Articles and News

Industry News: AGS Names Circle Of Distinction Honorees: Platinum Prices Drop; More May 20, 2015 (0 comments)

AGS Announces 2015 Circle of Distinction Honorees

Las Vegas, NV—The American Gem Society will recognize three leaders in the jewelry industry at its annual Circle of Distinction dinner, set for July 28 at the historic Plaza Hotel in New York City.

John Green, CGA, president and CEO of Connecticut-based Lux, Bond & Green (left) will receive the Society’s Lifetime Achievement Award. The honor is given to individuals who have made significant contributions to the industry throughout their career.

Georgie Gleim, CG, of Palo Alto, CA-based Gleim the Jeweler, and Yancy Weinrich, senior vice president of JCK Shows, will each receive a Triple Zero Award, which is presented to members of the industry for their accomplishments and contributions.

“The Society is pleased to honor these three individuals,” said Ruth Batson, CEO of the American Gem Society and AGS Laboratories. “Each has made a significant contribution throughout their career and we are proud to recognize their accomplishments. John is one of our industry’s most respected leaders. Both Georgie and Yancy are vital members of the Society’s Board. Beyond her years of volunteer service to the Society, Georgie has been a mentor to many in our industry. Yancy, of course, has helped make JCK Events the powerhouse that it is today.”

The Circle of Distinction event will begin at 6:00pm with cocktails, followed by dinner and the awards presentation at 7:30pm. To order dinner tickets or to learn about advertising opportunities in the Circle of Distinction Tribute Book, contact Lauren Ruggeroli, (866) 805-6500 x1005, or email lruggeroli@ags.org.

Image: GIA

NCDIA Free Seminar on Green Diamonds: Zimbabwe and The Kimberly Process

New York, NY—The National Color Diamond Association is offering a free audio replay of an important seminar it hosted recently about green diamonds, Zimbabwe and the Kimberley Process. The session featured Tom Gelb, NCDIA director of education, and Cecilia Gardner, CEO of the Jewelers Vigilance Committee. Click here to participate.

Demand For Gold Jewelry Rises For Eighth Consecutive Quarter

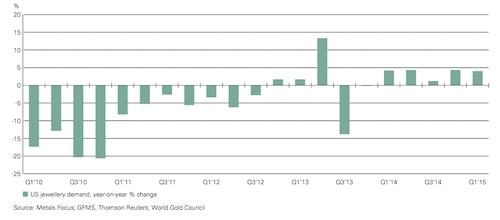

New York, NY—U.S. consumer demand for gold jewelry is edging up quarter by quarter, according to the World Gold Council’s first quarter Gold Demand Trends report. Although gold consumption was up in both the United States and India, it wasn’t enough to offset a soft global market, led by decline in China.

U.S. gold jewelry demand has increased in eight of the last 10 quarters, according to the Council. Its U.S. outlook for the remainder of 2015 is cautiously optimistic, as the import growth in Q1 came from inventory building within the jewelry trade.

While the U.S. economy is strong and household wealth is rising, consumers have a more conservative about spending [than prior to the recession], says the report. But value resonates: U.S. consumer preference is shifting to higher karat gold. Read more here and here.

Jewelers of America Offers Payment Processing Benefit for Members

New York, NY – Jewelers of America (JA) has finalized a new payment solutions and gift card membership benefit program through FIS Retail Payment Solutions, the world’s largest global provider of banking and payments technologies. Through the new membership benefit, JA members will receive discounted rates on everything they need to process non-cash payments. Among FIS Retail Payment Solutions cost-saving benefits are:

- Discounted rates on electronic check conversion to process checks like a credit card at lower cost

- Enhanced warranty coverage for fraud, forgery, stolen or NSF checks

- Discounts on the industry’s most robust, end-to-end credit/debit processing solutions

- No application fee, set up fee, item fee, transaction fee, annual fee or for credit card processing

- Pre-packaged and custom gift card programs that drive new and repeat retail traffic

“We know that check and credit card purchases are an essential part of jewelers’ businesses, and Jewelers of America members who take advantage of the exclusive discounts offered by FIS will find major cost savings,” says JA director of membership and sales Matthew Tratner. “FIS provides everything jewelers need to easily and efficiently process checks, credit cards and gift cards.”

For information, click here.

Investors Bearish On PT Group Metals; Jewelry Demand Up In USA

New York, NY—Reports from both Goldman Sachs and Thomson Reuters are bearish on platinum and palladium. Ahead of platinum week, which started Monday, Goldman Sachs cut its forecast for both platinum and palladium, while Thomson Reuters GFMS Platinum & Palladium Survey 2015 suggests the metal may see—or even break—the $1,000 an ounce barrier. But either scenario would be only temporary, says GFMS, while Goldman predicts prices to settle around $1,175 per troy ounce.

Key highlights from the GFMS Platinum and Palladium Survey:

Platinum mine production fell sharply in 2014, by 21%, to at least a 15‑year low of 4.70 Moz (146.1 t). The decline was almost entirely due to significant strike action in South Africa, which led to the idling of 60% of the South African industry for a period of 22 weeks. While this was a disastrous year for South Africa in terms of platinum output levels, it could have been worse at the level of corporate profitability, given the knock on effect of the strike on producer costs and continuing strong labor cost inflation. Substantial benefit did come, however, from the 13% depreciation of the rand against the dollar, but costs in South Africa grew by 5% last year.

Platinum jewelry fabrication retreated for the first time in three years, slipping by 3% to an estimated 2.57 Moz (79.9 t). The decline came mainly from the two largest markets, China and Japan, where the market contracted by 5% and 2%, respectively. Both fell in concert with a weaker domestic economy, which curtailed consumer sentiment and discretionary spending. European demand dropped by 3% as a weak economy and limited marketing for platinum jewelry impacted sales. But by contrast, platinum jewelry demand in North America increased by 3%, benefiting from a more robust economy and lower prices that saw domestic consumption enjoy a healthy rise.

Jewelry scrap return rose by 5% in 2014 to 0.52 Moz (16.1 t) despite the near $100 drop in the platinum price. A 7% rise in China coupled with a 4% increase in Japan accounted for the bulk of the gain. North American jewelry scrap retreated by 8% as consumers held out for higher prices.

Mine production of palladium posted a more robust outcome than platinum, yet nevertheless fell by 7%, to total 6.04 Moz (187.8 t), a 12‑year low. Again the main driver was heavy strike-related losses in South Africa, although the decline there was dampened somewhat by a shift in mined ore mineralogy to more palladium rich sources at the expense of platinum. Russian production provided a partial offset, growing by 3% due to the release of in-process palladium inventory, while production in Zimbabwe also grew by 3%.

Palladium jewelry demand fell for the sixth consecutive year, by 9%, to 0.47 Moz (14.7 t), the lowest level since 2004. This was mostly due to China with a drop of 16%, although this was the smallest fall since 2009. Jewelry scrap supply rose by 8% to 0.25 Moz (7.7 t) in 2014, falling just short of the 2011 record. China continued to dominate (at almost 80% of the total) and registered a 9% rise, with higher prices and supply chain de‑stocking accounting for the bulk of the rise.