Articles and News

Diamond News: Coronavirus Causing Worry In Diamond Market; WDC Seeks Input On Warranties Kit; More February 12, 2020 (0 comments)

Diamond Market Cautious Amid Coronavirus Concerns

Las Vegas, NV—Diamond market sentiment was positive for most of January but weakened as the outbreak of the coronavirus in China resulted in a shutdown of retail stores over the important Chinese New Year period, according to the latest news release from Rapaport. Left: Pedestrians in Hong Kong wear surgical masks. Image: Seattle Times.

The coronavirus outbreak is going to have a negative impact on the diamond and jewelry industry, along with many other industries. Already the epidemic has caused the Hong Kong jewelry shows to be rescheduled from their traditional March dates until late May, and travel restrictions are likely to affect global trading across the board. Meanwhile, the outbreak couldn’t have come at a worse time for domestic Chinese sales: the Chinese New Year holiday is as important to jewelers there as Christmas is here, and the sharp drop in sales due to the virus quarantine rules will impact first-quarter inventory replacement.

The recent influx of rough to the market, coupled with the weakened outlook for China, raised concerns that the trade would return to a polished oversupply, says Rapaport. De Beers sales rose 9% year on year to $545 million in January, with firmer prices on select boxes of commercial-quality diamonds. Mining companies are holding large quantities of rough they couldn’t sell in 2019. Rough production is projected to decrease approximately 6% this year, although the mining companies have enough inventory to offset the decline.

This has led to a volatile environment for diamonds. To support polished prices, the industry must invest in marketing to broaden the range of diamonds that are in demand, says Rapaport. Manufacturers must also refrain from buying too much rough as an oversupply of polished will exert additional pressure on prices. The RapNet Diamond Index (RAPI) for one-carat diamonds slid 0.4% in January, but the 0.30-carat index rose 4.1%.

But data from diamond industry analyst Edahn Golan shows a 3.7% rise in the wholesale price of one-carat polished rounds last month, and prices overall (all sizes) rose an average of 1.4%, based on manufacturers’ wholesale transaction prices. Still, he concurs with Rapaport in urging caution before stocking up.

“Wholesalers have increased their rough diamond purchases, which are expected to fuel manufacturing activity. This could be the start of another vicious cycle of available money followed by exaggerated rough diamond demand, then rising rough diamond prices, and oversupply of polished diamond leading to the inevitable polished diamond price fall,” he warned.

While Rapaport called for the industry to invest in more marketing, Golan is far blunter: it needs to do a lot more than that.

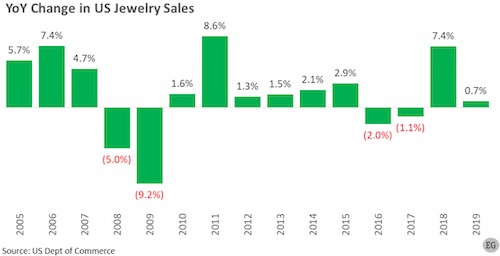

U.S. fine jewelry sales rose 4.4% year-on-year for the 2019 holiday season, he said, but those sales did little to boost sales on an annualized basis. For 2019, they barely budged, edging up only 0.7%. That’s less than one-third of the U.S. inflation rate of 2.3%, which means that in real value, jewelry sales fell year-on-year, he explains. Total U.S. jewelry sales for 2019 are estimated at $63.75 billion. Furthermore, says Golan, U.S. jewelry sales over the past 15 years have risen only an average of 1.8% annually. He believes this reflects a cultural change in tastes that, for the most part, the industry and retailers have not adapted to.

Chart: Edahn Golan

World Diamond Council Seeks Review Of System of Warranties Toolkit

New York, NY—The World Diamond Council (WDC) is encouraging stakeholders to review the WDC System of Warranties (SoW) Toolkit. This follows its unanimous adoption as a working draft by the WDC Board of Directors and its review by WDC members. The SoW Toolkit, which once released will be made available online at no cost to the industry, is designed to assist members of the diamond trade comply with the revised WDC SoW that was approved in 2018 and is scheduled to be phased in over a five-year period.

Stakeholders who wish to review the toolkit can download a copy from this link. Comments should be submitted to the WDC no later than March 31, 2020.

First introduced in 2002, the SoW as an industry self-regulation system that requires buyers and sellers of diamonds to pass on a warranty statement on B2B invoices and memos each time stones changes hands, assuring the next buyer that they originated from sources in compliance with the Kimberley Process Certification Scheme (KPCS). Unlike the KPCS, which only covers the trade in rough diamonds, the SoW also applies to the trade in polished diamonds and jewelry set with diamonds. Additionally, it must be applied each time a diamond changes hands, in contrast to the KPCS, where certificates are issued only when rough diamonds are exported from one country or region to another.

The revised system is based on new SoW Guidelines, which were approved in 2018 and reference the following universally recognized documents:

- Kimberley Process Certification Scheme (KPCS) Minimum Requirements and Recommendations on industry self-regulation issues;

- UN Guiding Principles on Business and Human Rights;

- UN Convention Against Corruption;

- FAFT 40 Recommendations on Money Laundering for Dealers in Precious Metals and Stones; and

- ILO Declaration on Fundamental Principles and Rights at Work.

The SoW Toolkit being reviewed is self-assessment questionnaire, where the questions that need to be answered depend upon the business model of the respondent and number of employees at work in the firm. This flexibility will ensure that respondents need to react to questions that are relevant to their businesses. The SoW self-assessment must be completed by every company that includes the revised SoW statement on their invoices, and it will need to be done annually.

Respondents will need to fill out several or all of following sections:

- Section 1: KPCS Section, for companies who deal (i.e. buy or sell) rough diamonds;

- Section 2: SoW Section, for all companies;

- Section 3: Compliance Section, for all companies, although firms with more than 100 employees will be required to respond to more questions than their smaller counterparts; and

- Section 4: Companies who source rough from artisanal mining operations.

“The stakeholder review is the final stage in the rollout of the new SoW Toolkit, and is a most critical one,” explained WDC President Stephane Fischler. “Our goal is to strengthen the System of Warranties, and in so doing reinforce the integrity of the diamond distribution chain. For this we are seeking the perspective of a range of experts. I call our colleagues to contribute.”

Element Six, De Beers’ Lab-Grown Division, Wins Patent Suit

Singapore—IIa Technologies was found to have infringed on the synthetic diamond patent held by Element Six, De Beers’ lab-grown diamond division that is responsible for producing its Lightbox jewelry line and other lab-grown stones.

IIa Technologies was found by The High Court of Singapore to have infringed an Element Six patent for proprietary synthetic diamond products and their method of manufacture (Singapore patent number 115872). The patent in question relates to the production of material used in both laboratory-grown diamond jewelry, as well as industrial, technical, and optical applications such as infrared spectroscopy, high-power laser optics, drilling, mining, and more.

A secondary Element Six patent relating to the treatment of CVD synthetic diamond (Singapore patent number 110508) was not found to be valid in Singapore and Element Six is considering its legal options with regards to this decision.

Element Six has invested hundreds of millions of dollars over more than 60 years to become a leading producer of synthetic diamond material, developing new material to tackle some of science and industry’s most intractable challenges, said a statement from the company, adding that any use of Element Six patents without its consent will result in a vigorous legal defense of its intellectual property.

Walter Hühn, CEO of Element Six, said, “This decision confirms the validity of our patent for the production of CVD synthetic diamonds, and we hold similar patents in many jurisdictions. We will continue to be vigilant for any other potential infringement of our IP rights around the globe, and we will defend our rights vigorously because protecting our ability to get a full return on our investment in R&D is vital to our future.”

The Element Six-IIa battle is not the only IP fight going on in the lab-grown sector, and a commentary in JCK suggests more legal wrangling between various companies in the sector may become de rigueur.