Articles and News

Market Fundamentals Support Long-Term Diamond Sales, But Who Buys And Where In Flux | September 22, 2015 (0 comments)

London, UK—Despite grave concern over consumer demand for diamonds, sales still are growing, says the latest Diamond Insight Report from De Beers. The report, released Monday, shows global diamond jewelry demand rose 3% to more than U.S. $80 billion in 2014, the fifth consecutive year of growth since the recession. But global rough diamond production rose twice as fast as demand: 6%, to $19 billion. De Beers and ALROSA of Russia remained the largest sellers of rough diamonds in 2014, accounting for 56% of global sales by value between them. By value, the top producing nations are Russia and Botswana.

Consumer demand in 2014 grew in each of the top five diamond consuming markets: the United States, China, Japan, India, and the Gulf states. These five markets account for 75% of total demand. The United States led the way, with 7% growth year-on-year. The strength of the U.S. dollar suppressed further global growth, which at constant exchange rates amounted to almost 5%, says the report. In local currencies, demand in China grew 6% and demand in India, 3%.

While rough diamond production value increased in 2014, volume actually decreased 3%, to 142 million carats. Rough diamond demand is likely to remain lower in 2015, as stagnant inventory mid- and downstream need to work through the system.

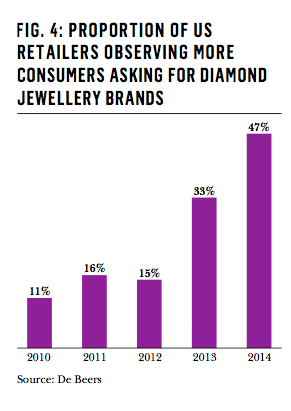

The report highlights three key trends, first of which is that consumers across the world are increasingly choosing branded diamond jewelry for product differentiation, distinctive design, authenticity, and quality. This is most prevalent in the United States, where four in five retailers stock brands, but developing markets are also seeing increased sales of branded jewelry as consumers seek the greater reassurance offered by brands.

The incidence of consumers asking for branded diamond jewelry has increased more than four-fold in four years, according to De Beers research.

Second, the number of jewelry shops in developing Asian markets increased again last year (albeit at a slower rate), but the total number in more mature markets—especially in the United States—saw an overall reduction. In the United States, a noteworthy finding is that independent jewelers and chain stores now carry roughly equal shares of the diamond market--each about one-third--although independent jewelers are slightly higher at 35% and chain stores are slightly lower at 31%. But the chain store gain comes at the expense of independent jewelry stores, the number of which continues to decline in the United States. (Editor's note: these figures cover all independent jewelers, not only luxury stores.)

Figures from De Beers research show that diamond sales in independent jeweler doors grew 2% from 2007 to 2015 (top bars, dark purple) but they ceded share of market to large chains in that same period (bottom bars, light purple).

Third, online sales in both developed and developing markets continue to rise. The report estimates between 7% and 13% of total diamond sales occur via online channels. Not surprisingly, online research is a factor in almost 100% of sales, even if the final purchase is at a brick-and-mortar location.

The report also found great cause for optimism in India. The growing economy and emerging middle class present a great opportunity for diamond sales. A widening consumer base, economic development, and increasing volume together have given India’s consumer diamond market 20 years of uninterrupted growth, and the retail landscape there is changing significantly with the rise of retail chains, online sales, and brands. Additionally, as affluence continues to grow, 75 million new Indian households are expected to see their incomes grow enough to support diamond purchases. Affluent and super-affluent households in India are expected to quadruple to more than three million households by 2024.

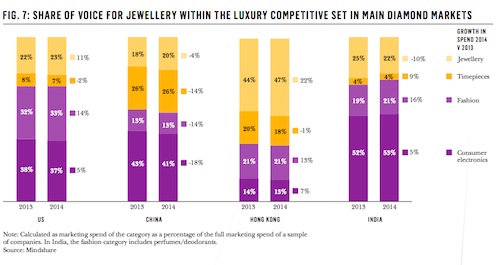

Demand in 2015 is expected to remain even with 2014. Philippe Mellier, CEO of De Beers, acknowledged the existing challenges to the market but believes those to be short-term, with excellent long-term prospects for the diamond jewelry market. One of those challenges--a lack of generic diamond advertising in the last decade--is something De Beers is looking to correct, having announced it will relaunch a generic diamond advertising program for holiday 2015, as well as amp up advertising for its own Forevermark brand.

The two bars at left show the relationship of jewelry advertising spend to other luxury categories in the United States. Jewelry (pale yellow) lags behind both electronics and fashion. When combined with ad spend for luxury timepieces, the gap narrows, but still lags behind both other categories. Source: Mindshare via De Beers.

“The industry has excellent prospects. The long-term trend for demand has been positive, with consistent growth in demand for diamond jewelry since the 2008-2009 financial crisis,” he said.

The executive summary of the Diamond Insight Report can be found here.

Separately, new research from jewelry analyst Edahn Golan finds the sweet spot age for U.S. jewelry consumers is between 35-54—mainly the Gen-X consumer. This is the oft-forgotten group of consumers who came between the Boomers and the Millennials—usually overlooked because there are about 10% fewer of them than either of the massive cohorts they’re sandwiched between.

Industry analyst Edahn Golan

But Golan’s research has found that while the worrying trend of declining fine jewelry sales in the United States continues, two groups of consumers that increased their spending on fine jewelry were, first, those age 45-54, who spent 76% more on fine jewelry in 2014 than in 2013, and second, those age 35-44, who spent 36% more. The first group encompasses mostly Gen-X consumers (born 1965-1979), but also a few tail end Boomers who are still in their early 50s. The entire Baby Boom generation spans 1946-1964; of this cohort, the prime jewelry buyers are currently age 51- 54.

The second group, whose fine jewelry expenditures jumped 36% in 2014 over 2013, again encompasses mostly Gen-X consumers, but also taps a very few of the first Millennials, who are just entering their peak affluence years.

By income, the highest increase in fine jewelry spending was among low-income consumers (suggesting they are not luxury-store shoppers) but the second highest increases came from consumers who would be prime targets for luxury jewelers: the well-off group earning above $150k, and the entry-affluence group earning between $120k and $150k. Read Golan’s full analysis here.

Golan's findings dovetail with that of luxury market researcher Pam Danziger of Stevens, PA-based Unity Marketing. Danziger maintains the strength of the luxury market lies with the consumer she nicknamed “HENRY,” an acronym for High Earner Not Rich Yet.

The HENRY demographic encompasses both of the key jewelry-buying cohorts, and includes consumers earning up to $250k, the baseline for ultra-affluence. While these consumers may spend less individually than their ultra-affluent peers, together they represent a much greater potential for luxury retailers.

Danziger also says that while luxury marketers tend to target middle-age women as their best prospects, young HENRY men on a career path that will lead to ultra-affluence are great prospects, eager to show their status as they climb the ladder to success. But their status symbols aren’t the same as their fathers’ or grandfathers’ were, she cautions. This is a consumer who will choose symbols that represent who he is, what his values are, and what “tribe” he belongs to. For example, he may choose a Mini Cooper over a Mercedes, a Triathlon watch over a Rolex, or a Shinola messenger bag over Louis Vuitton.

More information about this consumer can be found in Danziger’s new book, What Do HENRYs Want?