Articles and News

Do The Hustle! Marketing To Women Today Is a Whole New Dance (Part One) | August 13, 2013 (0 comments)

In the first of an exclusive two-part series examining women shoppers today, we see how much the Great Recession impacted the mindset of even affluent luxury consumers, and what that means for the jewelers who sell to them.

Merrick, NY—American women at every income level are tired of frugality. But while recent economic data is positive and surveys show a strong uptick in both consumer confidence and spending, retail is evolving into a new game where the old rules don’t apply, especially for women.

Bonnie Ulman of the Haystack Group, a market research and consulting firm in Atlanta, and the co-author of Hustle: Marketing To Women In the Post-Recession World, says, “People don’t understand the degree to which the Great Recession impacted women.” Although many women she and co-author Sal Kibler surveyed for their book sensed the boom couldn’t last, they were stunned by the severity, the scope, and the duration of the downturn, which has impacted them like the Great Depression did their mothers and grandmothers.

“Economists can tell you the recession only lasted 18 months, but women are a long way from changing behaviors learned because of the recession,” she said. The shift is equally true of affluent women as non-affluent women.

“With affluent women, the bottom is just higher. She didn’t have to make the austere cuts or trade as low,” Ulman told The Centurion in an exclusive interview. Even if she didn’t have to trade down out of necessity, the psychological impact of the recession was no different than for her less wealthy sisters.

While they think brands or retailers caused the recession, women who “did everything right” and still had the rug yanked out are disillusioned with everything, say the authors. The fire sales on luxury goods in 2008 added to the mistrust. Even an affluent woman feels like she’s been taken if she sees the product for 50% off—yet there’s a sense of pride if she’s the one who paid 50% less for it.

“Retailers and brands so underestimated the trauma of the recession. People are resilient, but it’s different. There is always going to be a group of customers who spend top dollar to fill a void, but lots of customers stuck with moderation,” she says.

Myriam Gumuchian of New York-based Gumuchian says buyers’ price points dropped a lot since the recession. It’s not that big diamond pieces don’t sell, but jewelers want a lot more affordable, “everyday” merchandise.

“Jewelers are buying pieces between $1,000 and $5,000 retail. That’s really low for Gumuchian, but now the sweet spot is up to $5,000 or $6,000 retail, and we’ve brought in lots of models at the sweet spot.”

Myriam Gumuchian says jewelers have consistently sought lower price points and more "everyday" jewelry since the recession. Top left, a three-row 18k rose gold and diamond ring from the Nutmeg collection retails for $3,000, but women are just as likely to want a single 18k yellow gold Nutmeg band at $900 retail, below, that they might stack with rings they already own. At top right, an 18k white gold and diamond pave pendant (0.24 ctw) from the brand's G Boutique retails for $1,600.

Gumuchian has direct consumer contact at trunk shows. There, she says, sales tend to be more varied, and she sees a lot more women buying for themselves than she did prior to the recession. They’re also a lot more focused and educated.

“Women are shopping alone more. They’re not bringing a partner or even a friend, and women who come alone also know what they want.”

Colleen Rafferty, co-owner (with Diane Christensen) of Christensen & Rafferty in San Mateo, CA, says the middle-market customer base—the ones who spend between $600 and $1,400 for fashion-forward jewelry—slowed down dramatically in the recession They’re coming back slowly but still haven’t returned to prerecession levels. As a result, the jewelers have had to get very creative in promotions to bring in new clients and bring back clients who haven’t been there in a long time.

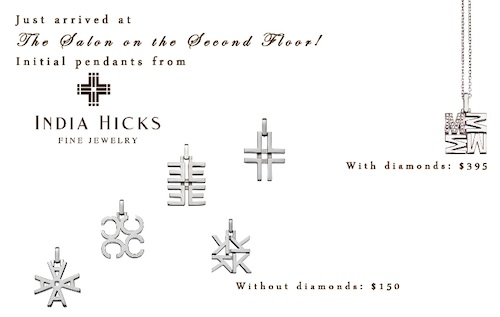

Designer India Hicks' initial pendants are one example of the category of affordable, easy-to-wear jewelry Christensen & Rafferty's clients want.

Ulman says one of the key tectonic shifts in marketing to women now is in transactional vs. relationship selling. Historically, men were all about the transaction, whereas women wanted a relationship. Luxury jewelers, of course, are focused on building relationships.

But Ulman says women now don’t want the relationship, they want a flawless transaction. A repeat purchaser used to be brand loyal; now any appearance of loyalty is only because she hasn’t found something better and if she does, she’s gone.

The only way to build a long-term relationship is by focusing on one transaction at a time: what is this transaction like for her? After the first one is flawless, so must the next, and the next, and so on.

Rafferty still believes in relationships, but there’s been a subtle change in how that happens. For example, the jewelers have a “bring a friend” event where any client can enter a raffle for a $1,000 shopping spree if they bring a friend that never shopped at the store or who hasn’t been there in a very long time. Every friend they bring nets them another raffle entry. The friend, meanwhile, gets a small free jewelry gift as a “thank you” for visiting.

“It’s not about selling that evening, it’s about meeting friends of friends,” says Rafferty.

But even if women don’t want a relationship, they want to know with whom they’re doing business. Says Gumuchian, “People are researching a lot more than before [the recession]. They come to a trunk show like they already know me. They’ve been following my brand, watching my videos, and they know about me, my mom, and my sisters. “It’s almost creepy,” she adds.

She noticed this shift beginning in 2012, and while she acknowledges her reserved European upbringing made her feel “creeped out” at first, she’s gotten used to it. “People want more information, and you have to give it. I connect to women because we’re all women.”

Rafferty organizes “field trips” to the store for members of the various civic organizations she and Christensen are active with. “Even though we’re involved with these organizations, there are hundreds of members we don’t know,” she says. But because of the shared interest in the cause, the women know they’re doing business with someone like-minded.

Christensen & Rafferty gets creative to appeal to today's women. Here, their website shows a special event in the store featuring pearl speaker Jack Lynch.

Don’t underestimate how important social and ethical issues are to post-recession women, especially Millennials, stressed Ulman. Reiterating her point about how 60% of women surveyed have lost trust in brands and institutions, they really are looking for organizations to earn their place on the planet.

“You have to be in lockstep with that,” she says. “The calculus has shifted. You’re not going to see a movement away from corporate responsibility. She wants to know the businesses she supports are dedicated to positive change.”

Next week: How post-recession affluent women spend money for jewelry, fashion, and other discretionary expenses, and what deals they expect from retailers.