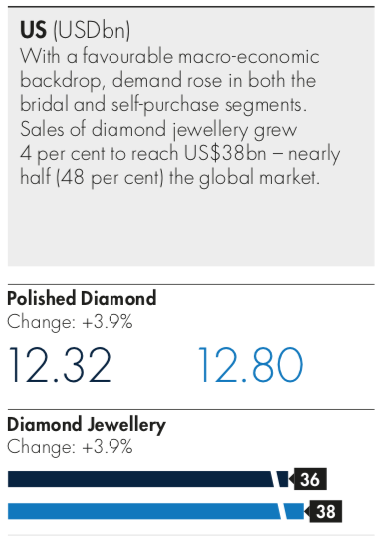

The report also includes a diamond value chain dashboard based on 2019 data, which found that global consumer demand for diamonds grew slightly in 2019, up by 0.5% to US $79 billion. This was supported by 4% growth in the United States, which accounts for almost half of global diamond jewelry sales, and 3% growth in Japan. The strong growth in the United States and Japan in 2019 was dampened by the impact of currency exchange rates in other markets.