Articles and News

EFFECTIVE CASH FLOW MANAGEMENT: MAKE YOUR INVENTORY ASSESSMENTS WORK FOR YOU May 11, 2011 (1 comment)

This is the second of a series of exclusive articles addressing cash flow and sound financial strategy, by the Vantage Group for The Centurion.

La Costa, CA—It’s safe to say that the overwhelming majority of retail jewelers have some type of inventory management system. Regardless of the system, the real question is, "How well do you utilize it?" Computers and inventory management systems collect a great deal of information but how you examine the information and then make it work for you is key.

To maximize a store's potential, inventory must be managed on a deeper level than total inventory investment dollars; not just bought with the hope of being sold. We highly recommend examining inventory down to the category level when calculating both turn rate and open to buy. Merchandise should be tracked from both styling and price points, as well as potential lost sales. Lost sales opportunities are discovered by examining the percentage a category contributes to the total sales, and comparing those sales results to inventory levels.

As you prepare for buying trips, be certain to establish clear objectives and a detailed buying plan. Never go to a trade show or sit down with a manufacturer without a pre- calculated open to buy. Your open to buy keeps you on course to avoid over-buying, while still buying enough to maximize your sales opportunities. You are simply determining how much inventory your company will need to buy to maintain an inventory goal for a determined period of time.

Establishing Target Inventory Turn. Here's a little refresher on the calculation. First, determine what your target ending inventory for the set period will be. For example, if you are buying for now through the end of the year, how much inventory do you want at the end of December?

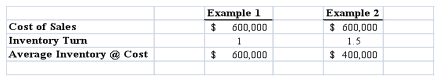

An easy way to do this is to determine your desired inventory turn. The majority of jewelry stores in America have an annual inventory turn of 1 time. In other words, an average store will have an annual cost of goods sold equal to their average inventory at cost. If you want to increase your cash flow, work towards a 1.5 to 2.0 time turn. The Inventory Turn chart below provides a workbook example of how to optimize inventory turn rate.

Chart 1: Inventory Turn

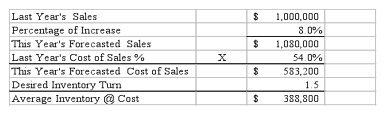

Calculating Average Inventory and Open to Buy. Your inventory turn multiplied with your cost of sales forecast will give you your average inventory.

The Average Inventory chart demonstrates how to calculate your target average inventory.

Chart 2: Average Inventory

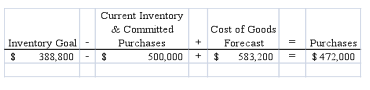

To calculate your open to buy, subtract current inventory from the inventory goal, and add the cost of goods forecast.

The Open to Buy chart provides an assessesment of current and future inventory attainments with COG forecasts.

Chart 3: Open to Buy

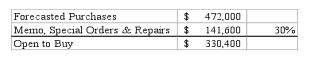

An important part of your calculation is considering how much of your business is from memo sales, special orders, and repair cost. By subtracting these mandatory purchases you will have a clearer picture of your open to buy.

Chart 4: Compensating for Special Orders

Your open to buy should be calculated for each merchandise category. Buying in this manner will keep your merchandise in line with what you are selling and allow you to take advantage of a calculated opportunity to increase sales in areas you have missed. This information will allow you to make truly good buying decisions and take your business to the next level.

Now that you know how much you plan to spend to keep your inventory on track, the next step is to prepare purchasing goals for the trade shows.

Prior to a Trade Show

- Step 1: Determine your total open to buy (see Chart 3). Identify which quick selling merchandise you are currently out of and replace this first.

- Step 2: Identify your top 20 gross profit-producing vendors and focus energies here first. These are the proven strengths in your company.

- Step 3; Identify old product you want to exchange. Consider how much additional investment you will need to exercise the exchange.

- Step 4: Match these necessary orders to your open to buy.

- Step 5: Set an appointment to see each of your identified vendors, allowing yourself time to accomplish your goals.

At the Show

- Step 1: Work cooperatively with each vendor. Discuss exchange policy, delivery, coop advertising, training, terms, and cash discount.

- Step 2: Ask vendors for advertising materials that you can utilize and perhaps an item to be given away at an upcoming special event.

- Step 3: Write orders as ‘hold for confirmation’ if you are not 100% confident of the complete order. This gives you the opportunity to reassess all purchases at the end of the trip.

- Step 4: Look for new products: this should be a main reason for going to a show.

With these formulated steps, you will find yourself more confident in your purchases and see your inventory start working for you. By buying specifically to suit the needs of your customers, and tailoring your merchandise to what they want to buy, your sales and turn rates will climb and so will your cash flow.

See you at the shows!

Vantage Group understands success depends on how well all aspects of your organization work together. After decades of experience with both national retailers as well as independent chains, Dan and Lori Askew apply their expertise to assisting the independent retailer and manufacturers in the jewelry industry. They closely examine each area and address them in the order that will make the greatest impact in the most time efficient way on your business. They are committed to partnering with owners to grow their businesses incrementally while avoiding many of the pitfalls that may exist along the way. What sets Vantage Group apart from other consulting groups is the broad base of expertise. The commitment is to insure your overall success through cash flow, merchandise planning, inventory control, advertising, and store management by partnering with you from the beginning or joining you at any point along the way.