Articles and News

The Centurion Holiday Sales Success Index: Better News For Week Two | December 18, 2019 (0 comments)

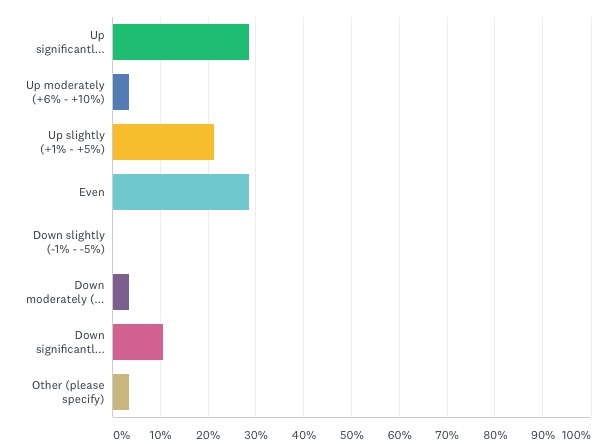

Merrick, NY—After a mixed start to the 2019 holiday season, things are looking up for luxury jewelers. For the second full week of the season (December 9 through 15), more than half (53%) of respondents reported sales increases over the same period last year. 28% reported sales on par with the same week in 2018, while only 14% said sales are down.

Among those reporting sales gains, the majority (29%) are seeing significant gains of 10% or more. Another 4% reported sizable sales gains between 6% and 10%, and 21% reported modest increases between 1% and 5% over the same week last year.

Retailer Sales For The Second Full Week Of The Holiday Season, December 9 through 15

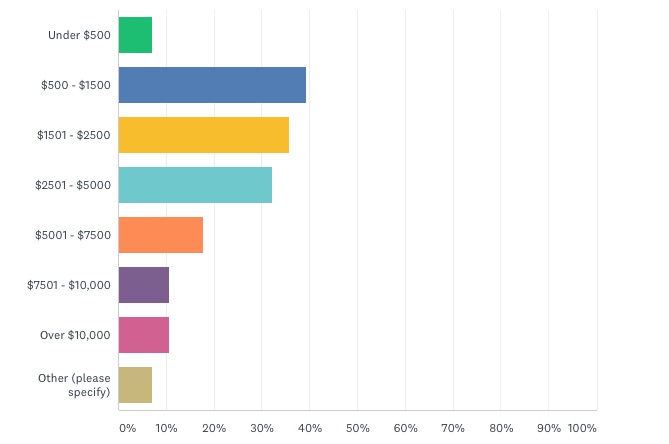

The majority of jewelers responding to The Centurion’s spot-check survey are reporting strength in more attainable price points: 39% said their best-selling sweet spot price is between $500 and $1500.

36% of respondents say slightly higher priced goods ($1,501 - $2,500 retail) are performing best this season, and 32% are doing best with goods between $2,501 and $5,000. 18% are drawing in a well-heeled clientele and reporting their best-selling price points landing between $5,001 and $7,500.

Retailers' Best-Selling Price Points For The 2019 Holiday Season, So Far

Without a doubt, this is a diamond Christmas. More than two-thirds of respondents (68%) said diamonds are their best-selling product this season. In distant second place were watches (20% of respondents, 60% of which named Rolex specifically), with 8% each reporting gold, silver, and colored gemstone jewelry as their top sellers. (Respondents could give more than one answer; totals add up to more than 100%).

The Centurion’s survey tracks closely with recent findings from De Beers in its 2019 Diamond Insights survey: bridal jewelry sales are down but sales of other diamond jewelry categories are up. Indeed, among Centurionrespondents, the top-selling diamond product was earrings, outpacing engagement rings and bridal jewelry by 18%. 45% cited earrings (including studs) as their best-selling diamond product, followed by 27% who named bridal—or, as De Beers now calls the category, commitment diamonds. But that group was tied with the remaining 27% who cited necklaces, pendants, and bracelets as their leading sellers, for a total of 73% non-bridal jewelry to 27% bridal.

Related: De Beers Diamond Insights, Part II: Smaller Stones, Lower Cost, And A Huge Terminology Change

Hopefully, strong diamond sales will help a diamond sector that’s been moribund for a few years. In a recent call to investors, De Beers parent Anglo American said it’s been a tough market for diamonds: retailers started 2019 with a lot of stock left over from the 2018 holidays, and that reverberated up the supply chain, causing De Beers to cut its production goals for the next few years. (Editor’s note: De Beers’ figures take in the entire industry, whereas luxury jewelers had a strong holiday last year, much better than the industry as a whole.)

Bain & Co., meanwhile, expects 2020 to be a better year for the diamond sector than 2019 was, but cautioned that significant improvement won’t be seen until 2021.

Retailers: Be sure to participate in our remaining two holiday sales success surveys, next week to track the third full week of the season, and the full season total after Christmas. Look for notice of the survey in your email inbox!