Articles and News

Gold Ends August On Down Note, But Experts Say That Won’t Last September 01, 2020 (0 comments)

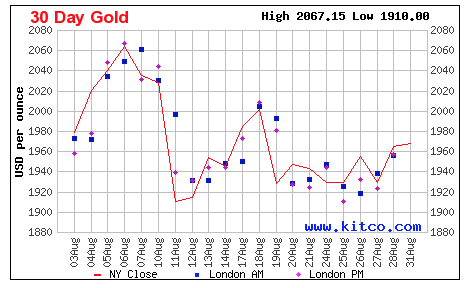

New York, NY—Gold closed out August lower than it did in July, ending the record-breaking month back below $2,000 an ounce. Gold futures hit $2,088 and spot gold hit $2,067 on August 8, which to date is the all-time high. (Futures are exactly that—locking in a price for future purchase, whereas spot gold is the price for immediate delivery, such as bullion.) Spot gold closed at about $1,968 on August 31.

Figures from Dow Jones Market Data show that for the full month of August, gold lost 0.4%, while silver climbed about 18%. Platinum, meanwhile, is trading at less than half of gold, at $938 an ounce.

Writing for metals-trading site Kitco.com, metals analyst Gary Wagner pointed out that after breaching the important $2,000 barrier, gold was never able to sustain it for more than five consecutive trading days in August. Nevertheless, he sees market forces—interest rates near zero, quantitative easing, a weak U.S. dollar—driving gold to regain strength, and predicts it will establish a base over $2,000 in the next few months.

Analyst Christopher Lewis, writing for FX Empire, concurs. “A break above the recent high from a couple of weeks ago would send this market looking towards the $2100 level. A break above there then opens up the door to $2500 which is my longer-term target,” he writes.

Image: This chart from Kitco.com shows the price volatility of gold during August 2020.