Articles and News

Q3 Survey Reveals More Key Jewelry-Buying Attitudes: Sourcing Matters, And White Gold Is Leading Metal | October 27, 2021 (0 comments)

New York, NY—A recent consumer survey conducted by the Platinum Guild International shows there is a consistently good level of jewelry demand in the United States. However, Americans’ preference for platinum, specifically, is still the lowest of all major platinum markets studied by PGI: China, Japan, India, United States. Here are some more key findings to help you understand and serve your customers better:

Consumption:

- Non-bridal jewelry purchase is mostly stable in US. Around 60% of respondents have purchased or plan to purchase non-bridal jewelry within a year.

- Bridal jewelry purchase for increased a bit in the third quarter, driven by men ages 31-45.

- Expenditure on precious jewelry in Q3 2021 tracks closely with 2020, except that higher spending is expected for bridal jewelry for others.

Preference:

- Overall American consumers are open to various metal types, with white gold (33%) being the most popular overall. Nearly 30% are also interested in platinum, yellow gold and rose gold.

- Brand preference is stable in US, where shoppers are generally open to different brand types and have purchased a range of them. National brands, international brands and regional brands are the top 3 preferred choices.

- A physical store is still the top channel for jewelry shopping. Most consumers feel comfortable shopping in person in a jewelry store.

- TV is the most used channel for information in United States, followed by word-of-mouth and Amazon.

Sentiment/ Attitude:

- Americans’ sentiment towards the future economy has dropped. Slightly less than half are feeling optimistic—although perception on future personal finance is stable, with more than half feeling positive about it. (Editor’s note: The National Retail Federation says what consumers do is more important than what they say, and spending remains robust.)

- The overall consumption sentiment is positive in this quarter, with 24% looking to spend more on precious jewelry. Fashion and wellness are the top two category drivers for spending.

- Slightly more consumers expect to spend more on jewelry under the new [Biden] administration, especially for males age 31-45, and New Yorkers.

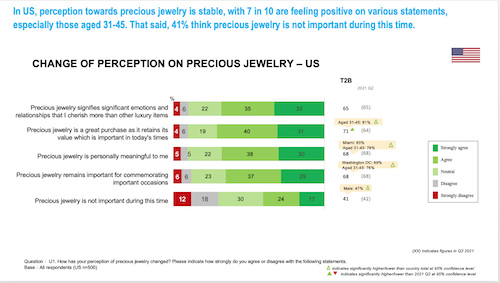

- Perception towards precious jewelry is steady, with nearly seven in 10 respondents being positive and more agree that precious jewelry is great for retaining value than in prior surveys, especially among ages 31-45.

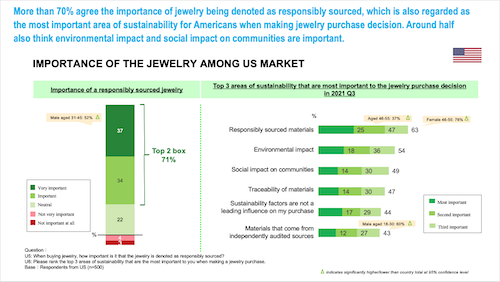

- Responsibly-sourced materials are the most important area of sustainability when making jewelry purchase decision, for seven in 10 respondents.

Responsible sourcing matters to 70% of U.S. survey respondents, above, and 70% have positive attitudes about precious jewelry, below:

Related: Survey Shows Growing Interest in Precious Jewelry, Especially Among Millennial and Gen-Z Consumers