Articles and News

MasterCard: Jewelry Sector Was One Of Retail’s Biggest Growth Categories In May June 21, 2021 (0 comments)

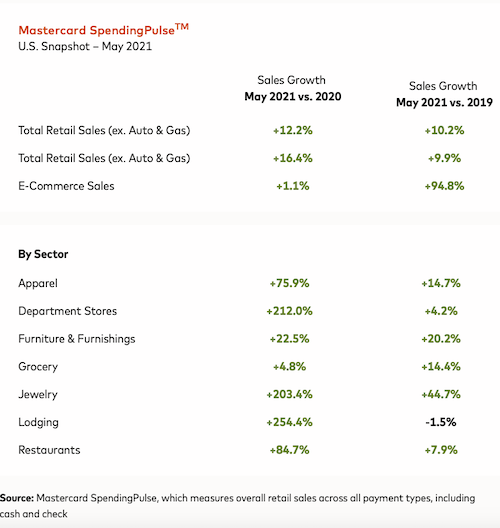

Purchase, NY—Jewelry sales rocketed more than 203% in May 2021, vs. 2020, says the latest retail spending report from MasterCard SpendingPulse, which measures overall retail sales across all payment types, including cash and check.

That puts jewelry in third place behind only lodging (+254.4%) and department stores (+212%) for May 2021 over 2020. Both the other categories were very hard hit during the pandemic, as few people traveled and department stores in many parts of the country were closed for weeks. Jewelry, meanwhile, has weathered the pandemic quite well.

But more importantly, jewelry led the way in growth over 2019 figures for the month of May. SpendingPulse says the category grew 44.7% over May 2019 sales, a more realistic “business as usual” comparison. That’s a resounding jump and more than double the next-highest growth category of home furnishings, which saw a 20.2% jump over 2019—but only a 22.5% jump over 2020. Neither department stores nor lodging fared as well in that comparison: department stores edged up 4.2% over May 2019, while lodging is still down 1.5% compared to May 2019.

Restaurants and apparel also both are coming back. Both categories saw significant growth over 2020 and modest to solid growth over 2019.

In the broader retail picture, May marks the eighth consecutive month of total retail sales growth. Mastercard SpendingPulse says U.S. retail sales (excluding automobiles and gasoline) increased 12.2% year-over-year in May, and 10.2% compared to May 2019. Online sales in May grew 1.1% and 94.8% respectively, compared to the same periods.

Looking ahead, SpendingPulse is anticipating a robust “back-to-school” season which, while not a direct boost to jewelers, is one barometer used to predict the holiday season. Consumers’ willingness to spend during back-to-school often foreshadows their willingness to spend for holiday gifts.

“Back to school has always been a prime season for retailers. This year, the broader reopening brings an exciting wave of optimism as children prepare for another school year, and the grown-ups in their lives approach a similar ‘return to office’ scenario,” said Steve Sadove, senior advisor for Mastercard and former CEO and Chairman of Saks Incorporated. “This back-to-school season will be defined by choice as online sales remain robust, brick and mortar browsing regains momentum and strong promotions help retailers compete for shoppers' wallets.”

More from SpendingPulse:

As the broader U.S. reopening occurs and consumers return to brick and mortar, we anticipate e-commerce sales will ease slightly compared to last year (-6.6%) but will remain up a significant amount (+53.2%) when compared to 2019. In terms of what consumers are buying this back-to-school season, we anticipate the following retail trends:

- Apparel Refresh: While athleisure was the fashion statement of 2020, this year brings the diversification of the wardrobe as in-person schooling, reunions and other events drive consumers to make their social debuts in style. Apparel is expected to grow 78.2% YOY / 11.3% YO2Y.

- Department Store Shopping Returns: Department Stores, outdoor shopping centers and malls offer a fresh change of scenery for shoppers. We forecast a 25.3% YOY / 9.5% YO2Y increase in the Department Store sector as they rebound from last year’s dip in foot traffic. Buy online, pick-up in store as well as technologies such as contactless will remain important as consumers continue to seek low-contact experiences.

- Tech Upgrade: If we learned one thing this past year, it’s that technology keeps us connected. With many states and schools determining the virtual/in-person cadence, we anticipate Electronics will be up 13.0% YOY / 9.6% YO2Y.