Articles and News

Holiday Jewelry Sales Momentum Continues And People Are Spending More | December 07, 2021 (0 comments)

Merrick, NY—Better jewelers continue to experience a very solid holiday. The Centurion 2021 Holiday Sales Success Index, a spot-check survey of better jewelers, shows the momentum that started before Thanksgiving continued through the first full week of the Christmas season, November 29 through December 5.

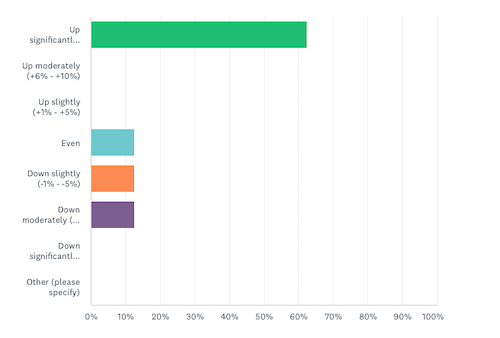

Almost two-thirds of respondents (63%) said sales for the week grew more than 10% over the same period last year. 25% said sales dipped compared to the same week last year, and 12% said sales were even.

Meanwhile, in the broader retail picture, jewelry sales led the way for a 14.1% year-on-year gain in Thanksgiving weekend retail. According to Mastercard SpendingPulse™, which measures overall retail sales across all payment types including cash and check, jewelry sales leapt an astounding 78.4% over last year’s figures for the weekend. That helped push U.S. general retail sales up 14.1% year-on-year for Thanksgiving weekend, and 5.8% over 2019. (These figures exclude auto.) The remarkable growth in jewelry far outpaced every other category. Apparel was a distant second, with 51.2% growth.

The jewelry industry will no doubt view the past year as a golden time for the industry (no pun intended). Mastercard SpendingPulse figures show jewelry sales grew 83% in July 2021 vs. 2020, and 73.9% in August 2021 vs. 2020, but 2020 was of course a most unusual year. A better gauge of the strength of the category is the whopping 54% growth in jewelry sales recorded in July 2021 vs. 2019, and 58.9% in August 2021 vs. 2019, the last non-pandemic year available for comparison.

The Centurion's findings, above, track with Mastercard SpendingPulse: our 2021 Holiday Sales Success Index found that almost two-thirds of better jewelers experienced sales gains of more than 10% over last year for the first full week of the Christmas season following Thanksgiving weekend.

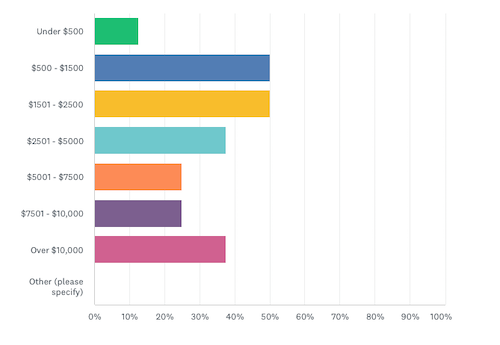

Best-selling price points for jewelers responding to the Centurion survey were between $500 and $2,500, and half of all respondents said their average tickets are coming in higher than last year. 50% said this year’s tickets are comparable to last year, but in an indicator of the market’s strength, more than one-third of respondents (37%) said items over $10,000 were selling briskly, and not one respondent observed a drop in their average holiday sale vs. 2020.

Best sellers so far this year: diamonds (both bridal and fashion), color, earrings, two-tone pieces, Rolex. Platinum also is on the increase.

Above: While jewelers are experiencing the strongest sales in price points between $500 and $2,500, a surprising number are doing well with goods over $10,000 as well. Figures from The Centurion 2021 Holiday Sales Success Index, Week One.

Mastercard SpendingPulse, meanwhile, also reports that in-store sales rebounded over the Thanksgiving weekend, increasing 16.5% year-on-year, with department stores a winning category at a 19% increase over last year.

E-commerce sales growth maintained a 4.9% year-on-year increase for the traditional Thanksgiving weekend (Black Friday, November 26 through Sunday, November 28). But Cyber Monday sales also rose 8.7% over last year. In general, luxury retail—jewelry and otherwise—is doing very well, likely benefiting from a continued diversion of cash from travel and experiential spending.

Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks Inc, said, “Coupled with a strong Thanksgiving weekend, retailers continue to see healthy consumer spending this holiday season.”

Figures from the National Retail Federation show a slightly different breakout. In a study with Prosper Analytics, NRF says 179.8 million consumers shopped in-store and online over the Thanksgiving weekend through Cyber Monday, compared to 186.4 million last year. That’s a slight drop year-on-year, but still exceeds NRF’s initial expectations by over 21 million, and NRF president and CEO Matthew Shay says it’s because consumers have started shopping earlier, not because they aren’t shopping.

“Retailers have adapted and enticed customers with a number of incentives throughout November. The Thanksgiving holiday weekend remains a significant time for friends and families to check specific holiday items off their lists,” said Shay. “Over the last few years consumers have shifted their holiday shopping plans to start earlier in the season.”

Foot traffic was up, said NRF. Black Friday remained the most popular day for in-store shopping, with 66.5 million shoppers, followed by 51 million shoppers on Small Business Saturday. The importance of supporting local businesses remained top of mind for many consumers, with 71% indicating they were shopping specifically for Small Business Saturday.

Black Friday still surpassed Cyber Monday in terms of total online shoppers, with 88 million shopping online Friday, compared with 77 million on Monday.