Articles and News

EXCLUSIVE: THE CENTURION SURVEY OF JEWELERS’ VIEWS ABOUT INTERNET SALES TAX | July 06, 2011 (1 comment)

Merrick, NY—In a recent spot-check survey of prestige jewelers, The Centurion Newsletter asked how many feel their business has been adversely affected by Internet retailers who are not required to charge sales tax for online purchases. Not surprisingly, most respondents—87.3%—said yes. But even more startling are some of the estimates for lost sales. 65.5% of respondents estimate they’ve lost substantially more than $10,000 in potential revenue each year due to competition from tax-free Internet sales. Some among these estimate their lost revenue stretches into the hundreds of thousands. One jeweler wrote, “I’ve lost many larger sales; maybe $300,000 [annually].”

Another told The Centurion that he’s seen many fingers sporting rings that were shopped in the store but bought online. And it always comes down to price, he says. “My staff and I know all the closes to prevent the customer going e-commerce, but sometimes it’s just going to happen and cost me sales.”

But not every jeweler says the lack of tax online has hurt business. While those who didn’t were admittedly a small minority (12.7%), Jay Seiler of Security Jewelers in Duluth, MN, pointed out some very big gray areas in the debate. “Everyone wants sales tax on the Internet, but what about the phone?” he asks. Shoppers who order by phone from an out-of-state jeweler aren’t charged sales tax either.

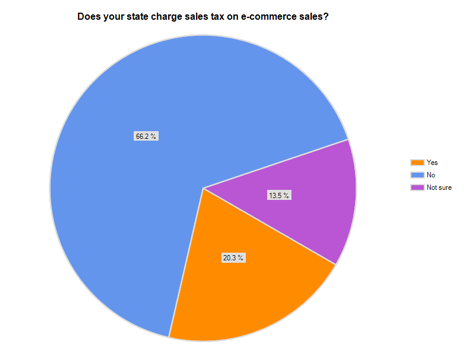

The Centurion's spot-check survey of Internet tax burden found that 66.2% of respondents live in a state that does not charge sales tax for online purchases (blue slice), 20.3% live in a state that does (orange slice) and 13.5% aren't sure of the law in their state.

Not every state gives a free ride to online merchants. California is the most recent state to enact an Internet sales tax law, effective July 1. It joins New York, Arkansas, Illinois, Connecticut, North Carolina, and Rhode Island in requiring online merchants to collect on taxable items just like a brick and mortar store.

But contrary to popular belief, even prior to the legislation not every online sale was tax-free. If a retailer has any kind of physical presence in the state where the sale is being made, it is required to collect sales tax. A physical presence doesn’t necessarily have to be a storefront; it can be an office, a warehouse, or, says Diane Yetter, president of the Chicago-based Sales Tax Institute, even an agent in the state.

Some states—-including the ones listed above, as well as South Dakota, Vermont, and Colorado—have enacted legislation commonly called "Amazon" or "Click Through Nexus" laws, which generally mean that if an out-of-state seller receives a referral from an in-state entity or person and pays a commission based on the successful placement of an order, the in-state referral agent is acting as an agent of the seller and therefore establishes a physical presence or nexus. This then requires the seller to collect sales tax on sales into the state, Yetter told The Centurion.

In lieu of a tax collection requirement, she added, some states have imposed reporting and advertising provisions that prohibit an out-of-state seller from advertising that no sales tax is due and, in some cases, to provide states with information about sales volume made to residents.

More information can be found on the Sales Tax Institute’s website; click here to be redirected.

Large retailers have been able to get around this rule by establishing separate legal subsidiaries for the Internet portion of their business. Thus, even though the consumer-facing brand is the same, the dot-com division is a different legal entity from the same store at the mall. But another huge gray area surfaces when those two entities start to commingle—such as allowing online returns in-store—and this hasn’t yet been challenged in court.

Says Seiler, “A lot of these organizations that are fighting for online sales tax parity present it as saving Main Street, but in reality it’s the national big-box chain retailers who have stores in all 50 states that most want to see tax collected online.”

He himself has a significant online business, with more than 30,000 items on Amazon.com. He acknowledges that small merchants who don’t have the online presence he does may be hurt by the lack of Internet tax, but his sympathy goes only so far.

“I feel badly for them, but you have to get with the times,” he said. His own online business dates back to his first site in 1995. “We had our first sale within 24 hours—and we didn’t even have a computer in the store! “

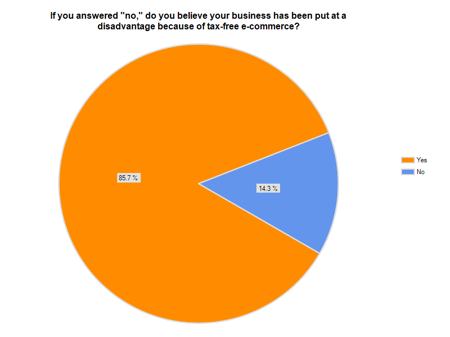

85.7% of respondents to the Centurion survey believe they've lost revenue due to unfair competition from tax-free online sales.

Five states don’t even charge sales tax at all, even for brick and mortar stores. These include Alaska, Delaware, Montana, New Hampshire, and Oregon. Retailers in neighboring states, especially near the border, know they may have to address customer requests for tax breaks, though it appears to come up more often in non-jewelry stores than jewelers.

Aida Leisure of DBS Jewelers in St. Michaels, MD, says she’s never heard a customer say, “I’ll go get it in Delaware.” Jewelry is too personal, she says. But it is common for Marylanders (and Pennsylvanians) to trek to nearby Delaware for large purchases such as televisions or home appliances.

Technically, consumers who live in a state that does collect sales tax are supposed to report such purchases and pay the tax on appropriate items even if the online or out of state retailer doesn’t charge it. In this case, it’s called a “use” tax, rather than a “sales” tax, but let’s face it—how many consumers report it? And how many states have the resources to track down every single purchase? Some states are stepping up efforts to collect, but most states don’t bother unless it’s a large purchase that needs to be licensed, such as a motor vehicle or boat. And, as Diane Christensen of Christensen & Rafferty in San Mateo, CA muses, even if jewelers make it a point to tell customers that they're supposed to report the purchase and pay the tax--which she does--it's still the customer's responsibility to actually pay it.

“For a while, the state [of Maryland] was trying to crack down on those purchases,” says Leisure of people who bought appliances in Delaware. The state would try to stop delivery trucks to find out where they were headed, but she thinks the effort wasn’t very successful.

Because DBS Jewelers is in a resort area, she a lot of customers ask to have their purchases shipped home—possibly assuming that means they’ll get out of paying sales tax. Not so, says Leisure. If they call from another state, they don’t pay tax but if they’re physically in the store at the time of purchase, they have to pay sales tax, she says, so her standard answer is, “why don’t you just wear it now and enjoy it so you don’t have to pay shipping on top of the tax?”

But, she says, for a large purchase where the customer hasn’t asked for any special discounts or accommodations, sometimes she will offer to pay the tax herself. Those purchases are specially marked “back out” on the receipt, which means that the store pays the tax when it’s due.

Finally, a point to consider is whether it’s only the lack of sales tax—or lower prices in general—that drives shoppers online. Certainly tax favoritism doesn’t help, but most sales tax is less than 10%. While even 5% can add up on a big purchase, if a site is charging only 6-8% over cost in the first place, can a jeweler compete? Does he even want to?

Seiler says no. He’ll happily meet Blue Nile’s prices, which he estimates are between 12-15% over cost, but he won’t meet some of the other sites’ prices. “I’ve lost that sale,” he says.

“I love it when a kid comes in with a Blue Nile printout. I get on the computer and show him Rap and a few other sites show him there’s his diamond—Blue Nile doesn’t own it.” He’ll offer to match the Blue Nile price and he often gets the sale, along with whatever designer mounting the customer was seeking from him in the first place. Seiler says he’d much rather sell the mounting, anyway; the margins are better.

Where The Taxman Waits

In most states that collect sales tax, the only place one is almost guaranteed a break is for out-of-state purchases. Here’s the breakdown:

- 80% of respondents said taxes must be charged for purchases at flea markets, craft shows, and such in their state.

- 75% said taxes are collected at home parties and on corporate sales in their state.

- 55% of respondents surveyed said their state collects sales tax on catalog or direct mail purchases.

- 35% said their state collects taxes for TV shopping.

- 42.5% said their state collects taxes for phone sales.

- Only 5% said their state collects taxes for products shipped out of state.