Articles and News

ENCOURAGING SIGNS POINT TO HOLIDAY GROWTH | September 28, 2011 (0 comments)

Merrick, NY—Are consumers really as fearful and lacking confidence as surveys proclaim, or are their wallets speaking louder than their words?

Getting a handle on consumers’ mindset these days is a lot like singing Katy Perry’s Hot ‘N Cold. It’s up then it’s down, it’s hot then it’s cold, and so forth. For, buried deep inside the dismal confidence surveys and doomsayers’ warnings, are signs that consumers are dealing with their angst in a time-honored American way: with a little retail therapy.

It bodes well for jewelers heading into the most critical months of the year.

This article in the New York Times says shopping behavior has flipped around since the early days of the recession when consumers hunkered down and opened their wallets only for necessities. Now, instead of foregoing indulgences, consumers have grown tired of “being good” and are cutting back on basics in favor of the fun stuff, including jewelry.

In another recent article on CNBC.com, Bank of America Merrill Lynch economist John Dennerlein pointed out that some of the numbers just don’t match. For example, the number of consumers who indicated in August that they plan to purchase an automobile in the next six months jumped a full percentage point from July’s survey figures—despite the debt ceiling drama—and for the first time since September 2010 more than half of respondents indicated their intention to purchase a new major appliance. The number of consumers planning a vacation also rose. These are not numbers typically associated with people who think we’re headed for another recession, argues Dennerlein; he posits that the dismal confidence survey numbers are more of an expression of people’s frustration with the government’s inability to get its act together on fiscal policy.

The Thomson-Reuters Same Store Sales Index rose 4.4% in August, just shy of the 4.6% previously estimated. Still, analysts say that’s healthy—especially when one takes into account higher prices on most consumer goods, continued high unemployment, Congressional spitting contests, and a hurricane. At the same time, MasterCard Advisors’ Spending Pulse showed a 3% increase for the July/August period, the highest gain for the period since 2006’s boom-time figure of 6.2%.

Back-to-school, while not a terribly important selling season for jewelry, is considered to be a good barometer of holiday spending. Some years—like 2010—it’s off target, as luxury jewelers experienced a robust holiday following a BTS season that was generally underwhelming. This year, however, BTS was solid and while some analysts remain cautious, some early signs point to a positive holiday season.

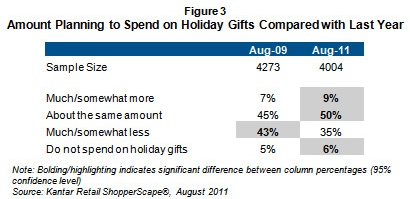

These figures from the Kantar Retail Shopper Scape survey taken in August show 59% of consumers planning to spend the same or more for holiday gifts this year, compared to 43% planning to trim their budget.

In its most recent Retail Compass Survey, BDO USA says 100 retail CFOs it polled in July and August anticipate a 3% growth for sales in 2011 overall, with 3.5% for the second half of the year. Doug Hart, partner in the retail and consumer product practice at the financial and tax advisory firm, says the respondents are individuals from large retailers, with access to realistic sales data on which to base their predictions. The results, he says, indicate that macroeconomics aren’t pulling on consumers’ wallets as much as previously feared. CFO’s anticipate moderate spending levels to continue through the holiday season. Still, writes Hart in his blog, the CFO’s say lower unemployment, improvement in the housing market, and increased consumer confidence are key to improving the stagnant economy.

Luxury, too, keeps moving in the right direction. Both Nordstrom and Saks posted solid gains for the same period, though Saks did cite Hurricane Irene as a reason why the gain was slightly less than initially predicted. Tiffany & Co. also posted a 19% jump in U.S. same-store sales—at least 9% of which are real increases in sales, not just price-based numbers.

Indeed, this article in the Minneapolis Star-Tribune cites a robust 9.4% increase in August sales and a 5% increase in traffic year-over-year at the famed Mall of America in Bloomington, MN. The gain is attributed to luxury spending at the mall’s upscale tenants like Nordstrom, Michael Kors, and Hugo Boss, as well as its Nickelodeon theme park.

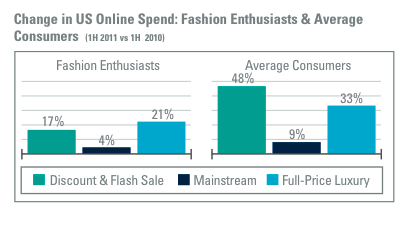

The latest Global Luxury Fashion Spending report from American Express shows fashionistas pulling back on luxury spending again—but ordinary consumers picking up the slack. Since the recession, the group Amex dubs “fashion enthusiasts” has led the way—these are consumers who make up the top 5% of spending across all categories of luxury fashion and accessories globally. But in 2011, the “enthusiast” group has pulled back while “average” consumers are making notable increases in their spending, says the report. “Average” women showed a spending increase of 125% in the first half of 2011 over 2010, while “average” men spent 156% more. “Enthusiast” males dropped spending for luxury fashion by 11%; enthusiast women held spending flat with last year.

In this chart from American Express, we see a rise in luxury spending by "average" consumers outpacing that of fashion enthusiasts, or those who typically are responsible for the top 5% of spending on luxury fashion.

Other findings from the Amex study:

- Older consumers are showing strong interest in online discount and flash-sale shopping.

- Boomers (age 45-66) increased their spending at online discount or flash sites by 25%. Gen X (age 30-44) increased by 60%, but seniors (age 66+), jumped their spending 124% in this category.

- Both enthusiasts and average consumers are embracing online shopping overall.

- Ironically, Gen-Y, the group practically born with mouse in hand, had the lowest rate of growth for luxury flash- or discount site spending, only 13% more in the first half of 2011 than the same period last year. (Editor’s note: The report did not indicate whether Millennials started from a higher base of flash site usage, which would naturally lead to slower growth.)

Meanwhile, a new report from The Luxury Institute in New York says that two-thirds of affluent households (earning $150,000+) don’t plan to trim spending in the coming months, a three-year high for optimism among this group. 32% still do plan to cut spending—but that figure has dropped from 37% last year and 42% in 2009. 10% have increased spending in the last few months, compared to 7% during the same period last year.

The good news comes with one note of concern for jewelers: jewelry heads the list of areas where the wealthy say they are likely to cut spending. 39% cited jewelry as an area to cut, followed by antiques (37%), custom apparel and art (34% each), and handbags and watches (33% each). Still, flipping these figures upside down and adding the proverbial grain of salt, it means 61% of luxury consumers don’t plan to cut back on jewelry spending—and most Centurion retailers have seen their customers returning to buy and are experiencing a solid year. Even at the mass level, consumers want jewelry: Signet Group, owner of Kay Jewelers and Jared The Galleria of Jewelry, recently said same-store sales for the period increased 12.2% over last year’s figures, and in the Times article JC Penney also cited jewelry as one of its strong-selling categories.

Meera Raja, marketing manager of the Luxury Institute, told Luxury Daily that 64% of respondents to The Wealth Survey: The State of the Luxury Industry According to U.S. Consumers 2009-2011 felt the prices of luxury goods are too high and the products don’t deliver enough value. 28% said discounts on these products would entice them to spend, and many plan to shift their spending to travel and technology, areas where they feel the experience and value proposition is better.

Makers of luxury goods also are carefully watching the European economic situation, wondering whether the turmoil might ultimately result in the dissolution of the euro and a return to individual currencies.

This will have greater implications for global luxury brands than individual jewelers. Luxury jewelers have close personal relationships with customers, whereas global luxury brands often don’t. Also, while different currency exchange rates may affect the cost of European goods that American jewelers carry, they typically don’t conduct sales transactions in multiple currencies. But, says luxury researcher Pamela Danziger, in a global economy worry is contagious and a crisis in Europe can put the brakes on American luxury spending.

But in the long terms, as industry marketing expert James Porte told The Centurion recently, this industry is built on relationships and therein lies its advantage. A jeweler is in a far better position than a global brand to help customers understand the real value of a luxury piece and, more importantly, tap into the emotion behind it.