Articles and News

De Beers Recommends Jewelers Put More Focus On Diamond Self-Purchase | September 21, 2016 (0 comments)

London, United Kingdom—The just-released 2016 Diamond Insight Report from De Beers says Millennials spent a collective U.S. $25 billion on diamond jewelry in 2015; more than any other generation. And almost one third of it was bought by women for themselves; a figure that’s only likely to rise with current demographic shifts toward later marriages and greater female advancement in the workplace. By contrast, diamond bridal jewelry actually now accounts for a smaller percentage of the total women's diamond jewelry market in the United States.

In the second of its biennial Diamond Insight Reports, De Beers addressed a variety of topics, including a general industry outlook, the diamond industry value chain, and a focus report on Millennials, the customer group every luxury category is courting with vigor. But in a surprising turn, the company that hammered the idea of diamonds as a gift of love for so long—to the point where both industry and consumer had a hard time seeing them in any other light—is finally acknowledging that there's money to be made in selling diamonds to women shopping for themselves.

While bridal and occasion gifting remains a pillar of the diamond market, the female self-purchase segment—and the non-romantic gifting segment—have grown from fringe extras to almost half the diamond jewelry acquired by Millennials. As a result, De Beers’ report not only embraces the non-bridal diamond purchase but actually now urges jewelers to put as much focus on these customers as on their bridal business. Women who buy diamond jewelry for themselves typically do so to mark a personal accomplishment or milestone—or, increasingly, just because they like the design of the piece.

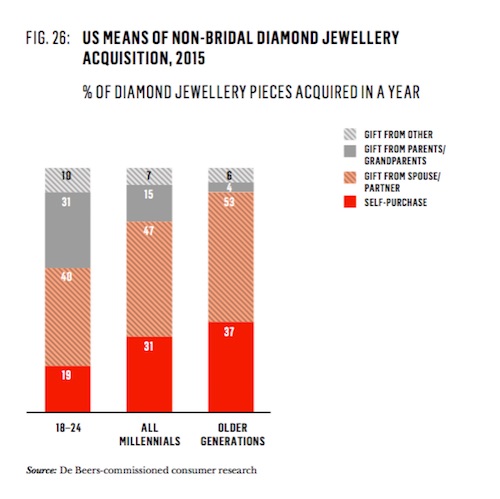

Among all Millennials, more in total (53%) received diamond jewelry from a source other than a spouse or partner. As figures later in this article will show, almost half (46%) of diamond jewelry acquired by Millennials was unrelated to bridal, anniversary, or other romantic partner occasions. Even among older generations, more than one-third of all diamond jewelry acquisition is a self-purchase.

Millennial consumers account for almost half of the total retail value of new diamond jewelry acquired in the United States, China, Japan, and India, the four largest markets for diamonds in the world. Demand in the United States in 2015 returned to the levels of 2004, five years before the Great Recession, according to the report. Despite this generation’s financial challenges that far surpass prior generations’ at the same age (especially in the United States), De Beers believes the potential for growth in the market remains significant: it’s a cohort of 220 million people globally that won’t reach its most affluent life stage for another 10 years.

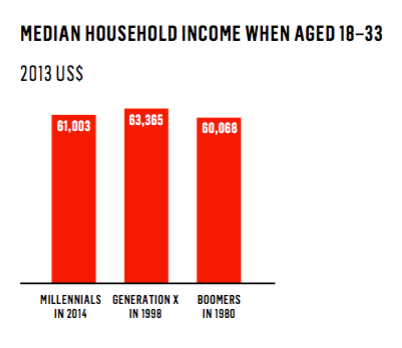

On the surface, Millennials' median household income at ages 18-33 appears consistent with earlier generations; however, when those figures are run through an inflation calculator, Boomers' median income in 1980 is equivalent to more than $172,000 in today's dollars. Gen-X's median income at that age in 1998 is equivalent to $125,300 today.

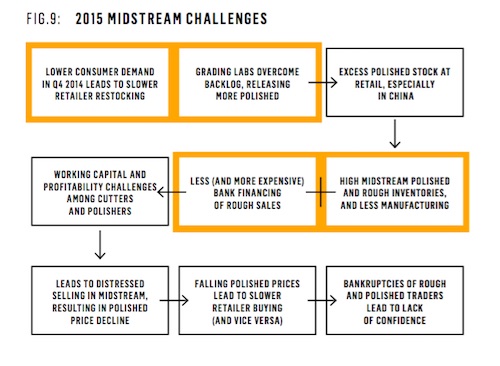

In the broader diamond industry, analysts at both Morgan Stanley and Bank of America Merrill Lynch estimate global diamond growth at 4% annually through 2021-2022. De Beers anticipates the sales and price volatility the industry has experienced in recent years will become the norm. Organizations across the entire diamond pipeline will need to improve both forecasting and planning to adapt.

A flow chart of midstream challenges facing the diamond industry. Source: De Beers Insight Report

Millennials’ penchant for spending on experiences over tangible things is well documented and remains a competitive issue for the diamond industry, as does competition from other retail product categories. But De Beers believes Millennials are emotionally similar in many ways to previous generations and that their interest in diamonds can be influenced with the right mix of marketing and product. Investment will be required to “keep the diamond dream alive,” says the report.

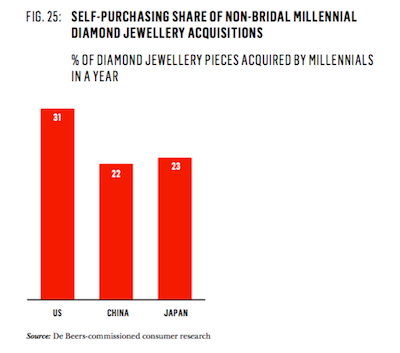

Key shifts in Millennials’ buying patterns and attitudes mean the market dynamics will change, however. On the upside, this group has a much higher self-purchase drive for diamond jewelry than previous generations. As social mores change, not only are many Millennials delaying or foregoing marriage altogether, but also the notion that diamonds should be a gift is changing. 31% of all non-bridal diamond jewelry purchases in the United States are self-purchases by a Millennial consumer, especially women. This will grow over the next decade and will drive demand for design-driven, lower price point merchandise. But the point about investment in marketing is well-taken: although diamond self-purchase has grown significantly, it still trails historic female purchase levels for gold jewelry (approximately two-thirds); pearl jewelry (approximately three-fourths) and silver jewelry (more than 90%).

As with other categories, the U.S. leads in diamond self-purchase.

Another rapidly increasing consumer segment is the non-partner/spouse gift segment, predominantly parents and grandparents gifting diamond jewelry to Millennials. Among all Millennials, it accounts for 15% of non-bridal diamond acquisitions, but among younger Millennials (18-24) that figure rises to 31%.

When added together, a staggering 46%—almost half—of all diamond jewelry that Millennials acquire is not related to bridal, anniversary, or other romantic partner occasion. That's more than 16% higher in market value than the U.S. bridal jewelry market.

“Diamond engagement rings (DERs) accounted for almost a quarter of total women’s diamond jewelry US sales in 2015," a De Beers representative told The Centurion. "The average price of a DER was estimated by De Beers at $3,400 in 2015, an increase of 75% since 2006. Diamond wedding bands (DWBs) represented another 4% of market value, taking the total bridal category to just under 30% of total U.S. women's diamond jewelry sales value in 2015."

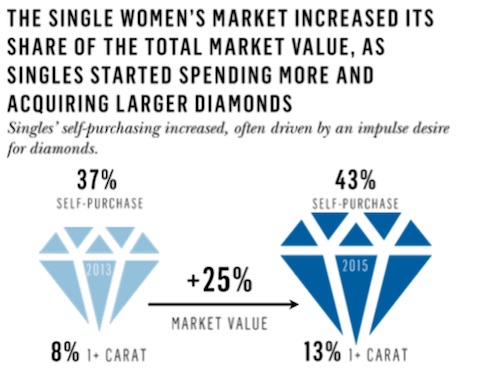

Women increasingly are spending more on diamonds for themselves, says De Beers. Though the report shows increased demand for designs at an entry price point, higher-priced goods are selling too. The market value of diamond jewelry purchased by women for themselves rocketed 25% between 2013 and 2015, and the number of women buying jewelry with one carat or more of diamonds also rose 5% in that time.

Consumer demand for social responsibility, ethical sourcing, and beneficiation will continue to rise, as will demand through nontraditional distribution channels. But growing price deltas between natural and synthetic diamonds are highly likely to impact the market as mining costs increase, synthetic production costs decrease, and a rising self-purchase fashion consumer demands design driven product at entry price points.

Some key numbers in female self-purchase trends:

- Single women’s diamond jewelry acquisition levels increased slightly in 2015, but their average spend rocketed 20%.

- The demographic of single U.S. women is expected to grow as marriage rates are at historic lows and the age at first marriage is an historic high. While Millennials do profess to have many of the same attitudes toward marriage, family, and lifetime values as older generations, their much later age of financial maturity means any upticks in traditional marriage rates are going to happen much later in their lives than it did for Boomers.

- Married women with more than eight pieces of diamond jewelry (“heavy owners”) remain a pillar of the non-bridal diamond market. This group too increased in 2015.

- Female self-purchase is on the rise, especially in households above $75,000 income and among 25-39 year olds. De Beers has targeted this as one of the best opportunities for growth and recommends jewelers put as much focus on this group as they do on bridal and other relationship-milestone jewelry. A particular emphasis on design and customization is needed.

Some key retail trends:

- While online sales of luxury goods still are remarkably small (about 6% of total market), “research online/purchase offline” drives 60% of the market. By 2020, the jewelry industry is expected to also fully adapt this model.

- Online influencers are growing at the expense of traditional media in capturing consumers’ interest and attention.

- Mobile commerce is expected to increase exponentially.

- Consumers will continue to value the experience over products alone; marketers must incorporate the story and the experience into the product along with customization and personalization.

- As with all retail, there is evidence that U.S. diamond consumers are increasingly turning to non-traditional sales channels such as Net-A-Porter. From its launch in February 2012 to March 2016, Net-A-Porter’s fine jewelry category has grown by some 350%, according to De Beers.

More on Millennials:

- Despite being the most highly educated generation ever, overall, Millennials’ real income level is lower than Generation X’s was in 1998.

- In 2014, only 28% of Millennials were married, more than 40% lower than it was for Boomers at the same age.

The complete Insight Report can be read online here and a video of Stephen Lussier discussing the findings can be viewed here.