Articles and News

Industry News: JBT’s COVID Strategy; Plumb Club Webinar; Diamantaires Bolt From Rap; More April 07, 2020 (0 comments)

JBT To Take Pandemic Into Account In Credit Ratings

Warwick, RI—As business has ground to a standstill during the coronavirus pandemic, jewelers are understandably worried about the ramifications to their credit ratings as well as their bottom lines.

The Jewelers Board of Trade has been hashing out policies to address their concerns.

“We have spent the past two weeks consulting with our membership, our management, and our listed firms on how to manage credit information during this crisis,” says JBT president Erich Jacobs, left. “To be honest, some of the discussions have been pretty heated, reflecting both the concern and the passion for industry survival from all of the participants. As you would expect, the opinions ranged from "Don't change a thing" to "Freeze everything until this is over" and everything in between.”

But, says Jacobs, nobody has the answer as to when the economic crisis will bottom out and what the recovery will look like. Changing JBT’s entire methodology to suit the crisis is not a viable option—but adding context to account for the crisis is important.

“We recognize that every jewelry firm has been adversely impacted by this crisis, and to give large numbers of firms a low rating because the economic supply chain is broken isn't particularly helpful for either the rated company or the JBT member extending credit. What is needed is additional context,” he says.

“In that regard, in addition to the rating using our normal methodology, we will be including in every JBT Credit Report the rating of the listing as it stood prior to the COVID-19 crisis. If a firm was highly rated prior to the crisis, that will be visible to the JBT member. By the same token, if the firm had a low rating prior to the crisis, that will also be visible. We believe this approach balances both fairness and accuracy, while providing the greatest amount of data transparency.”

In this way, JBT can provide the most accurate information regarding store closings, changes in financial position, and overall changes in operations, which also will make it easier to determine both the economic bottom and the upward slope of the recovery when it happens.

“With a solid pre-COVID-19 baseline to work from, maintaining our current methodology will help everyone comprehend the scale and speed of the eventual upswing. As part of that strategy, we are asking our members to continue to submit their data as they have before the crisis without modification. We will also be asking our members to highlight if any special terms or extensions were granted so that our aggregated data isn't unintentionally skewed by unanticipated member credit modifications,” he says.

For firms worried about updating their own information once the recovery is under way, JBT is in the process of building a web-based solution for any jewelry business owner to claim their own listing, provide updated information, and their latest trade references.

“These are obviously challenging times for everyone. At JBT, our goal is to provide the best and most transparent business data possible, which we hope will help everyone in the jewelry industry, navigate successfully out of this ditch. In the meantime, it is our sincerest wish that everyone remain healthy and safe. Together, we will get through this,” said Jacobs.

He encourages the industry to submit their thoughts. Visit www.jewelersboard.com, email jbtinfo@jewelersboard.com, or call 401-467-0055.

Rap Goes Monthly As Hundreds Of Diamond Traders Bolt To New Platforms

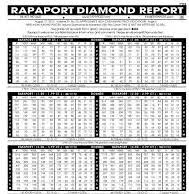

Ramat Gan, Israel—Rapaport’s famous weekly diamond price sheet (left) will become a monthly publication, but with potentially many fewer subscribers.

Rapaport’s March 20 sheet listed massive price drops in all but a few diamond categories, sparking outrage from the trade. Publisher Martin Rapaport said the sheet reflected market realities; the trade said it’s impossible to have market realities when there is no market at all.

Related: Facing Major Industry Blowback, Rapaport May Suspend Diamond Price List

In response, hundreds of international diamond manufacturers and traders came together in search of a new independent, transparent, third-party-operated polished diamond trading and buying platform. Rapaport, meanwhile, acknowledged the blowback by agreeing to hold off on a new sheet until May 1 and subsequently announced it will go to a monthly format from then on, “giving the industry time to react” to changes.

But by then the pitchforks were already out.

The World Federation of Diamond Bourses (WFDB) responded by announcing a state-of-the-art “cross-bourse” trading platform, www.get-diamonds.com, is under development and will soon be available for the diamond industry and trade at large.

In the meantime, the angry traders have announced that they will use the March 6 Rap sheet as a reference point for prices until the new platform is ready.

The hundreds of diamantaires clamoring for an alternative trading platform come from all the major diamond trading hubs: Mumbai, Antwerp, Tel Aviv, New York, and Dubai. Apart from their grievances about the Rapaport list, they argued the current slow trade of polished diamonds is the direct result of the crippling effects of sovereign nations under total lockdown, not from supply and demand fundamentals. Therefore, they argued, the latest polished diamond prices published by Rapaport do not reflect trading prices in the global wholesale diamond market.

As for their grievances about Rapaport’s list in general, the traders say it operates in non-transparent manner, dictating polished diamond prices upwards or downwards without offering any guidance or explaining the rationale or mechanism that lies behind its upward or downward revisions.

Plumb Club Hosts Online Roundtable For Navigating Financial, Legal, and HR Landscape; Launches Podcast Series

New York, NY—The Plumb Club on Tuesday hosted a webinar aimed at helping retailers traverse the financial, legal, and personnel issues that many may be facing during the COVID-19 outbreak.

The Plumb Club’s panel of leaders from the financial, legal, and banking sectors each gave a three to five minute synopsis on their area of expertise and spent the remainder of the hour-long session addressing attendees’ specific questions in real-time.

The webinar, moderated by Lawrence Hess, executive director of The Plumb Club, featured these experts:

Howard Hoff, CPA, GCMA, Marks Paneth LLP, has more than 25 years of experience in accounting and consulting to his position as the partner-in-charge of the Commercial Business Group at Marks Paneth LLP. In this capacity, he provides a broad range of services to a diverse client base and is recognized for his expertise in the jewelry and apparel industries. He addressed questions about the government CARES Act, IRS extensions, employment issues, refunds and other business challenges.

Laurence S. Tauber, Founding Partner, Cohen Tauber Spievack & Wagner PChas practiced corporate, business, real estate, and commercial law for 30 years. A trusted advisor to executives, business owners, and in-house attorneys, Tauber has business experience and perspective that has become a valuable resource for clients. He offered insight on a wide range of legal issues, with a focus on lease issues and employment law.

Erik A. Jens, CEO of LuxuryFintech.com, brings a wealth of knowledge in commercial and corporate banking solutions, as well as expertise in human resources, operations, technology, and legal areas. Before heading up his own firm he was the CEO for diamond and jewelry clients with ABN AMRO Bank, offering commercial banking products to the diamond and jewelry industry. He discussed how to best work with your bank on current loans, manage a line of credit, restructure debt, and other types of loans that may be available beyond government loans.

“We know that there has been a lot of information recently provided by industry resources”, said Michael Lerche, President of The Plumb Club. “However, we are also hearing from retailers that there are still many unanswered questions. We are hoping to give retailers a chance to ask these questions directly to the people who may be able to provide answers.”

Participation was open to all retailers, and the session was recorded. For information about listening to it, visit www.plumbclub.com

Separately, the organization announces a new series of podcasts to provide retailers with information and insights across a variety of disciplines. The subjects, which will be introduced monthly, will cover a group of business topics and consumer insights, supplying retailers with knowledge and immediately actionable steps that they can use to impact their business. The Plumb Club chose now to release the series as many retailers are using this time to learn about how they can make their retail stores stronger once business resumes.

The first two podcasts are available now and are focused on the bridal category, often the point of entry for many jewelry retailers. Hosts are Severine Ferrari, editor-in-chief and founder of Engagement 101, the first consumer platform dedicated to proposal planning. She will discuss “The New Bridal Consumer – How You Can Best Help!” In this podcast she reveals the newest consumer trends in the engagement ring market, such as “starter" engagement rings, alternative center stones, and changing gender norms. Further, she provides insights on the new consumer and how a retailer must shift their thinking to use affirming and inclusive language to help win consumer confidence and make the sale.

Severine Ferrari, left, and Kevin Reilly, right

Kevin Reilly, vice president of Platinum Guild International USA hosts “Cracking The Code on Customer Experience With Platinum.” This podcast talks about consumer perceptions of jewelry stores and how to change the perception with memorable and fun experiences. Reilly explains how to reach and communicate with today’s consumer and underscores how having platinum in a retail merchandising mix helps deliver consumer satisfaction. He describes how to end the “catch and release cycle” to build customer loyalty, as well as the benefits of presenting platinum to consumers, along with language to help illustrate the benefits.

“We are happy to launch this new series,” said Lawrence Hess, executive director of The Plumb Club. “Part of our organization’s mission is to positively impact the industry via education. These podcasts were designed to provide needed insights, information and tools that retailers

can easily and effectively use to help grow their business.”

ICA Launches Ethical Member Accreditation Program

New York, NY—The International Colored Gemstone Association (ICA) announces the launch of its Accredited Ethical Member program (AEM), an online questionnaire which, upon completion, will recognize ICA members for responsible, ethical and sustainable trading practices in accordance with ICA's mission to provide greater consumer confidence. The AEM is an educational tool promoting best practices amongst ICA members to both improve consumer confidence and enhance industry good-will.

To create the AEM, ICA has worked closely for several years with the American Gem Trade Association (AGTA) and The World Jewellery Confederation (CIBJO), developing strategies to continuously improve how colored gemstones are traded.The accreditation program was designed exclusively for ICA members as a practical self-audit and a voluntary pledge on responsible sourcing.

The program is also a stimulus for continuous improvement. "It is intended that ICA members who undertake this accreditation process will understand more fully their duty of care within the gem and jewelry supply chain and improve the practices within their organization," says Damien Cody of Cody Opal, Melbourne Australia, and chair of the AEM program.

The AEM consists of a series of steps containing key ICA and industry objectives around responsible sourcing: the ICA Code of Ethics, Duties of Disclosure, and CIBJO's Responsible Sourcing Book. Upon submission and satisfactory completion, ICA grants the member status of Accredited Ethical Member (AEM) and provides holographic AEM seals for sales dockets and invoices as evidence of the AEM accreditation.

ICA CEO Gary Roskin says members who complete the online accreditation will now be listed as such in ICA's online membership directory. To maintain the AEM status, members will need to undertake the accreditation online each year and be a member in good standing.