Articles and News

MINE UNREST SPIKES GOLD AND PLATINUM PRICES, BUT LONG-TERM INCREASES ALSO LIKELY | September 12, 2012 (0 comments)

Johannesburg, South Africa—Both gold and platinum prices spiked last week in the wake of recent strikes at multiple mines in South Africa, but experts in the field predict these spikes are just the beginning of a long-term rise in price for both metals.

15,000 workers at Gold Fields International’s KDC mine walked off the job Monday, just days after 12,000 workers in another section of the mine ended a weeklong walkout. The key sticking point for the gold miners is pay; the workers are asking for their monthly wages to be doubled to 12,500 rand ($1,533), according to this article in The Telegraph. Gold prices jumped 2.3% in the wake of the walkout; at press time the spot price was $1,730—the first time the metal has topped $1,700 since March of this year.

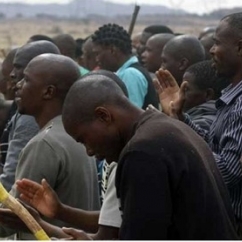

The gold strikes come on the heels of violent clashes between workers and South African police during a mid-August wildcat strike at the Marikana platinum mine, about 60 miles northwest of Johannesburg. 34 miners were shot dead by police in the four-week walkout, which is still not fully settled. A total of 42 miners and two policemen now have died since that strike began.

The Marikana violence stems from both pay and from a series of disputes between two rival unions in the platinum mining sector. The dominant National Union of Mineworkers (NUM) is being challenged by a newer and more militant organization, the Association of Mineworkers and Construction Union (AMCU).

Mining company Lonmin, which owns the Marikana mine and is the world’s third-largest platinum producer, halted production at all of its operations in South Africa during the violence. Platinum prices rose 2% in the wake of the violence, and at press time was trading at $1600, up from the low- to mid-$1400 range where it’s been trading from mid-May through mid-August.

The Telegraph reported on September 6 that all but two of the unions had signed a peace accord with Lonmin, but as of Monday, only 6.3% of workers had returned to their jobs, according to this report on miningmx.com. AMCU was one of the unions that did not sign, claiming that the mining company was interested only in restarting production and has no intention of addressing the miners’ wage demands, and that the NUM will just give in without securing the workers’ wage increase. Like the gold miners, the platinum miners also want 12,500 rand per month.

But strikes aside, both platinum and palladium are facing upward price pressure in the long term, says Michael Jones, CEO of Platinum Group Metals for Kitco. Labor issues such as these, as well as production costs, will drive prices up, he says, and may drive smaller producers out of the market. While Jones, speaking during the Gold Forum in Denver this week, declined to comment about any price specifics, he said the current prices really aren’t making money for the producers, and that will have to change. Watch Kitco.com’s video interview with Jones here.

Gold, too, is likely to increase long term. Brent Cook, editor of Exploration Insights, says there just aren’t enough quality deposits, and as a result the decline in supply will push prices up. Watch his interview here. Meanwhile, Richard O’Brien, CEO of Newmont Mining, the world’s number-two gold producer, told participants at the Denver Gold Forum that it’s not unreasonable to think gold will hit $2,000 soon.

Separately, Reuters reports the first ATM dispensing gold bars has been installed in the Westin Palace Hotel in Madrid, Spain. For as little as 40 euros (about US $53), guests can purchase gold bars in amounts of one, five or 10 grams. The gold price is constantly updated, and the machine—sort of a cross between an ATM and a vending machine—delivers the ingots in neat presentation boxes.

The gold ATM, left, dispenses gold bars in one, five, or 10 gram sizes. At right is a closeup of the display window shown in the middle on left.

A similar machine, below, was on display at Borsheim’s in Omaha, NE, during the annual Berkshire Hathaway shareholder’s meeting held in early May. That kiosk, a prototype for Berkshire Hathaway’s Richline division, dispensed gold coins and silver jewelry from Borsheim’s.