Articles and News

Industry News: Venture Capital Group Eyes Jewelry Lending Gap; Pinterest To Add Buy Button; More June 03, 2015 (0 comments)

Venture Capital Group Seeks To Fill Lending Gap In Diamond And Jewelry Wholesale Sector

New York, NY—Excelsior Capital Ventures, LLC, founded by industry leader Nehal Modi, is in the process of a significant capital raise targeted solely for deployment in the diamond and jewelry manufacturing and wholesaling sectors. ECV will seek to close a $5 billion lending gap by providing loans securitized by diamond and precious metal inventories. The Excelsior platform allows for a host of lending solutions that are tailor made to the borrower’s requirements.

In an environment where the diamond and jewelry industry is seeing a significant decline in lending and access to capital, ECV’s business model is built around an ecosystem that encompasses secure asset management, risk mitigated logistics, spot market appraisals, asset monetization, and assisted marketing solutions for customers’ inventory.

According to ECV chairman David Barr, “Excelsior will fill a capital void, but simultaneously be a catalyst for clients’ business growth. We are extremely excited about being a part of the solution to allow diamond and jewelry wholesalers to once again fund their growth.”

ECV CEO Nehal Modi added, “The industry is at a critical juncture where all stakeholders have to adapt to the ever-changing landscape. In that regard, companies must re-evaluate their capital structures, systems, and willingness to demonstrate transparency to lenders. Excelsior can greatly assist clients with all three of these goals.”

Top industry manufacturers commented positively on Excelsior’s asset-based lending model. “It’s a game changer for sure. The industry needs the liquidity, but more importantly the innovative integrated lending solution that Excelsior brings to the table,” said Greg Sofiev, CEO of LLD Diamonds USA, a Leviev group company.

Excelsior has engaged investment-banking firm Consensus (www.consensusadvisors.com), to advise on the capital raise and structure of any future transactions. Michael O’Hara, CEO of Consensus, commented that the jewelry industry is experiencing a shortfall of liquidity and a model such as Excelsior will be well received by the industry. “We expect that the vehicle Excelsior is creating will be welcomed by sources of capital who recognize the need for liquidity in the jewelry industry but who have had structural concerns about lending to the asset class. Excelsior’s model is both unique and innovative and will remove the sector’s historical barriers to capital formation.”

Excelsior executives met with top current industry lenders and potential clients in Las Vegas to help them better understand the ECV finance offering. ECV anticipates funding loans prior to the 2015 Holiday season.

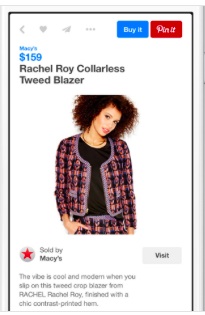

Pinterest To Add "Buy-It" Button

Merrick, NY--Jewelers active on the predominantly-female social media site Pinterest may soon be able to seize the moment of impulse and make an instant sale as a customer is pinning something she likes to her board. The site announced it will add "buy it" buttons and will not take a cut of the sale. According to a report in JCK, payments will be processed through Apple Pay or other online methods, and at present the capability is limited to retailers using certain software platforms. But plans are in the works to expand outside those parameters. Learn more here.

A sample of an image with the "Buy It" button. Image: Pinterest

NAJA Announces Mid-Year Conference

New York, NY—The National Association of Jewelry Appraisers (NAJA) announces its 44th Annual Mid-Year ACE It Education Conference will be held August 8-11 in Washington, D.C.. NAJA is the appraisal organization dedicated exclusively to gems and jewelry. Sessions and speaker schedule includes:

Saturday, August 8:

- How Different Styles of Lab Reports Influence the Gem Market Cigdem Lüle, GIA GG

- How to Look Like a Clever Jewelry Expert Duncan Parker, FGA

- Around the World in 60 Minutes! One Hallmark at a Time William Whetstone and Danusia Niklewicz, GIA GG

- Imperial Russian Counterfeits & Other Forged Hallmarks William Whetstone and Danusia Niklewicz, GIA GG

Sunday, August 9:

- Understanding and Evaluating Chinese Jade, Eric Hoffman

- To Curl or not to Curl/ Art Nouveau vs. Arts & Crafts Jewelry Elyse Karlin

- Secrets of the Vintage Watch World Gary Lester, GIA GG

- Appraising Emerald and Tourmaline: New Developments in Clarity Enhancement Arthur Groom, GIA GG

Monday, August 10:

- An Overview of The Appraisal Foundation and its Activities in Personal Property David Bunton

- Estate Jewelry in Today's Market Gloria Lieberman

- The Gift and the Estate Tax for Appraisers Theresa Melchiorre

- Buy/Sell/Appraise Gems with Confidence Art Samuels, GIA GG

Tuesday, August 11:

- The Care and Feeding of Clients Deborah Finleon, GIA GG

- Appraising - From the Essentials into the Nonsense Dave Atlas, GIA GG

- Contracts & Agreements: Can’t Live With ‘Em, Can’t Live Without ‘Em Martin Fuller, GIA GG

Click here for a conference brochure or contact Gail Brett Levine, GG, executive director, (718) 896-1536, naja.appraisers@netzero.net.