Articles and News

De Beers’ Latest Insight Report Finds Diamonds Will Matter A Lot In The New Normal | August 10, 2020 (0 comments)

London, UK—Bruce Cleaver, CEO of De Beers Group, on Monday shared key insights for the diamond trade in advance of the upcoming holiday gifting season and in the context of COVID-19, based on the findings of a comprehensive consumer research recently undertaken in the US, China and India. The results were published in the company’s Diamond Insight Global Sentiment Report and shared in a virtual keynote for Luxury by JCK. Image: De Beers Diamond Insight Global Sentiment Report

Very good news for jewelers: consumer desire for diamonds remained strong in all three markets, and sentiment is improving as consumers adjust to the ‘new normal’ wrought by the COVID-19 pandemic. The research surveyed 2,800 men and women ages 20-65 with household incomes of at least $75,000 in the United States, and a similar demographic in China and India. It examined a range of consumer indicators, including how they were feeling in the current environment, gifting intentions for the holiday season, and preferences for engaging with brands and retailers over the coming months.

Millennials in particular are considering diamond jewelry purchases this holiday season, says De Beers' research.

Key findings include:

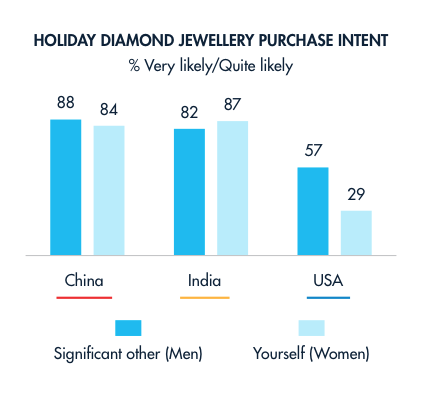

- Intention to purchase diamond jewelry during the upcoming holiday/festive season was high across all markets. In the United States, almost 60% of men surveyed said they intend to purchase diamond jewelry for a significant other, while nearly one third of women intend to purchase it for themselves. In China and India, diamond jewelry purchase intention (whether for gift or self) was over 80% for both men and women.

- Professionals under age 35 professionals of middle affluence and employed full-time drove the high levels of intent and expectation to acquire diamond jewelry in the season.

- Consumers in all three markets felt that emotion was the most important factor in gifting this year, outweighing usefulness or practicality. How beautiful the piece is also is an important factor in purchase intent.

- The 80/20 rule holds true. The old adage that says 80% of your business comes from 20% of your customers was reinforced by the findings, that show heavy users are the ones most likely to buy. over 80% of those intending to purchase diamond jewelry during the 2020 holiday season had either self-purchased or gifted diamond jewelry in the past two years, highlighting the importance of connecting with past customers.

- Classics rule. In every market, consumer interest gravitated towards classic pieces, with simple solitaires the main preference. However, a subset of consumers—largely those who felt their lives were returning to normal and with higher household incomes—were more interested in experimenting beyond classic designs, showing a greater interest in diamond jewelry brands.

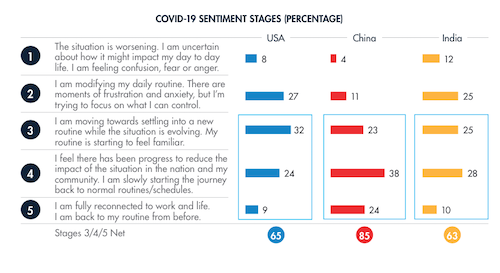

- Only 8% of consumers surveyed in the United States and 4% in China felt their situation was deteriorating. Chinese consumer sentiment was ahead of other key markets, with 85% feeling settled into a new and familiar routine and 24% feeling fully reconnected to their life and previous routine. In the US and India, confidence lagged but was improving, with the majority of respondents in these markets believing they were moving towards settling into a new routine.

- The majority of consumers surveyed want and expect a dialogue with diamonds this season, even those who remained uncertain about the current situation.

Chinese consumers lead the way in feeling like normal. U.S. and Indian consumers are still feeling much more fragile, but even they are starting to get used to the situation and find a path toward their new normal, says De Beers' report.

“This research, undertaken in three of the largest consumer markets for diamonds, highlights a number of important insights for diamond jewelry retailers as we enter the key end-of-year selling season,” said Cleaver. "While it clearly demonstrates that consumer desire for diamonds is as strong as it has ever been, holiday communications to consumers should focus on the power of diamonds as inherently beautiful miracles of nature, to convey emotional meaning, gratitude for loved ones and expressions of self-reward, all of which bring joy and positivity in a time when it is desperately needed.

“While the external environment remains uncertain in this unprecedented moment in time, we have the unusual opportunity to build even more lasting and meaningful connections with consumers at the culmination of a year when we’ve all been reminded that we cannot take our precious relationships, or even human connections, for granted.”

Consumers are more focused on acquiring classic pieces that will stand the test of time, says De Beers' research.

Separately, Yoram Dvash, president of the World Federation of Diamond Bourses, sent a letter to members last week expressing some of the same optimism Cleaver sees. While he acknowledged the first half of the year was almost a complete washout for the diamond industry with some centers seeing declines of 70% to 80% in imports and exports, there now are signs of recovery.

"It is clear that the responsible policy of De Beers and Alrosa of limiting production and flexibility toward customers, along with the limited capacity of the Surat manufacturing center, has had a positive effect on the diamond pipeline.

Here are some signs that promise a light at the end of the tunnel:

- Diamond prices are for the most part holding steady, mainly due to shortages in various categories.

- Q3 2020 is seeing smaller export and import drops, with July showing around 50% declines year over year. We expect that this will only strengthen over time and will deliver a strong holiday season.

- Manufacturers’ profit margins have improved and they are better than before the pandemic. Manufacturers are able to buy only the rough they need to meet actual demand.

- Diamond jewelry retail is doing fairly well. China has shown strong demand with sales soaring after the lockdown. In the United States, independent jewelers are reporting steady demand for jewelry to celebrate life-cycle events.

- Our industry has proven its resilience by moving to online trading. Get Diamonds, for example, is enjoying a huge part of this traffic. Consumers are also buying more diamonds through ecommerce, with some of the largest luxury brands selling more diamond jewelry online.

All of the above are reasons for optimism. In the meantime, enjoy your summer holidays and come back refreshed and rejuvenated. The coming holiday season promises to be a busy one."

But despite the optimism expressed by Cleaver, Dvash, and others, there are still problematic underlying issues in the industry. In his most recent blog post, diamond analyst Edahn Golan points out that despite a surge in jewelry sales in June, revised U.S. Department of Commerce figurs show jewelry sales still shrank 14.9% in the first half of 2020, and jewelry in general has been losing share of wallet since 2006. June sales figures show rocketing volume but not as many dollars, signifying that consumers don't want to spend as much as they did before.

Ultimately, says Golan, the market is coming back, just as both Cleaver and Dvash have said. But he emphasizes that the industry will have to be attuned to what customers want--likely lower priced goods--and be ready to supply it and provide strong messaging that we have what they want.

"We need to keep our collective ears wide open to what our clients really want and need. Marketing absolutely needs to be in place – powerful, precise, engaging, and effective," he says.