Articles and News

FROM BULL TO BUBBLE: HOW TO PREPARE IF GOLD GOES CRAZY | March 07, 2012 (2 comments)

Merrick, NY—When Warren Buffett speaks, investors listen. So when the Oracle of Omaha recently suggested in his annual letter to Berkshire Hathaway shareholders that gold prices might be in a bubble—and that bubble might soon pop—it’s no surprise his words would send a collective shudder down the jewelry industry’s spine.

The “B” word isn’t new to gold; it’s been bandied about frequently since gold began its steep climb starting around January of 2009. But it’s more than a little unnerving to hear it spoken by Buffett himself, especially knowing he has a vested interest in gold because of his jewelry industry holdings. Berkshire Hathaway owns retailers Borsheims, Ben Bridge, and Helzbergs, and gold jewelry supplier Richline. (Buffett himself will man one of the Borsheims sales counters during the Berkshire Hathaway annual meeting this May in Omaha.)

What, exactly, constitutes a bubble? Is there a clear dividing line that tips a strong bull market into bubble territory? Or is it more like the proverbial definition of pornography, “I know it when I see it.”

To find out, The Centurion asked Andy Waldock, the founder of Ohio-based Commodity & Derivatives Advisors. Waldock told The Centurion that gold currently is not in a bubble—yet—but like Buffett, he believes it’s very likely to be within a year or so. It’s going to make 2012 a very tough year for jewelers to plan, he says, but the good news is that with careful observation (and knowing what to look for), it’s possible to be prepared and minimize negative impact to the bottom line.

Buffett, in his letter, observes that investor behavior with regard to gold buying is consistent with other bubbles such as housing or technology stocks. He also observes that gold has value because people think it does—not because it actually does anything to provide value.

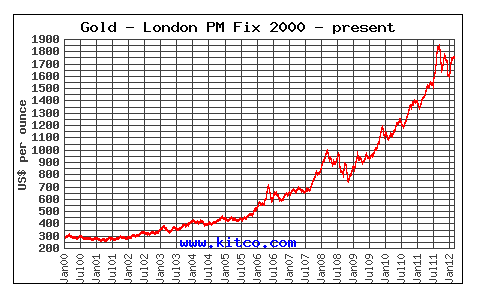

Waldock agrees that both these factors can be indicative of a bubble, but he says there are some very important parameters that define a bubble vs. just a strong bull market. First, prices must increase both significantly and rapidly, doubling within two years, and a new five-year high must be made. Gold has indeed done both between 2009 and 2011. This chart from Kitco.com shows the path of gold prices from 2000 to present; the sharp climb begins around January 2009.

Historic gold chart from Kitco.com shows a steady uptick from January 2000 to present.

Second, the market must demonstrate parabolic increases, or exponential growth—and that is what gold has not yet done, Waldock says. The historic chart from Kitco shows a solid uptrend, but no parabolic gains. For that reason, gold hasn’t crossed over into bubble territory yet.

The emphasis is on “yet.” Waldock believes there will be some seismic event that will trigger a gold buying spree, whether it’s a Euro-zone crisis or even something in the United States or somewhere else, but he believes something will happen this year that will flood the gold market with what he calls “the stupid money” and we will see huge volatility—as much as 4% to 5% a day—and the exponential or parabolic increases that define a bubble.

“Bubbles have about a five year cycle. The market doubles in two years, you make a new five year high, and that’s when things get stupid,” he told The Centurion. Then the top blows.

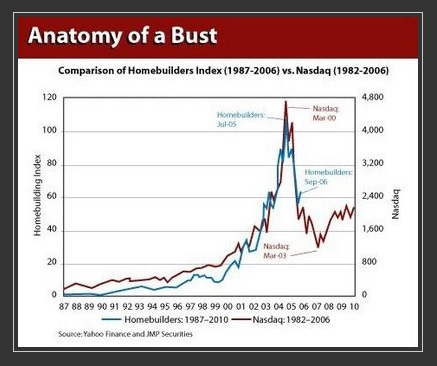

This chart from The Economic Edge shows the parabolic curve of both the housing and NASDAQ bubbles. NASDAQ is red, housing is blue. The curve on the historic Kitco chart is roughly parallel to the curve from 1999-2003 here, not the sharp spike after 2003.

But in the case of gold, Waldock believes that after the fuss dies down, the market will ultimately return to the levels where the rally began—roughly to 2009 levels between $1,000 and $1,200—not to the $300 gold at the start of 2000.

“In modern history, most bubbles return to their base. They don’t give it all back and then some,” he said. (Separately, both the increase in gold production costs at the mine and rocketing demand in the emerging Chinese and Indian economies also will help keep prices from dropping down to early-2000s levels.)

Currently, from about late September 2011 through now, the gold market has been sorting out its imbalance of players with sideways action, says Waldock. Commercial traders who sold off at the highs are now actively re-buying, which will drive prices up.

Bubble watching: what to look for. Waldock is an ardent follower of the Commitment of Traders reports and the gold volatility index. Both are free and provide publicly available information. When the gold volatility index starts jumping, watch out, he says. If you look at the historic charts since 1992 for comparison, you can start to recognize a bubble when the gold volatility picks up, he told The Centurion.

He personally pegs about the $2000 to $2100/ounce mark as the point where the stupid money will start pouring in. Buffett in his letter quoted the old proverb, “What the wise man does in the beginning, the fool does in the end.” The wise man is the smart money, and the fool has the stupid money.

When a bubble bursts, it's the late, stupid money folks who lose their tail, Waldock said. The smart money investors already made their gains long ago--and Waldock says a burst gold bubble "won't affect the man on the street in any form."

Waldock says there are investment products available that can help jewelers or other industries that use gold hedge their cash risks in the event of a gold bubble. Through the use of the futures market, gold users can buy in advance of a run-up in price, or, conversely, if they’ve got a lot of inventory to unload, do it before a huge drop.

“I can’t begin to tell you how vital that could be for your industry,” Waldock told The Centurion.

Yet Waldock is no gold bug, he says. His perspective of gold is simply in how it behaves as a commodity, just like any other. While man has treasured gold since Biblical times, it’s valuable just because people believe it is—and lately, because of fear, says Buffett. That’s why Buffett prefers to invest in companies that make products people need.

While Waldock acknowledges the history of gold as a store of value does matter—a lot, obviously—he also says gold won’t feed a family, put a roof over one’s head, or multiply itself to make more. An ounce of gold today will still be an ounce of gold 100 years from now. It has value because it does. If history is any indication, it still will—unless people are no longer convinced of that value.