Articles and News

New Study Shows Simon G., A. Jaffe, Tacori Are Genius At Instagram Engagement | August 10, 2016 (0 comments)

New York, NY—Instagram is quickly becoming the go-to social media site for the jewelry industry to promote itself to consumers, according to research conducted by Karus Chains, a manufacturer and online retailer of gold and silver chains.

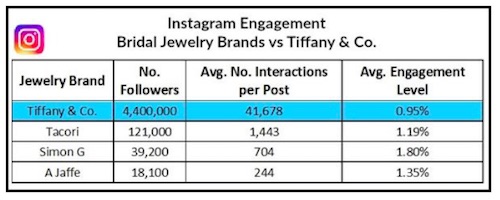

Karus’s most recent research study examines bridal jewelry brands’ social media strategies; in particular, three brands that are, in the words of Caemin O’Connor, Karus’s chief researcher, “killing it” (in a good way) on Instagram. All three brands—Simon G., A. Jaffe, and Tacori—are outperforming Tiffany & Co., widely held as the standard-bearer for social media in the fine jewelry industry.

“Based on pure performance alone, Instagram is one of our top digital priorities, and a huge focus for our social media strategy. Instagram is quickly becoming a discovery platform for wedding planning, with 70% of couples saying they use the platform to help plan their wedding,” said a Simon G. spokesperson.

While Tiffany has much higher total numbers on Instagram—4.4 million followers versus less than 200,000 followers for all three of the other bridal jewelry brands combined—each of those brands have higher levels of engagement with their followers than Tiffany & Co. does. Simon G in particular has the highest level of engagement at 1.8%; almost two times higher than Tiffany.

Karus measured the number of likes and comments for 50 Instagram posts (not including video) for each brand in June 2016. Engagement levels were calculated by totaling comments and likes for those posts, and dividing that number by the brand’s total number of followers.

What are their secrets? Luckily, most are strategies that better jewelers can easily replicate on their own, and those that carry the brands can tap into: hashtags, customer-created content, influencers, and co-promotion.

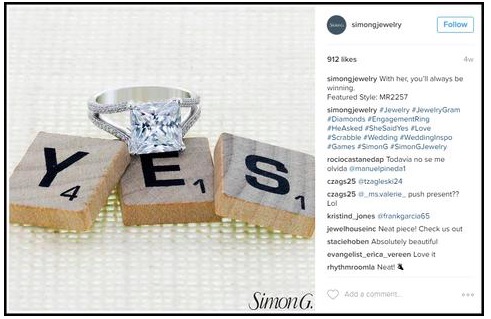

For example, says Karus’s report, Tiffany loses a lot of opportunity to be found via hashtags, by not attaching one to many popular descriptive terms such as wedding, pendants, rings, and so forth, in its content. Simon G. and A. Jaffe, on the other hand, hashtag every relevant term, averaging 10-12 hashtags per self-created post. Tacori could do more, O’Connor suggests. The brand’s posts average about three to five hashtagged terms each, and while they’re doing better at it than Tiffany, she says adding an additional five to seven hashtags per post would really help their search results.

Hashtags are a key to Simon G.'s successful engagement numbers on Instagram.

Customer-created (also called user-generated) content in particular appears to have a very positive impact on engagement levels for the brands, and may explain why all three out-performed Tiffany & Co. User-generated content is 35% more memorable and 50% more trusted than brand-created content, according to Sprout Social, a software and digital media strategy company.

Magazine publishers have long known that readers love party pictures. In social media terms, that translates to user-generated content—photos that consumers take of themselves and their friends using or wearing the product—and it works. Simon G. in particular makes outstanding use of user-generated content: out of 50 Simon G. posts that Karus analyzed for its research, almost half (23) were consumer-generated posts. Both A. Jaffe and Tacori did use consumer-generated posts, but at far lower levels (three and six, respectively, out of 50) than Simon G. did. Tiffany used none.

Influencer-generated content is another key component to Instagram success. Influencers are to social media what high-wattage celebrities are to the red carpet. While big brands like Tiffany can rely on red-carpet placements, smaller brands can get as much if not more engagement with potential customers by tapping online influencers.

Again, this is a strategy that is central to Simon G.’s success. The brand periodically lets key influencers, such as blogger Merrick White of Merrick’s Art, take over its Instagram feed for a day and field interactions with consumers. Tacori, meanwhile, teamed up with Whitney Port, and A. Jaffe got great placement on The Zoe Report (top of page).

And of course co-promotion is key to success for both brand and retailer. By co-promoting, businesses provide their followers with information that is appealing and very relevant to them, and the businesses that they co-promote reciprocate by publicizing the jewelry brands on their social media channels. Sometimes it’s a jewelry store, and sometimes it’s another category relevant to bridal consumers. For example, Simon G. cross-posted with California-based engagement ring retailer Robbins Brothers, while Tacori did so with Smyth Jewelers. A. Jaffe, meanwhile, did cross-promotion with a supplier of luxury wedding invitations.

Tacori credits consistency of the brand's consistent message, yet while still reflecting the uniqueness of each social media platform.

“They [social media channels] are all part of a larger marketing strategy, designed to build the brand and grow customer interest and passion. It’s about the message we can tell within a specific channel, and the customer who is there. We see them as all integrally linked to each other, and supporting each other.

For example, our customer may log on to Facebook in the morning, then check Instagram several times a day, and then go home and conduct research on Pinterest later that night, whilst streaming YouTube content. They may also be searching on Google, or flipping through a magazine, or reading blogs,” says the brand.