Articles and News

Early Report: Jewelers’ Holiday Season On Track To Smash All Previous Records | November 30, 2021 (2 comments)

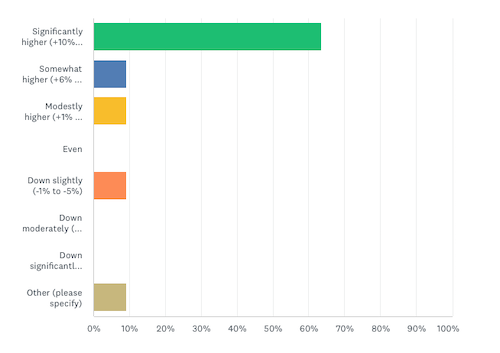

Merrick, NY—2020 was a year for the record books in the jewelry industry. But if early indicators are on point, 2021 is going to smash those records to bits. In the first Centurion Holiday Sales Success Index for the 2021 season, 81% of respondents reported sales gains, with two thirds already reporting sales of more than 10% over last year’s record-breaking totals. Meanwhile, industry analyst Edahn Golan predicts U.S. holiday jewelry sales will rise 40%-42% in the November-December period with annual jewelry sales rising a staggering 51%-53% year-on-year. Annual jewelry sales are expected to total $94 to $95.3 billion in 2021, he says.

That’s not just good, that’s stratospheric territory. It’s not surprising, though, as all the indicators were there before the start of the season. A study of 1,504 Americans between the ages of 21 and 65 conducted in late September by market research firm Provoke Insights found that more than 10% of consumers are buying jewelry and watches, up slightly from earlier this year. Fine jewelry sales increased 1% from January to September 2021, and luxury watch sales increased 3%. 11% of respondents purchased jewelry or watches in the month prior to the survey.

Related: Consumers Value “Investment” Purchases, 43% Ready To Splurge This Year

How were your sales for the full months of October and November (to date), compared to last year?

The Provoke survey turned up some interesting findings. Not surprisingly, affluent, educated consumers are likely to buy luxury jewelry and watches—but so are those who are neither.

Some key demographics of jewelry buyers in the Provoke survey:

- Average age was 42 (on the cusp of Millennial/Gen-X) and likely to live in an urban area.

- 34% of respondents had a household income over $100,000—but 35% had income under $49,000.

- The largest percentage (29%) have a bachelor’s degree, but the second-largest percentage (23%) have a high school diploma or less.

- 68% of respondents were vaccinated, vs. 30% unvaccinated. 2% didn’t say.

- 45% of respondents have children.

- 39% of respondents are Democrats, 28% are Republican, and 27% are Independent. 3% each said “other” or didn’t provide their political affiliation.

- 61% enjoy the shopping process, 49% are likely to stick with brands they know, 41% prefer shopping online for jewelry and watches, and 43% of jewelry buyers are willing to pay a premium for responsibly sourced items.

- Consumers are still dressing more casually than before the pandemic. But only 66% of women say they’re wearing less jewelry than pre-pandemic, vs. 80% who said the same in 2020.

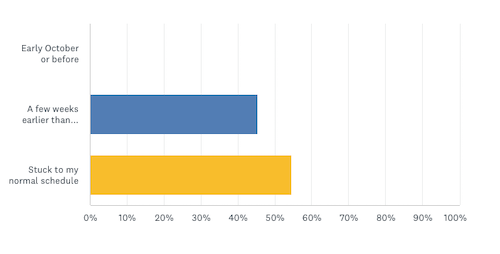

Although retailers were advised to start their holiday season in early October, jewelers weren't in a particular rush to do so. When asked whether they started a holiday push early at all or stuck to their normal schedule, better jewelers were pretty evenly divided:

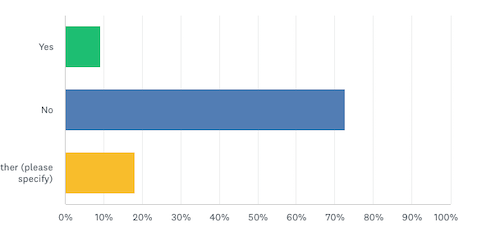

One thing that doesn’t seem to help jewelers overall is Small Business Saturday, the day after Black Friday. While consumers in general responded very well to the day—some even consider it a responsibility to support local merchants—Centurion survey respondents said “meh.”

This article said Peaced Together, a fashion/craft jewelry and home décor store in Johnstown, PA, saw a steady stream of customers on Small Business Saturday. But only 9% of luxury jewelers responding to the Centurion survey credited the day for driving more traffic than they’d have gotten anyway (green bar). 72% said it didn’t add anything to their sales (blue bar), and 18% said they weren’t sure (yellow bar):

Meanwhile, a post-Thanksgiving report from Retail Dive identified the winners and losers of the weekend: winners were Thanksgiving Day not being a shopping day, curbside pickup, and installment financing, otherwise known as buy now/pay later. What didn’t happen this year was a lot of discounting (good for retailers, not so much for bargain-hunting consumers). Supply chain issues also continue to dog retailers.