Articles and News

The Centurion 2020 Holiday Sales Success Index: Season Totals Astound Jewelers | December 30, 2020 (0 comments)

Merrick, NY—In 2020, a year that will go down in infamy--probably on a scale beyond 1929, 1941, and 2001--almost two-thirds of respondents to The Centurion Holiday Sales Success Index reported that their total sales for the holiday season were at least 10% higher than in 2019, itself a record year for jewelry sales.

Who’d’a thunk it? When the coronavirus pandemic exploded onto the world in March, jewelers and retailers of all kinds (except those selling food, cleaning products, and toilet paper) wondered if they’d ever recover. As we now know, by June those worries began to abate for jewelers, who started reaping the benefits of unspent travel and entertainment dollars, as well as people’s shifting priorities and willingness to seal meaningful relationships with a meaningful token.

As summer progressed into fall, the dust of the initial economic plunge began to settle and a clearer picture emerged. A lot of people are hurting and hurting badly—which cannot be dismissed—but a lot of people didn’t lose their jobs and in fact are flush with cash.

And the results of The Centurion Holiday Sales Success Indexbear this out. In 2019, a record-smashing 80% of jewelers reported their total holiday sales rose year-on-year. In 2020, more than three-fourths (76%) reported total season increases over 2019; negligibly fewer than last year. It’s on par with 2013, another blockbuster year when 77% of respondents to the Sales Success Index survey that year said their holiday season sales were up over the prior year.

But what sets 2020 apart isn’t the total number of jewelers who grew their holiday sales—it’s the number of jewelers that grew holiday sales by a substantial amount, at least 10% higher than the year before.

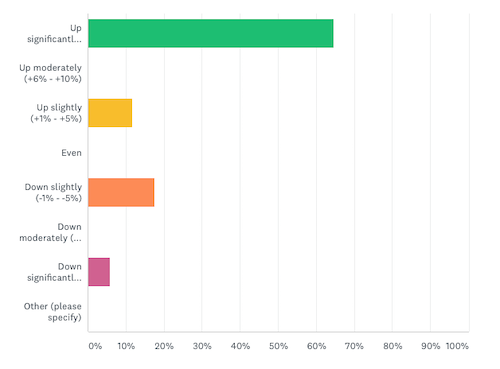

How Was Your Business In Total For The 2020 Holiday Season?

65% of respondents to our survey reported 10%+ gains over last year’s figures, the most on record in the history of Centurion’s surveys. Even in 2019, only 38% of jewelers reported sales gains over 10% from holiday 2018 figures, and in 2013, another banner year for luxury jewelers, only 50% of respondents had sales gains of 10% or more against the previous holiday season.

“Best season ever. Overwhelming,” wrote one about 2020.

“This will be one of our top three December incomes,” wrote another who reported their holiday season sales rocketed 32% over 2019.

The results surprised everyone. When asked how their 2020 holiday season sales results compared to their own expectations, all but one respondent said they far exceeded what they’d expected to do for the season. Only one respondent said “meh.”

“I did not know what to expect. It was not the best and not the worst,” wrote the jeweler. “Overall for the year we were up and our margins were mostly higher, but it was a difficult and stressful year.”

Difficult and stressful as it was, for the total year, most jewelers came out ahead. 82% of respondents said their total year sales for 2020 (up to press time) were ahead of 2019, besting the 78% who came out ahead for the year in 2019.

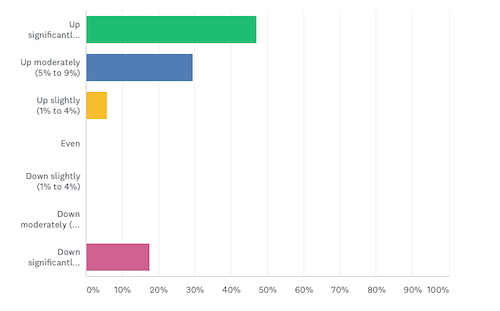

Of those whose total year sales grew in 2020, again a majority (47%) were up at least 10% for the year in total (compared to 33% in 2019), and another 29% were up moderately (between 5% and 10%), compared to about 22% last year.

23% of respondents said their total year results for 2020 were down year-on-year from 2019. Of those, the majority 17% were down slightly (1% to 5%) and 6% were down more than 10% for the total year. By contrast, fewer total respondents (17%) had a negative year in 2019, but of those, a slightly higher number (8.6%) were down by 10% or more vs. 2018 than the 6% who were off by 10% or more in 2020 vs. 2019. All in all, financially speaking at least, for all its stressful, harrowing anxiety, 2020 turned out quite ok for better jewelers.

How Was Your Total Year Business For 2020?

Who’s buying? More good news for jewelers: it looks like much-needed progress is finally being made in attracting younger consumers.

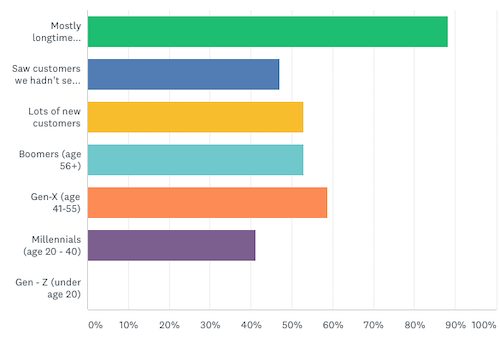

In 2019, our survey results revealed an alarming lack of Millennials buying jewelry for the holiday season. Last year, only 18% of jewelers said Millennials made up a significant portion of their holiday customers, compared to 25% in 2018. In 2019, 62% of respondents said Boomers—and their substantial wallets—were the biggest boost to their numbers. But our 2020 survey results potentially suggests the beginning of the age shift that demographers have been discussing for at least five years. (Note: respondents could check multiple boxes; totals exceed 100%).

In 2020, 41% of respondents said Millennials (age 20-40) comprised a significant part of their holiday customer base—more than double from 2019. In 2020, and the largest percentage of respondents (59%) cited Gen-X consumers (age 41-55) driving a lot of sales, up from 48% last year.

But while they might finally be starting to age out of the jewelry-buying market as analysts have been warning, don’t count Boomers (age 56+) out just yet: 53% of jewelers still said a lot of Boomers contributed to their overall sales totals.

Who Were Your Customers This Season? Check All That Apply.

But is this the start of a trend or just an unusual year? Let’s unpack some things we know:

- Broad industry-wide marketing and awareness efforts, such as the rebranded Natural Diamond Council’s ads and the public-relations efforts of Diamonds Do Good, are largely targeting Millennials.

- The pandemic has driven consumers to reassess priorities, leading to an uptick in relationship commitments being sealed with a jewelry talisman. For those already in a committed relationship, appreciation and emotion is being expressed with jewelry.

- Experiential spending, the biggest competition for Millennials’ dollars, was not possible for most of the year.

While this year’s figures about selling to Millennials are indeed encouraging, if the new COVID vaccines work as hoped and restrictions on travel and gatherings are lifted, it will likely take the next two years’ figures—or more—regarding sales to younger consumers before we know for sure whether this is an aberrant spike or a long-term trend. Industry experts are already warning that once the virus is under control, jewelers may see sales decline as pent-up demand for travel, entertainment, and experiences grab a large share of wallet, at least in the immediate aftermath of the pandemic.

Other insights revealed in The Centurion’s survey: 88% of jewelers reported lots of sales to longtime good customers, but 53% encouragingly also saw a lot of new customers. And 47% said they sold to customers they haven’t seen in a while.