Articles and News

NEW RICH DRIVING LUXURY BOOM, WSJ SAYS; CONSUMER CONFIDENCE UP TO PRE-RECESSION LEVELS TOO February 29, 2012 (0 comments)

Paris, France—Luxury marketers are bullish on 2012, says Christina Passiarello, a European-based correspondent for the Wall Street Journal. But the luxury market in 2012 is much different than the prerecession market, she says—it’s being fueled by the newly rich on a global scale, rather than the middle class Americans stretching for a taste of the good life on credit.

Affluent tourists, especially Chinese, are a big segment of the market, and there, the men spend more than women on luxury goods like suits and watches as trappings (and visual proof) of their status and success. Watch the video here.

Meanwhile, in the United States, the Dow topped 13,000 on Tuesday, and signs continue to point to economic recovery. As affluent consumers feel better about their portfolios, they are more apt to loosen their purse strings. The Dow has hit 13,000 several times in recent weeks, but this was the first time it closed the day without slipping back below the magic line. And on Wednesday, the NASDAQ composite index briefly cracked 3,000--the first time it's done so since the dot-com meltdown more than a decade ago. At press time it hadn't sustained the over-3,000 mark, but still was on its way to closing the best February performance in 14 years.

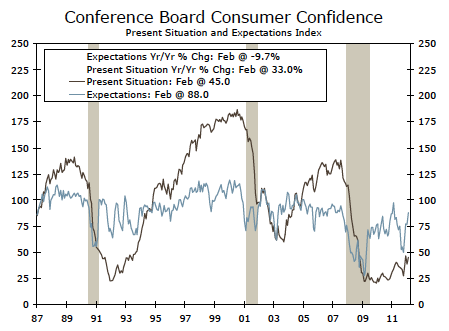

Correspondingly, the latest figures from the Conference Board show consumer confidence rebounded in February to 72.0, the highest reading since before the autumn 2008 financial crisis. This reading was substantially higher than what pundits predicted; they were looking for a reading around 63.0.

Even more encouraging is the fact that this reading came during a period of rocketing gasoline prices. In some parts of the nation, gas prices rose 25 cents in February alone—which usually is an automatic downer for consumer confidence polls. But this report from the Wells Fargo Economics Group says noticeable improvement in both labor and stock markets may outweigh consumer concerns over gas prices.

This chart from Wells Fargo shows rising consumer confidence in both the present situation (black line) and optimistim for the future (blue line).

Wells Fargo’s report acknowledges that most of the gasoline increase came later in the month and as such may not have played a significant role in the February reading, especially for consumers who paid with credit cards and haven’t yet gotten the bill. But while gas prices may affect upcoming confidence polls, initial jobless claims have dropped to a four-year low and in fact are now at a level that historically has been associated with strong job growth, says the Wells report. That has helped spark a rally in the stock market, with major equity indices such as the S&P 500 up more than 8% so far in 2012—and which in turn has helped consumers feel good about both the present and the future.

Consumers’ assessment of the present situation jumped 6.2 points in February, but their outlook for the future jumped 11.3% to 88.0, the highest reading since 2007, and a 38-point gain from the 50.0 reading taken in October 2011.