Articles and News

More Ways To Find Wealthy Customers | October 21, 2015 (0 comments)

Merrick, NY—Where is the next generation of ultra-high net worth (UHNW) individuals coming from? Where are they likely to live and where are they likely to shop? What products and brands will they buy? These are questions that every luxury retailer and brand wants to answer.

In the previous article, wealth market expert Doug Gollan points out that many companies like to target UHNW individuals at high-end cultural events, but that’s not their only watering hole. They’re equally likely to be found at exclusive sporting events—both as spectators and participants—and in many other surprising places, not the least of which is at their alma mater. As he pointed out, they’re not all Ivy League grads—in fact, many didn’t go to the Ivies at all, and more than a few didn’t graduate college, period. But among those who did, Wealth-X says 5% of the world’s total ultra high net worth individuals (those with U.S. $30 million or more in assets), graduated from one of 10 American universities:

- Harvard University

- University of Pennsylvania

- Stanford University

- Columbia University

- New York University

- Massachusetts Institute of Technology

- University of Chicago

- Northwestern University

- Yale University

- Cornell University

Harvard University leads the pack, with 3,130 UHNW individuals among its alumni. Number-two Penn has 1,580 UHNW individuals among its alumni. But the list proves that no matter where they live, the world’s ultra-wealthy value an American education. It also suggests that alumni gatherings could be ripe for getting a luxury brand or retailer name in front of the right audience.

The United States is home to one-third of the world’s ultra-high net worth individuals, says Wealth-X. Almost 70,000 UHNWs live here. Not surprisingly, UHNW individuals are concentrated in major metropolitan areas across the country, of which Washington, DC and New York City are the leaders. But the rich aren’t all in the obvious places. Four states—California, Texas, Florida, and Missouri—have more than one metro area with high concentrations of UHNW. Florida is one of the fastest-growing areas for UHNW individuals; North and South Dakota were the other two fastest-growing areas. Gollan pointed out in the previous article that Wisconsin and Minnesota have more UHNW residents than Saudi Arabia and Russia, respectively. Other states with high concentrations of wealthy include Montana, Wyoming, and Oklahoma.

Be it through their alma mater, business, friends, or favored causes, rich people tend to hang out with other rich people. According to Wealth-X data, the typical wealthy individual (including billionaires, UHNW individuals worth at least $30 million and high net worth individuals worth at least $1 million) is connected to seven other UHNW individuals, one of whom is a billionaire. On average, these seven individuals are worth a total of $6.5 billion, a sizeable pool of future clients, says the report. 91% are married and through their spouse, have an extra connection to five other adult UHNW individuals.

“These personal connections constitute a person’s social graph, and from our experience, the social graph is the most effective method of generating qualified referrals,” says Wealth-X. 90% of new business is generated from existing relationships, says the study. Read more detail here.

Wealth-X's Social Graph shows the networking potential of three categories of rich consumers: billionaires, ultra-high and high net worth individuals.

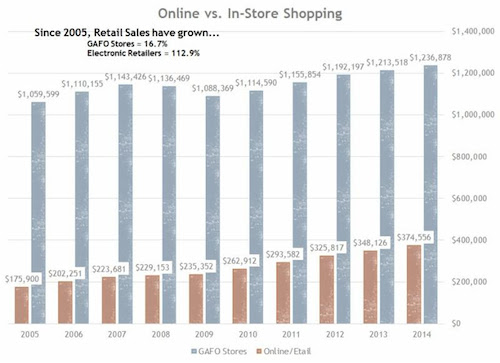

Another place to look is online. In the last 10 years, retail sales grew 17% but online sales grew twice as much, says Pamela Danziger of Stevens, PA-based Unity Marketing, a market research firm specializing in luxury consumer behavior.

In Unity Marketing’s latest Affluent Consumer Tracking Study (ACTS) Shopper Track survey, which examines affluents’ shopping behavior, online shopping tops the list of their favorite shopping experiences, used by 72% of the affluent high-end shoppers surveyed in the three-month study period. It’s especially important to the segment that Danziger calls “HENRY” (high earner, not rich yet). While an ultra-high net worth consumer can greatly outspend a HENRY consumer, the total spending power of entry-level affluent consumers dwarfs that of UHNW customers. But whether they’re just entering affluence or enjoying it fully, rich young consumers both expect an online shopping experience to be outstanding.

Unity Marketing's chart shows that while in-store shopping (blue bars) still greatly outweighs online shopping (brown bars), it's a largely saturated market with more fluctuations compared to the steady increase in online shopping among affluent consumers.

And while much has been made of the Millennials’ slow rise to wealth, some made it very big at a very young age. Of the Wealth-X list of the world’s top 20 wealthiest individuals under age 35, 11 are American. Six of the 20 are female, but only two of those are American.

Of the 11 young UHNW Americans on the list, eight are self-made. Two have a combination of inherited and self-made wealth, but only one inherited his wealth.

(Scott Daniel Duncan of Enterprise Products Partners, an oil/gas company). By contrast, the only non-American whose wealth is fully self-made is Eduardo Saverin of Brazil, who co-founded Facebook with Americans Mark Zuckerberg and Dustin Moskowitz. Zuckerberg leads the list with a personal fortune of $41.6 billion, Moskowitz (USA) and Saverin are second and fourth on the list, respectively.

Among the other eight non-Americans on the list, six inherited their wealth and two gained their wealth through a combination of inheritance and self.

Nine of the young billionaires made their money in technology (including health care tech); three in food/beverage and three in investment banking. One each came from real estate, retail, iron/steel, oil/gas, and jewelry. Adrian Cheng of Hong Kong’s Chow Tai Fook Jewellery Group (parent of the Hearts On Fire and Mémoire brands) is number 20 on the list, with a personal fortune of $1.4 billion. (Technically, CTF includes retail, though Wealth-X counts it differently from pure retail like the fortune of Thomas Persson, 30-year-old heir to Swedish fast-fashion giant Hennes & Mauritz (H&M).

In a recent report, The Next Decade Of Wealth: New Money And Implications For Brands, Wealth-X provides some additional insights:

Over the past decade, inherited wealth (i.e. “old money”) has steadily decreased. Among the global UHNW population today, 18% inherited their wealth, 63% were self-made and the rest have a combination of both. Over the next decade, however, the share of those whose wealth is inherited will grow by more than 2%, mainly in the rapidly developing areas (particularly Asia) where most of the wealth is new. Behaviors and consumption patterns of those new to wealth are often compared disparagingly to those with established wealth—that’s nothing new—but the newly minted are even more quickly aware of the need to learn and behave like individuals with established wealth. They’re as eager to shed the “nouveau riche” label as prior generations were.

Newly wealthy consumers tend to travel abroad, and many are either themselves educated abroad or their children are, as the list of colleges above attests. Their exposure to western European and North American brands and buying habits are visible badges to their peers. Yet the study found that the current trend toward a globalization of wealth may reverse and a more localized wealth develop. Wealth-X says it will be important to segment into cities, not just countries.

In addition to the shift back to localized wealth, Wealth-X identifies four other implications of the shift in luxury consumer behaviors in emerging markets for brands that target wealthy consumers:

- Pushing frontiers: The wealthy have always been among any early adopter group, and new frontiers will become the focus of both luxury consumption (such as space travel) and of investment.

- Experience vs. products: it’s not just a Millennial thing. Growing discernment among the rich in emerging markets will increasingly shift luxury consumption away from product purchases to experiences such as space travel and underwater holidays.

- Exclusivity and personalization. As well as fundamental rarity, personalization will be the second major driver of exclusivity in the next decade. This will be manifested in tailored and unique products, through to one-off experiences. (Editor’s note: Jewelers have the advantage of emotional drivers for the sale; but adding experiences like travel to a jewelry-making center or even a gem mine can appeal to the UHNW customer.)

- Intimacy, privacy, and closeness. Wealth-X predicts there will be an increasing desire for privacy among the wealthy in the future, yet at the same time a desire for greater intimacy among the select providers they trust.