Articles and News

LUXURY JEWELERS SPARKLE IN GRIM HOLIDAY SEASON | January 02, 2013 (0 comments)

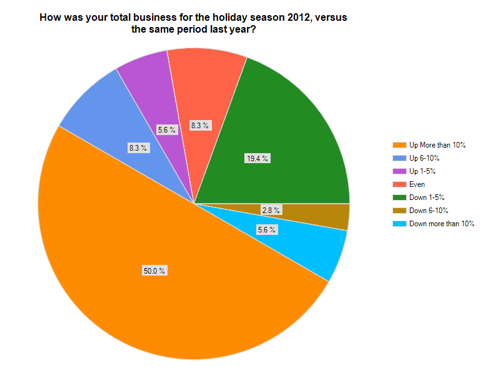

Merrick, NY—'Twas the season to be a prestige jeweler. According to The Centurion’s exclusive 2012 Holiday Sales Success Index, fully half of total respondents saw their total sales for the holiday season jump 10% or more over last year, making the category one of the few--if not the only--bright spots in a season most other retailers can only compare to getting a lump of coal in their stocking.

The number of Centurion respondents whose business grew at least 10% also increased from last year’s survey: 40.9% of respondents in 2011 had gains of more than 10% over the previous year, compared to this year’s 50% who said their business grew more than 10% during the holiday season. But the total number of respondents who reported any kind of growth in holiday sales over the previous year declined from 77.3% last year to 64.7% this year, and the number of respondents who reported total year sales growth also declined.

But the luxury jewelry sector wasn’t entirely immune from the greater holiday malaise. The number of Centurion survey respondents who saw a decline in sales for the holiday season also grew slightly from last year. In 2011, 18.1% of respondents said their holiday sales had declined compared to 2010; in 2012, 26.4% saw a decline. Most of those were slight declines, between 1% and 5% off last year’s totals, but a small percentage (2.9%) saw sales drop more than 10%, compared with no drops that significant last year.

Fully half of all respondents to the Centurion survey reported sales gains of 10% or more during the 2012 holiday season, vs. 2011 (orange slice). 13.9% reported smaller gains (blue and purple slices), while 8.3% stayed even. Of the group who witnessed a decline in sales for the season (green, tan, and aqua slices), it was greater than last year's total, but the majority experienced only slight declines between 1% and 5% for the season vs. last year's holiday.

In the broader retail picture, expectations going into the season were tempered: most predictions already suggested sales growth would slow from 2010 and 2011 figures, but the National Retail Federation’s estimate still targeted 4.1% growth over last year. The International Council of Shopping Centers had predicted 3% growth. Estimates for growth in luxury jewelry sales also were modest going into the season.

But as anyone who has ever remodeled a home or fixed a car knows, estimates are only educated guesses, not guarantees. At season’s end, sales growth for retail overall (excluding automobiles and food) came in flat to 3%, which was well below NRF’s predictions and on the very low end of ICSC’s. Though there was growth—not a decline—it was the lowest level of growth seen since the 2008 financial crisis, when sales did decline from the previous season. As a result, despite better inventory management, many retailers still found themselves in the position of having to host fire sale discounts after the holiday to get rid of Christmas merchandise.

But luxury fine jewelry—which many point to as the epitome of a nonessential purchase—hugely surpassed other catgories this season, while according to figures from IDEX research, the entire fine jewelry category (both luxury and non) outperformed for holiday, with a predicted 4% gain in sales. But the Centurion survey shows luxury jewelers still beat that figure handily.

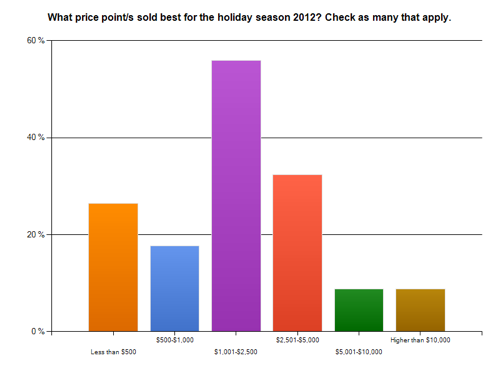

In an article in Women’s Wear Daily, Kelly Golden, owner of the upscale Neopolitan Collection in Chicago, said customers responded very well to trunk shows and jewelry from such luxury designers as Irene Neuwirth and Kimberly McDonald among others, and felt customers were once again willing to treat both themselves and significant others. While Golden said the price points of her tickets were up this year, the Centurion survey shows the best-selling price points relatively unchanged from last year.

As with the 2011 holiday season, the majority (54.3%) of respondents to the Centurion 2012 Holiday Sales Success Index said their best-selling price points of the season fell between $1,001 and $2,500 (purple bar). The next most popular price range for Centurion jewelers was between $2,501 and $5,000 (red bar), followed by low-end purchases under $500 (orange bar), and pieces between $500 and $1,000 (blue bar). 11.4% said their best-selling price points of the season were over $10,000 (tan bar), while 8.6% said their most popular price point was in the high four digits, between $5,001 and $10,000 (green bar).

The Centurion also asked respondents to name their biggest sale of the season. Many cited five-digit sales, such as a $72,000 Art Deco diamond ring, several Rolexes in the five-digit range, and a $27,000 Todd Reed ring and a $35,000 Pamela Froman piece. The jeweler who sold those is actually a clothing boutique with a fine jewelry department, and between female self-purchasers and male gift buyers bearing wish lists, this lucky retailer saw a 35% increase over last year’s holiday and racked up close to $1,000,000 in sales for the season.

There also were several who cited six-digit sales, such as a 3.0 ct. Hearts On Fire diamond for $100,000, a custom necklace for $150,000, another $135,000 ring, a 10-ct. diamond ring and, among others, one respondent who cited a single sale of 15 pieces that totaled more than $250,000 when all were rung up.

Ironically, the grim general retail results come amid some of the most positive signs of economic growth and recovery we’ve seen since the recession began. The jobs picture is improving, home values are rising, consumer confidence had been growing in the months leading up to December, and the economy continues to show encouraging news. But Hurricane Sandy affected sales in the heavily populated Northeast—New York and New Jersey alone account for 13% of all retail sales, says economist Diane Swonk of Mesirow Financial in an NPR report—while fears of the fiscal cliff and possible higher taxes spurred consumers nationwide toward caution in their holiday spending. Crawford Brock, owner of the Stanley Korshak, a luxury retailer from Dallas, TX, told Women’s Wear Daily in December he fears an unresolved fiscal cliff could shut down business in January. (Editor’s note: His comments were made prior to the 11th-hour deal reached in Congress January 1.) Several Centurion respondents alluded to the fiscal cliff in their survey comments. Wrote one, “A strong early start with a stutter near the end, probably the fiscal cliff uncertainty.”

Wrote another, “Sandy and the fiscal cliff, Pandora was even and gold buying was down.” Yet another said his store had a huge increase in 2011 and he stayed just about even this year with a negligible decline of less than 1%. He wrote, “We were happy despite all the looming news of the fiscal cliff, which impacts my customer.”

The additional two shopping days between Thanksgiving and Christmas, rather than boosting sales as many had hoped, instead only served to reduce the urgency to shop, said many experts. The result was a barbell season: heavy activity at the beginning over Black Friday weekend and at the end just before Christmas, with a prolonged lull in between.

Finally, the horrific Dec. 14 school shooting in Connecticut, while not responsible for the overall season’s disappointments, was cited by experts as both an additional distraction and adding to consumers’ somber moods.

Read more analysis from Reuters, NPR, Women’s Wear Daily, National Jeweler, IDEX, and JCK.

Next week: The holiday season's best sellers and best marketing strategies for prestige jewelers.