Articles and News

Snapshot: Who Has The Money, In Three Easy Pictures December 14, 2016 (0 comments)

Merrick, NY—With conflicting reports about Millennial affluence vs. Boomer wealth it can be very hard for a retailer to figure out where to target the bulk of their marketing spend.

Here, in pictures, is a snapshot of how wealth is concentrated by age group in the United States. The data comes from the most recent Census figures available—2014—and additional research from Stevens, PA-based Unity Marketing.

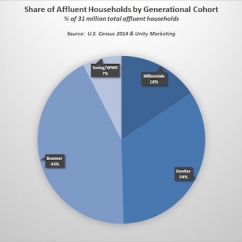

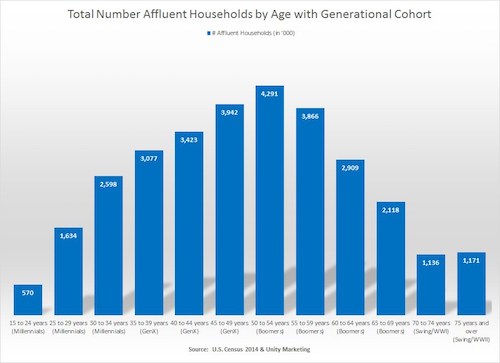

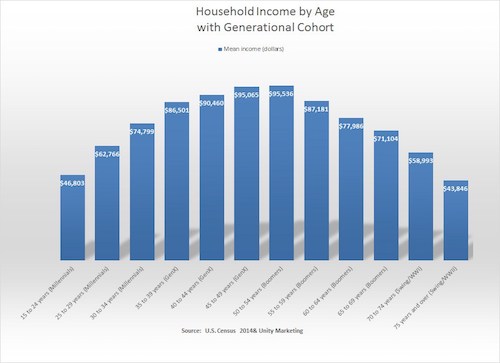

Pam Danziger, a noted luxury market expert and president of Unity Marketing, says household incomes typically peak between 45 and 54 years of age (see chart below). In 2016, that encompasses the leading edge of Gen-X (45-49 in 2014; now 47-51) and the tail end of the Boomer generation (50-54 at the 2014 census, now 52-56). Within that realm, the higher incomes fall among the Boomers (above, left slice from 6 o'clock to 11 o'clock position), who slightly outnumber the Gen X’ers by 0.4 million (above, right slice from 2 o'clock to 6 o'clock position). Millennials are the dark blue slice from noon to two o'clock position, and the Silent Generation (born before 1945) are the light blue slice.

Above: Consumers in their peak income years include leading edge Gen-Xers (ages 47-51 today) and the tail end of the Boomer generation (ages 52-26 today.) Below: income figures for the individual cohorts.

Working outward from the peak income bars, note that the younger consumers do out-earn their elder counterparts. The actual number of affluent households also is starting to show strength on the younger side, but one thing that all markets have in common is an increasing shift toward digital shopping, something that will only increase as the younger generation matures into its peak earning years.

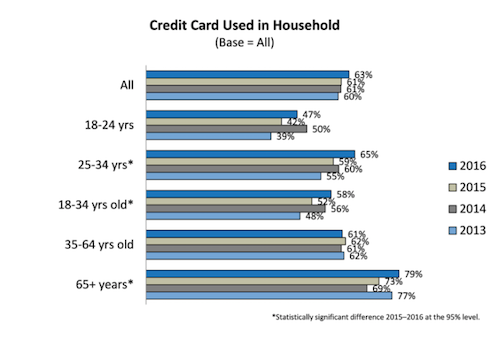

Separately, a new study from Mercator Advisory Group shows credit card use is on the rise among young adults, but still lags well behind their older counterparts. Millennials are far more likely than prior generations to shun credit card debt and live within their means, and are among the highest users of cash and debit cards, rather than credit cards. Here is the breakdown, as reported on retailcustomerexperience.com:

While credit card use among Millennials is increasing year-on-year, it's still well behind their older siblings and parents of Gen-X and Boomer generations. Millennials have proven less likely to put themselves into debt for the sake of consumption than older generations. Chart: retailcustomerexperience.com.