Articles and News

Survey Shows Growing Interest in Precious Jewelry, Especially Among Millennial and Gen-Z Consumers October 25, 2021 (0 comments)

Hong Kong and New York, NY—Luxury shoppers are showing greater optimism and improved consumer sentiment across all categories, especially fine jewelry. The latest consumer study commissioned by the Platinum Guild International interviewed 2,000 consumers 18-65 in four key markets—the United States, China, India, and Japan—who have bought or expect to buy precious jewelry. The survey, conducted during Q3 202, found a growing demand for precious jewelry (especially platinum) in these markets, particularly among Millennials and Generation Z consumers.

The majority of consumers surveyed displayed stronger willingness to spend on precious jewelry during the third quarter, compared to the previous quarter. In the United States, 63% of American consumers plan to maintain their current spending or increase spending levels for fine jewelry, 60% in Q2.

When asked about preferred materials for different kinds of precious jewelry, the study revealed an increased preference for platinum in some product categories. In the United States, preference for platinum engagement rings among women rose to the highest levels in a year. More than one third (34%) of women ages 18-30 and almost half (49%) of women ages 31-45 said they’d prefer a platinum engagement ring.

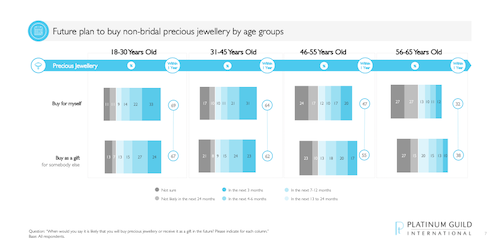

Millennials and Gen-Z consumers are the driving force of future purchases. A key finding of the study is that younger consumers will be the driving force of the fine jewelry market. Not only because they are the core consumers for bridal jewelry, but the study found more consumers aged 18-45 have plans to buy non-bridal precious jewelry in the next quarter and within the next year, either for themselves or for gifting.

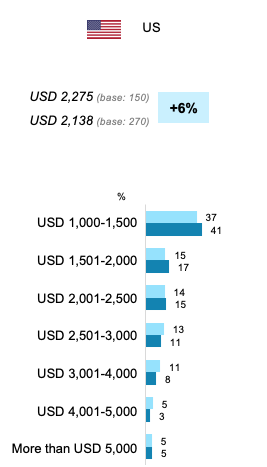

Among U.S. consumers who plan to buy non-bridal fine jewelry for themselves, the sweet-spot price point is between $1,000 and $1,500, but more consumers are willing to spend between $2,501 and $5,000 on jewelry in the third quarter of this year (light blue) than the same period last year.

“The third-quarter consumer survey shows a stronger willingness of consumers across three major markets to spend on precious jewelry, especially when pieces are associated with an emotional connection. Also, Millennials and Gen-Z consumers, who are leading the future market growth, have given more attention to platinum to express their value and celebrate special moments and cherished relationships. This creates an exciting opportunity for the jewelry industry to seize,” says Zhenzhen Liu, director of global corporate marketing for PGI.

“We continue to see growth of the demand for platinum jewelry, quarter after quarter, in 2021,” adds Jenny Luker, president of PGI USA. “This sustained upward activity as we move into the all-important holiday season should ensure retailers that the demand for platinum jewelry is evident and they should prepare their inventory accordingly to meet consumer demand.”

Jewelry with natural diamonds or gemstones is still the most preferred type in all markets, says the PGI study. In particular, U.S. consumers said they preferred natural stones to lab-grown by a 2:1 margin. Consumers also greatly prefer jewelry with stones over styles with only metal and no stones.

In terms of preferred metals, U.S. consumers preferred white gold the most, followed by platinum. Yellow and rose gold tied for third, with “other” precious metals in fourth place and “no preference” in fifth.