Articles and News

Diamond Sales Finish Q3 With Uptick | November 28, 2018 (0 comments)

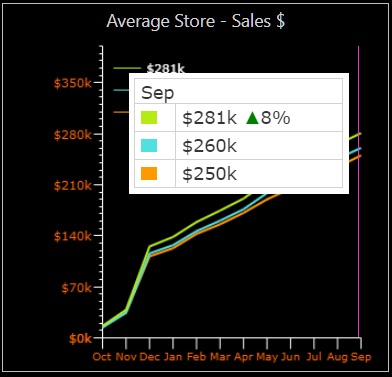

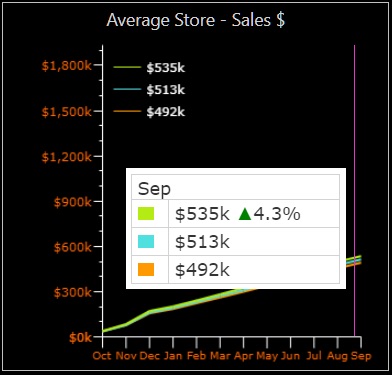

Omaha, NE—Sales of non-bridal diamond jewelry kept on a steady upward growth track through the end of the third quarter. Sales for the category rose 8% year-on-year through September 2018, while sales of diamond bridal jewelry edged up slightly from a month earlier. Bridal jewelry sales were up 4.3% year-on-year through September, compared to 4.1% through the end of August.

These figures, compiled by The Edge Retail Academy, represent aggregated sell-through data for more than $1.5 billion in annual fine jewelry sales at more than 1,000 better retail jewelers across the United States.

Sales of non-bridal diamond jewelry, by dollar volume, rose 8% year-on-year through September.

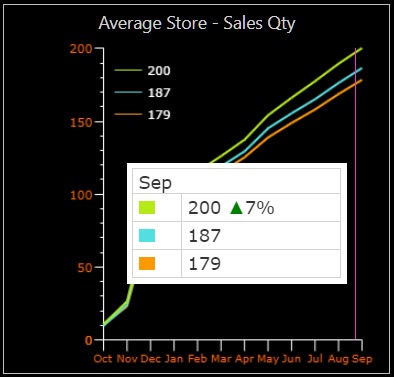

Unit sales of non-bridal diamond jewelry (below) were up 7% vs. the same period in 2017. The average retail ticket for the category had dropped incrementally (by $3/ticket) in August but rose 1% year-on-year in September, in alignment with the rise in dollar sales.

Related: Landmark Diamond Market Benchmark Data: How Do Your Sales Compare?

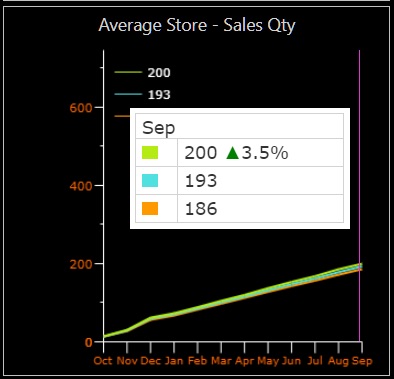

Bridal sales again increased more by dollar volume than unit sales, which were up only 3.5% year-on-year through September. The average bridal ticket rose 1% year-on-year for the same period and gross profit increases on bridal jewelry remained steady at a 5% year-on-year gain through September.

Bridal jewelry sales rose more by dollar volume, above, than unit sales, below. This corresponds to a slight uptick in the average ticket, bottom chart.

Gross profits on diamond jewelry continued their upward trend. Non-bridal diamond jewelry profits were again up 10% year-on-year in September.

Gross margins—i.e. markups—edged up 1% in both categories, but remain below what Edge Retail Academy’s experts like to see. On bridal jewelry, it edged up to 44%, while non-bridal jewelry averaged 48%. Ideally, says Becka Johnson Kibby, The Edge’s director of operations, retailers need at least a 50% markup across the board on everything, but the reality is that jewelers are constantly challenged to get it in categories like diamonds, bridal, and brands that are heavily comparison-shopped, so they need to focus on an overall margin of at least 50% by making it up in other categories (i.e. colored stones, silver, etc.) that can go over 50%.