Articles and News

The Jewelry Express: Retailers Thrilled As Sales Roar On Like A Fast Train | December 14, 2021 (0 comments)

Merrick, NY—If the jewelry industry were going to make its own version of the holiday movie classic The Polar Express, this is the year to do it, as the incredible sales growth of the past 12 months continues unabated. Image: Jill Wellington for Pixabay

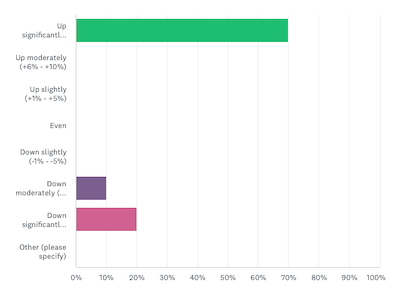

On the high end, The Centurion’s spot-check survey of better jewelers shows 70% of respondents to this week’s Holiday Sales Success Index say their sales have increased by more than 10% year-on-year for the second full week of the season, vs. the same period in 2020—itself a record-smashing season.

“After years of slow growth, diminishing share of wallet, creeping consumer doubt about diamonds, limited online activity, and generally falling victim to the growing popularity of dressing down, jewelry sales have come roaring back in the COVID era,” says industry analyst Edahn Golan in his latest monthly Insight Report. Golan says U.S. fine jewelry sales at specialty jewelry stores leapt an astounding 51% year-on-year in November, after already jumping 36% year-on-year in October. The latest figure is tracking roughly 10% ahead of Golan’s earlier prediction of a 40% to 42% rise in sales for the season.

Not everyone is going gangbusters, however: 30% of respondents to the Centurion spot-check survey are experiencing slower sales than last year; of those, 20% said sales have declined significantly (-10% or more) and 10% said sales are down between 6% and 10% from the same period in 2020.

90% of respondents to The Centurion's spot-check survey said their sales for the second full week of the season, December 6 through 12, rose significantly over the same week last year.

According to research from Tenoris—a sister company to Edahn Golan Diamond Research and Data, the best-selling product for jewelers in November was rings, closely followed by earrings—not surprising in the Zoom era. But necklaces and bracelets also showed rapid growth, suggesting consumers are looking ahead to getting away from their screens and back out into the world. Indeed, The Centurion’s data also shows earrings are a strong seller, as are diamonds of all kinds, not just engagement rings.

Better jewelers told The Centurion that foot traffic is back: 50% of respondents say it’s increased noticeably from 2020. 25% say it’s about the same, and 25% say it’s down from last year. Out-of-store sales may have peaked, however: when asked about online sales and phone sales numbers from this year vs. last year, 87.5% of respondents say they’ve stayed the same, while only 12.5% say they’ve grown year-on-year. Nobody reported a drop in either one.

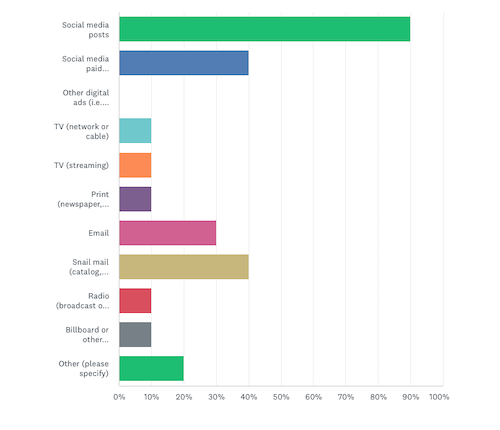

In terms of marketing, social media is far and away the most effective, say Centurion respondents. Fully 90% cited social media posts as their number-one marketing tool. 40% each credited snail mail—catalogs, store magazines, invitations, etc.—and paid social media as their second-best tool. Email came in third, with 30% of respondents saying it has been a successful marketing tool this season. (Respondents were asked to check all that applied; totals exceed 100%).

Social media posts have been the most effective means of marketing for jewelers this holiday season, followed by snail mail (catalogs, invitations, and so forth) and paid social media posts.

Finally, we checked in to see how better jewelers are addressing masks. Respondents were evenly divided on the subject: 50% of Centurion respondents do not require masks for either staff or customers, while 50% do require some degree of masking. Of the masked group, all require their staff to mask up. 20% require masks for everyone—customers and staff—regardless of vaccination status. Another 20% will ask, but not require, customers to please mask up. Finally, 10% do require unvaccinated customers to wear a mask.